Key points:

- FingerMotion is up well over 100% in a couple of days

- Short positions aren't large enough for this to be a squeeze

- So what is driving the FNGR stock price?

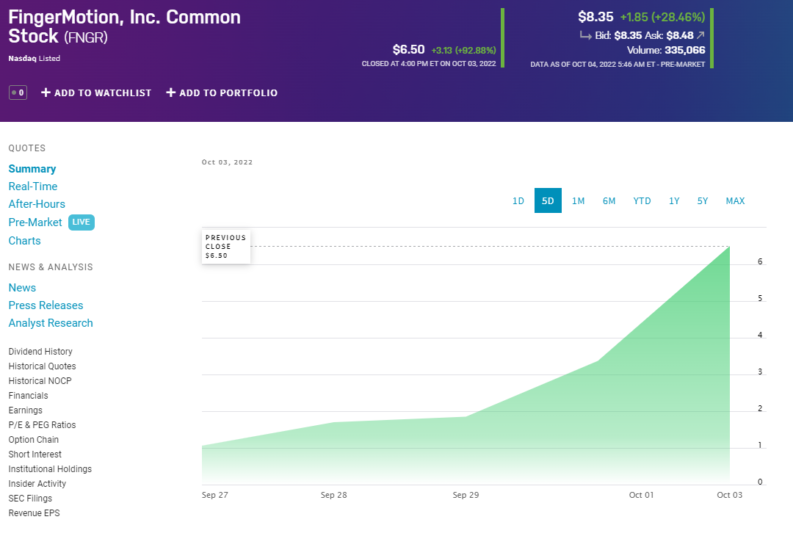

Something is definitely happening with FingerMotion (NASDAQ: FNGR) stock as it's up 29% today following a 93% rise yesterday. And that's the continuation of a trend. So, what is this trend – or perhaps more importantly, why this trend? Only if we grasp why a stock is changing in price can we begin to think about how it might continue to do so in the future.

One idea out there is that this is a short squeeze. This isn't likely to be the answer as the short position is very low. So, a squeeze just wouldn't work – one estimate has only 0.05% of the stock short and that's not enough to put a squeeze upon. Another possible thought is that this is all just very thin trade. But that's not true either. Average trade volumes run around the 300k pieces of stock a day, that sort of level. We saw trade of 73 million pieces of FNGR stock yesterday – that's not thin trade by any means.

So, we've a real price change and a very large one. But there's still no obvious and clear reason for it. Which means that we've got to rather speculate about what is happening in order to try to understand it. One thought is simply that it has become a meme stock. For some reason traders have seized upon it and the price changes are simply because of such trade. That could even be true even if it's not a very satisfying answer.

Also Read: 30 Global Stocks That Warrant Your Attention

The other alternative – and not entirely mutually exclusive – is that this is a market reaction to the recent deal signed in China. FingerMotion now has an agreement with China Unicom and China Mobile to offer mobile protection in certain provinces. This is somewhere between test marketing and a limited roll out of the service. Possibly one million or so new customers in two or three provinces, that's the sort of size that we're talking about at this point.

Obviously, China's a large place, it has many potential customers for a new such service and so, if this contract really works, there's a considerable upside for FingerMotion.

It is therefore possible that this is a proper rerating of FNGR stock. The size of trade, the persistence of it over several days, that announcement of the contract, those do rather argue in that direction. The short squeeze explanation doesn't work, the meme stock one could be congruent with this new contract.

It's also possible to be a little more wary here. Many people have been seduced by the size of that Chinese market. Only to find that either it's a little more difficult to exploit than it at first appears, or even that initial success is met by the emergence of home grown competition.

Our point here is simply that any trading position needs to be based upon your own evaluation of the reason for this price movement, For only once you've an analysis of why the FNGR stock price is moving can it be possible to predict where it might move to next.