- Leaders of the UK and EU have met in London to start the process of negotiating a new trade deal.

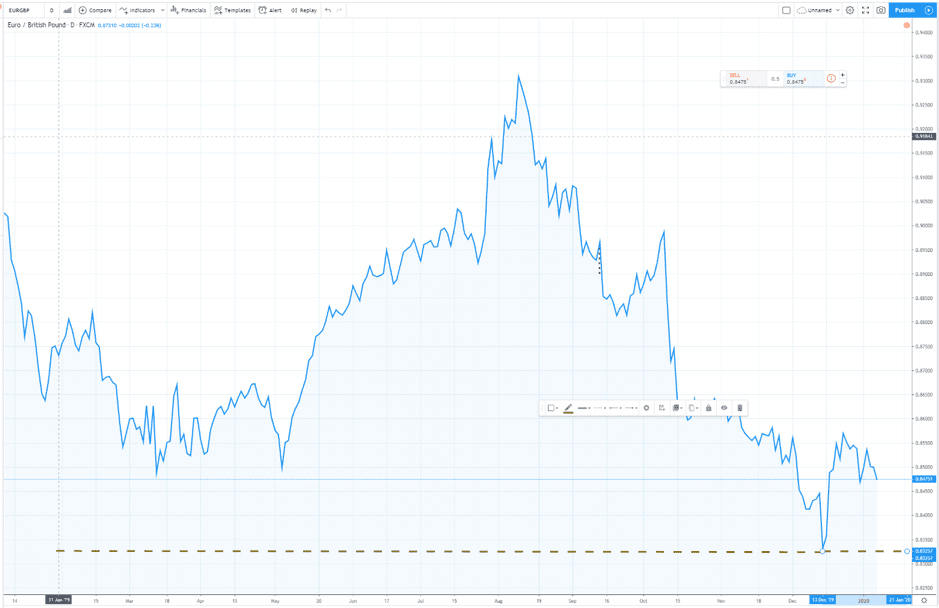

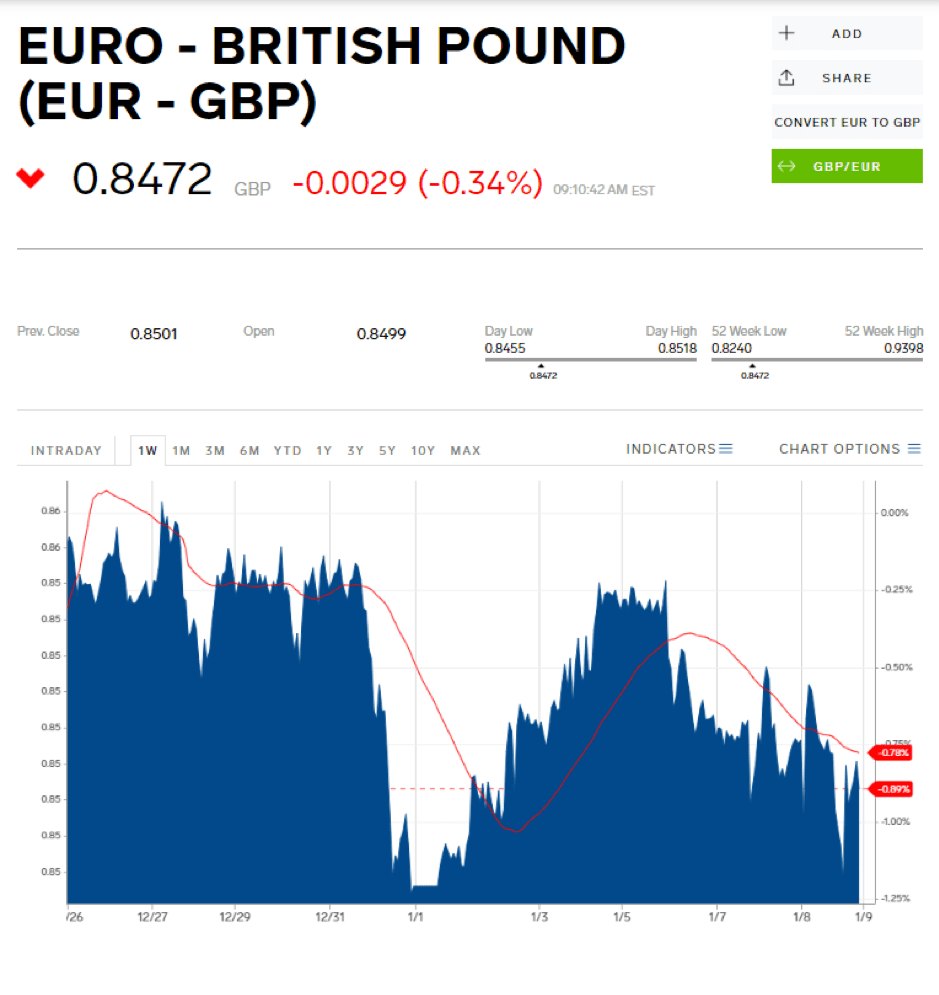

- The challenges and deadlines look set to increase price volatility in the EUR/GBP forex pair.

- It could be a long-term play, but plenty of analysts are proposing euro weakness is a trend to look out for.

A significant first step was taken on Wednesday morning when Ursula von der Leyen visited Downing Street in London to take part in the first face-to-face EU–UK trade deal meeting between her and Boris Johnson. Von der Leyen, the President of the European Commission, took up her powerful position in December, the same month that Johnson was elected Prime Minister of the UK with a governing majority of a size that hasn’t been seen for many years. The relatively strong position of both leaders and the dynamics of their relationship might offer hope to the financial markets. The task they face is thrashing out a trade agreement that is fit for purpose and to do so before 31st December 2020. Failure to complete the task before the deadline would lead the UK and EU to revert to standard and unappealing World Trading Organisation (WTO) trade terms.

Friends and close partners

When the UK officially leaves the EU on 31stJanuary, the number of member states will drop from 28 to 27. Von der Leyen will then receive a full brief from the group of 27 countries as to how to proceed. This collectively agreed directive is not likely to be forthcoming before the end of February.

With little clarity about her bargaining aims, the meeting of Wednesday is likely to be more social rather than business-like in nature. It will be an opportunity to repeat the consensus view that mutual interests require both parties to find a working agreement that supports future business activity throughout Europe. The problem for Wednesday’s meeting is that von der Leyen, in particular, will have her hands tied.

No news is, bad news

The two-month impasse provides an opportunity for the more hubristic factions on both sides to offer their possibly unhelpful opinion. The sabre-rattling might help each team set out an ambitious opening negotiation position but will also provide a trigger for market uncertainty. France President Emmanuel Macron kicked off proceedings on Tuesday when speaking in Paris. He said:

“It will be a complex negotiation that should be approached in cold blood by our negotiator Michel Barnier.”

Source: Politico

The EU’s position appears to centre on political necessity. If the UK were to agree a future relationship with the EU, which combined the benefits of borderless trade with the EU and improved terms with other global partners, then there would be a rush to the door as more members considered leaving. Von der Leyen said, in the build-up to her meeting with Johnson. The UK and the EU will remain the “best of friends”but they will “not be as close as before” (source: BBC). Negotiating terms that meet this political aim, but still maintain the trading relations between EU and UK firms is an unenviable task.

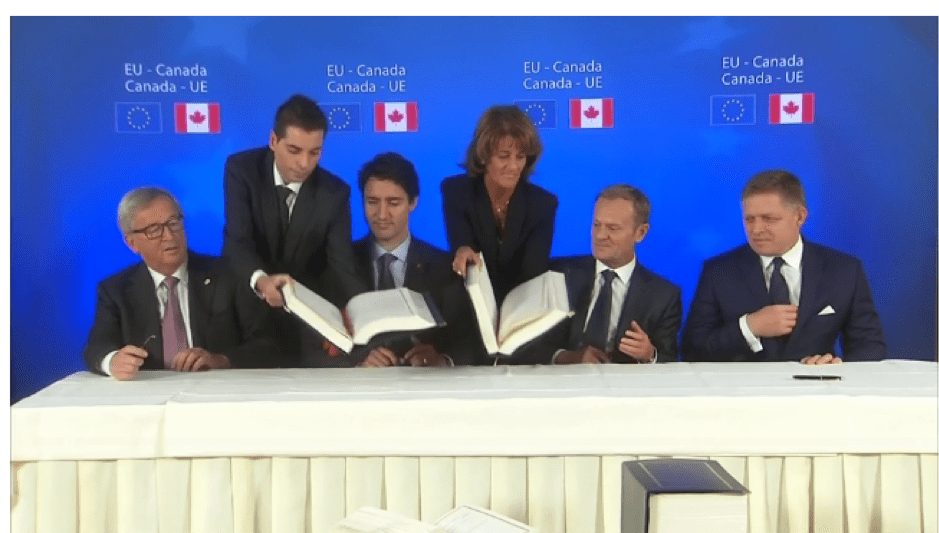

Practicalities also come into play. Trade talks take time to negotiate, particularly when all 27 members of the EU will have to be in agreement with the final document. The much-used example of how complex the negotiations are is the EU-Canada trade agreement, which took seven years to process. Even as the leaders of the EU and Canada met to ratify the terms, they had to add extra days to their summit meeting while a last-minute Belgian veto was resolved. The regional government of Wallonia held up the entire agreement due to concerns about terms specific to French-language films.

On the upside

More optimistic forecasts can reference the presence and characteristics of the new heads of the EU and UK. Von der Leyen and Johnson have both recently taken up their posts and escape some of the legacy issues relating to the protracted exit negotiations.

Von der Leyen is seen as a safe pair of hands. As a seasoned politician who has spent some time living in the UK, in her bid for the EU top post she managed to gain the support of member state leaders as diverse as France’s Macron and Viktor Orbán of Hungary. While her aversion to risk may at some stage become a disadvantage, the initial phases look set to benefit from her approach. The exiting leaders Jean-Claude Juncker and Donald Tusk now symbolise what could be described as a more ‘flamboyant’ approach to relationship management.

Long-haul

David Cottle, analyst at DailyFX, has picked short EUR/GBP as a trading idea for 2020.

“Whatever the rhetoric from Brussels, European Union member states won't want to lose such a key customer as the UK at a time when trade disputes with both China and the US are already casting clouds over other key export markets.”

Source: DailyFX

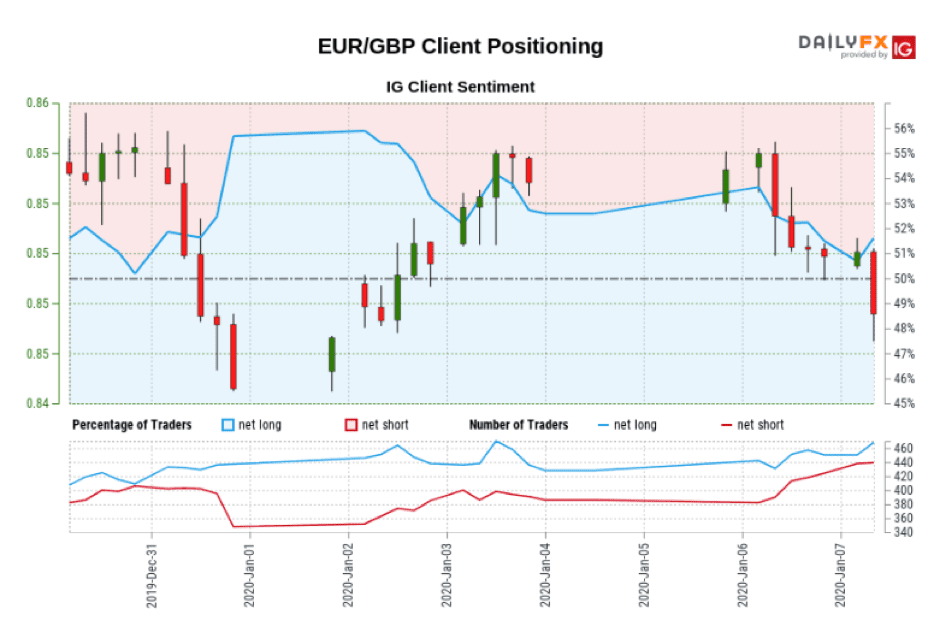

Client Sentiment reports from DailyFX and IG support the idea that traders have been taking positions that bank on a pragmatic Von der Leyen delivering on a deal — one that might favour holders of sterling. Back data shows net shorts that were taken over the year-end and again between 6th–7th January.

The first wave of shorts may have been taken by those sifting through ‘trading ideas for 2020’ articles, but the second shows some intent, with traders happy to put on or build positions despite relative EUR strength.

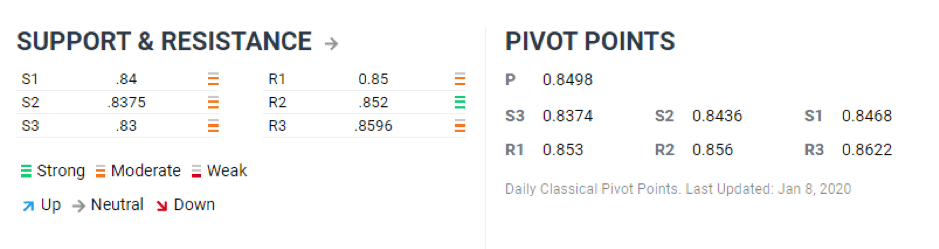

The EURGBP trade could be a long-term play, but there are also short-term opportunities. In the first week of trading, breaks of the 50-day MACD line have proven profitable indicators to the downside but not the up. The S1 support level at 0.84 looks like the first target for the short sellers and is still some way off current price levels.

The 12-month low of 0.83290 is another support/target level to hold in mind.

EURGBP — 12-month price chart: