Shares of electric vehicle startup Fisker Inc (NYSE: FSR) spiked on Friday following Morgan Stanley analyst Adam Jonas providing a bullish note on the stock.

Jonas assigned the stock an overweight rating and set a $27 price target representing a potential 76% upside.

Fisker offers one of the “most compelling strategies and positive risk-reward skews,” said Jonas, adding that it stands out as one of the more de-risked and strategically underpinned business models.

The Morgan Stanley analyst noted that the company’s low execution risk is enabled by its manufacturing partnership with Magna. The agreement with Magna will see the Canadian firm supply the vehicle platform and build Fisker’s Ocean SUV.

Jonas believes Fisker is a play on an asset-light design, centred EV business model that improved time-to-market and break-even points.

Fisker is expected to begin selling the Ocean SUV towards the end of 2022 at a price of $37,499.

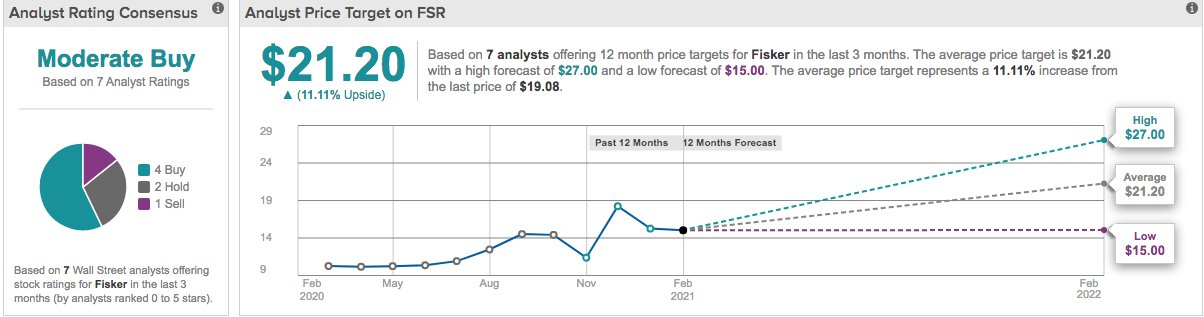

In a TipRanks survey of seven Wall Street analysts, a high price target of $27 was forecast, with a medium target of $21.20, representing a near 12% increase on Fisker’s current share price at $19.96. It is currently trading over 22% higher on the day.