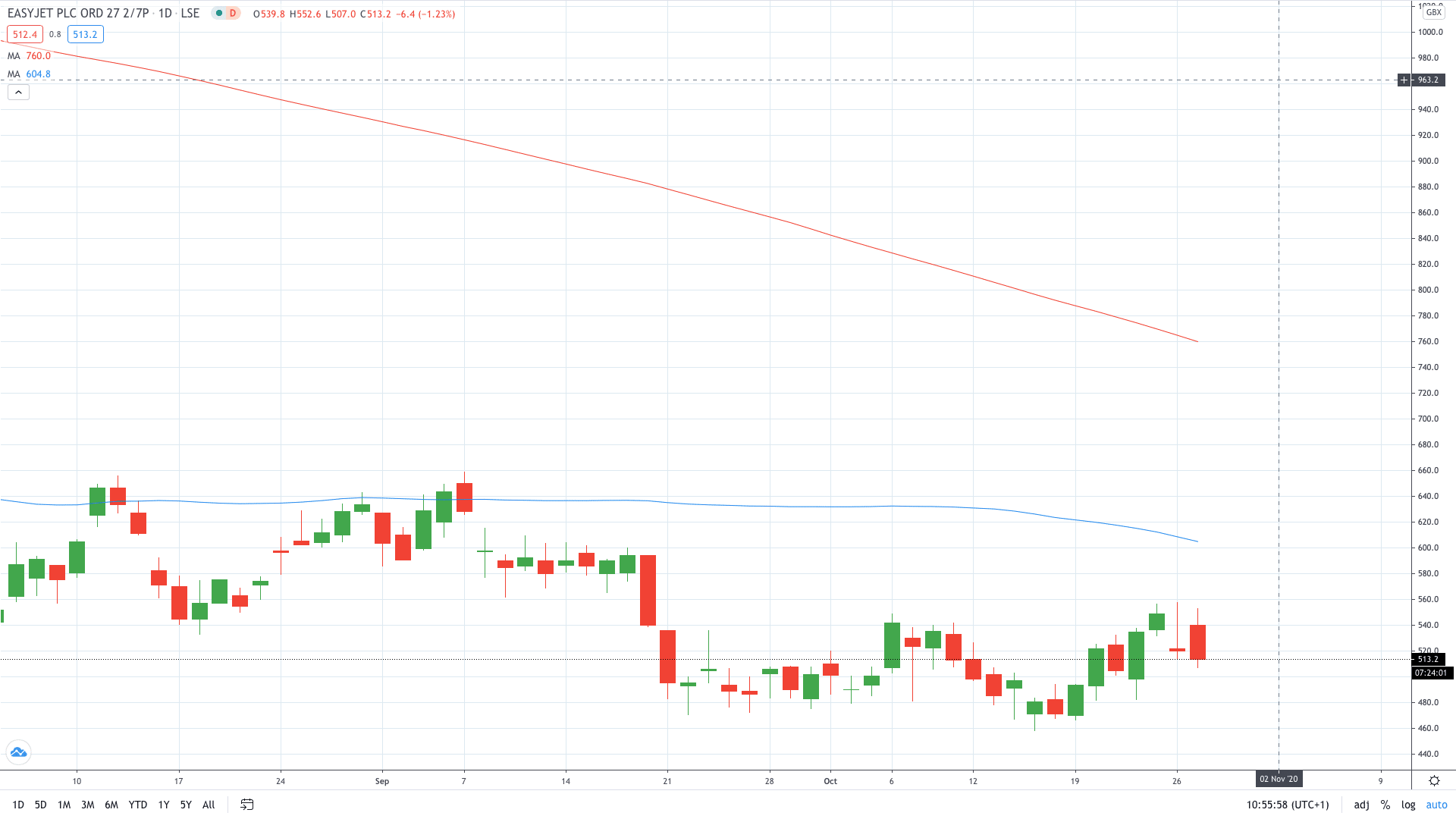

Shares of easyJet PLC (LON: EZJ) trade about 1% in the red despite this morning’s gains after the budget carrier raised $398.6 million to improve its finances.

The company was forced to sell and leaseback nine aircraft in order to bolster its balance sheet as the pandemic continues to create havoc in the sector.

“Over the terms of the nine leases the average incremental net annual headline cost reflected in easyJet's income statement will be £15m, which is driven by increases in interest charges and depreciation,” easyJet said in a statement.

“Once these two transactions are completed, easyJet will retain 152 fully owned and unencumbered aircraft, representing approximately 44% of the fleet.”

Today’s move comes after the budget carrier already raised over £608 million from aircraft sales.

EasyJet share price erased this morning’s gains to now trade at 515.4p, or negative 0.81% on the day. Shared opened higher to trade over 6% higher earlier in the morning.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan