Shares of Eastman Kodak Co (NYSE: KODK) are set to plunge on Monday on weekend reports that the firm’s $765 million loan agreement with the U.S. government has been placed on hold.

The U.S. International Development Finance Corp (DFC) has suspended the loan after “recent allegations of wrongdoing,” in relation to the performance of its stock lately.

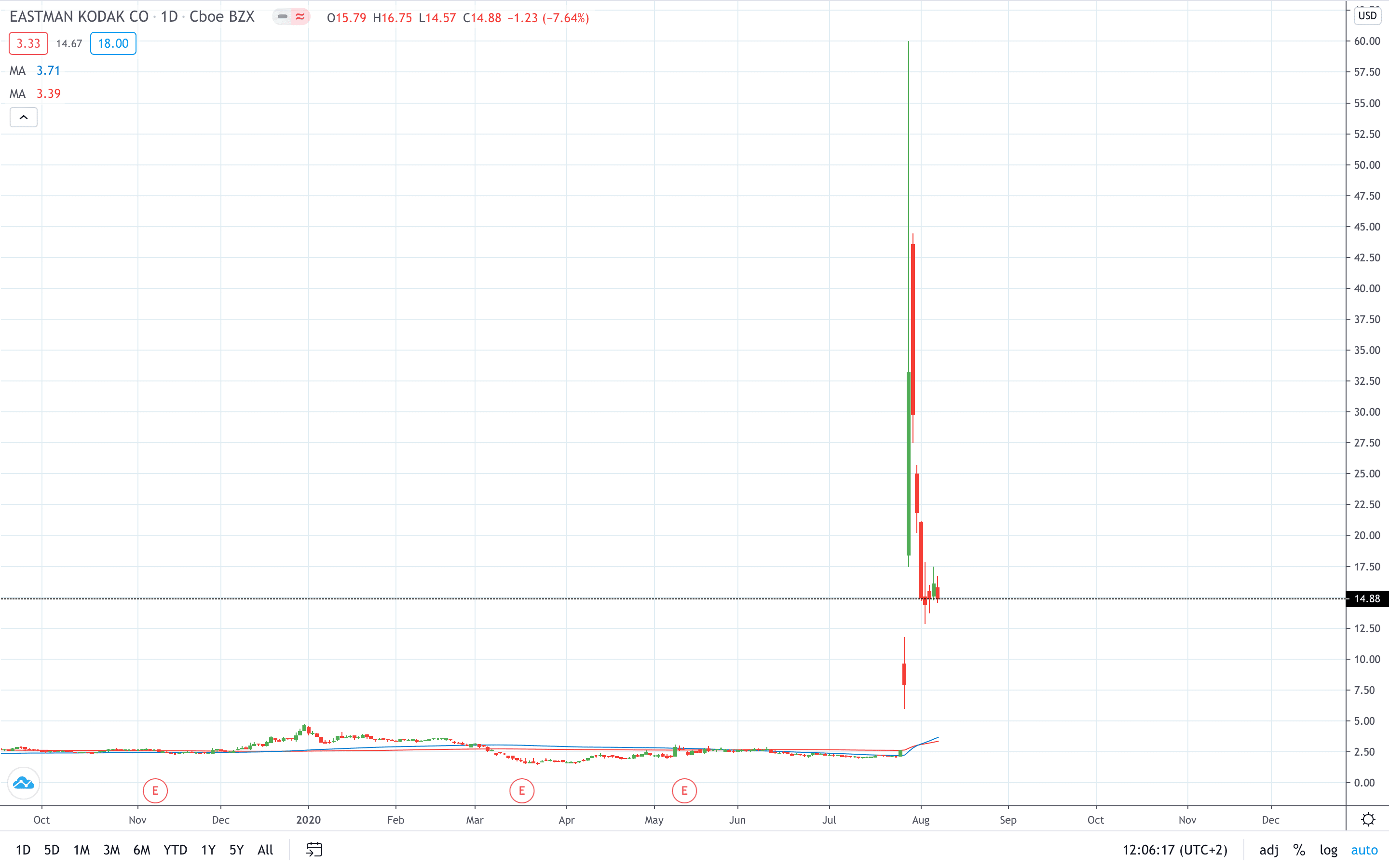

Eastman Kodak share price exploded over 1,000% higher in the last week of July after receiving a $765 million loan from the U.S. government to produce pharmaceutical ingredients.

“Recent allegations of wrongdoing raise serious concerns. We will not proceed any further unless these allegations are cleared,” DFC said in a statement.

The New York-based company was previously known for producing camera-related products and a long history in photography.

“The internal review will be conducted for the Committee by Akin Gump Strauss Hauer & Feld LLP,” Eastman Kodak said in a statement.

Eastman Kodak share price surged to $60 on July 29, before pulling back to close the last week at $14.88.

- Read more about why Eastman Kodak share price skyrocketed in July

- Start learning about stock trading strategies

- Learn from experts on risk management in trading