Key points:

- Ethernity Networks lists on OTCQB today

- The aim is likely to gain a rerating of the shares

- Americans do, often enough, seem to value tech stock higher than London does

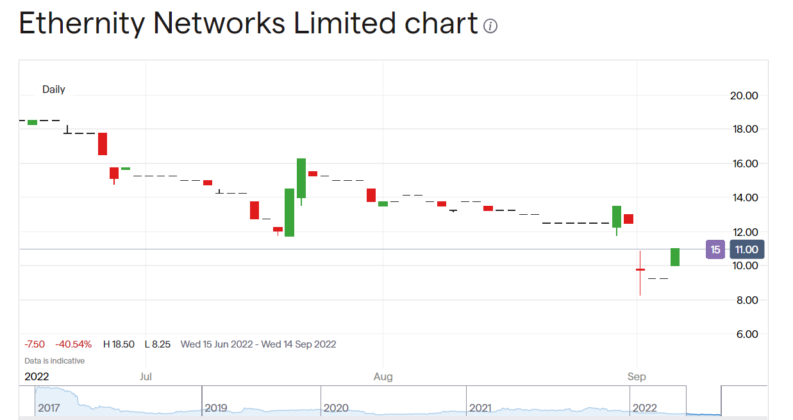

Ethernity Networks (LON: ENET) shares are up 16% this morning. Which is a welcome change from their 83% fall from the peaks of the past year. We'd much rather be owning something that increased our wealth rather than reduced it of course. The bigger question being, well, is this the start of some major turnaround? Are we going to see that lost ground being recovered? The answer to that is that this rise doesn't seem to be coming from anything within the company itself. Rather, this is about the equity trading on a new market. That might – could – lead to a revaluation.

Ethernity Networks has had a hard time of it this past year. The ENET shares peaked at around 60p and they're currently around the 10p level (moving up to perhaps 11.20p at pixel time). The actual business itself is working with field programmable gate arrays for moving data around networks. The translation of that jargon being making networks more efficient by enabling tuning of them (to put it in very non-technical terms). Given the ongoing expansion of the internet and the data sucking volumes of videos and cat pictures swirling around we might think this to be a market with vast expansion opportunities. Which it might even be, it's just that Ethernity Networks doesn't seem to be carving out a commanding position nor the sort of growth we might hope for.

Their last corporate announcement was, for example, to state that a year old contract with an Israeli company had been cancelled. That is, yes, it's entirely true that the company develops technology that could be highly useful within the current 5G rollout, But that's not quite the same as having invented that better mousetrap that the world lines up to buy.

Also Read: Juniper Networks Stock Forecast

Today's announcement from Ethernity Networks (OTCQB: ENETF) is that it is to commence, as that ticker suggests, trading on the OTCQB market over in the US. This does not, in fact, make any difference to the operation of the underlying business. No new shares are being issued for that market, so there's no inflow of capital either. But there is still a method to this madness. Which is that perhaps Americans will value ENET differently?

There is reasonable hope that they will too. It has long been a complaint by British tech types that the London market simply undervalues tech companies. Look at the astonishing earnings multiples that can be achieved on NASDAQ for example. Anyone trying to raise money in tech should look over there therefore. The argument being that London is simply much more conservative about the valuation of possible future success than New York is. So, for a doing not very well British tech share to list over there could lead to a distinct revaluation. That's what the argument is.

The Ethernity shares price rise today is likely on the possibility that OTCQB will lead to a revaluation. The next thing to find out is whether it actually does.