Key points:

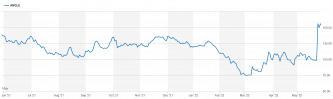

- Angle shares have jumped 50% this week

- Parsortix, the cancer diagnosis by blood test, received FDA authorisation

- The question is whether this has further to go as a revaluation

Angle (LON: AGL) shares have jumped 50% this week off the back of the FDA approval of Parsortix for metastatic breast cancer diagnosis. The question for us now as traders is whether this is all the reaction there's going to be, whether AGL has topped out and will decline, or is there more to go?

One thing we should note is that Angle PLC seems to be high on the buying lists for individual shareholders even if not institutions. That shows us that there is a following for the story.

Also Read: Best Healthcare Stocks to Buy Right Now

As background, Angle has developed – and owns – a unique technology for cancer diagnosis. It's possible to get lost in the weeds of medical terminology but the essential idea is “liquid biopsy”. In order to check on, test, decide upon the treatment for, a cancer it's necessary to know exactly what type it is. The collection of a sample is a biopsy. This usually means invasive treatment – actually cutting in and taking a piece. The limitation here is that it's only possible to do this a limited number of times – scar tissue forms and all that. So, the Angle, umm, angle, is to note that cancers often do send cells off into the bloodstream. So, sample them from there – liquid biopsy meaning it's just, to the patient at least, another blood sample – and be able to monitor the cancer much more often.

Sounds like an idea but then of course there are many such ideas that don't pan out. Angle has just received FDA approval for its system called Parsortix. That means that this idea has panned out. For FDA approval is the necessary thing to gain access to the American medical market. Where testing for any- and every- thing just is the medical style. At present the authorisation is for metastatic breast cancer. This makes sense as metastatic really means that the cancer is sending out cells through the blood stream where they might then embed and create secondary cancers.

It can and does take years to gain such approvals. As Angle themselves are saying, they know of no one else who has even started the process for a comparable diagnostic test. So, they think they have significant first mover advantage. That's the polite way of saying they've the market to themselves for at least some number of years.

For us as traders that's all background though. For what we want to know is whither the Angle share price? There being the usual three possibilities. One is that we've seen the reaction to the FDA announcement and the current level, around 150p, is the new baseline. Another is that folk have got a little too excited and it'll drift back. The third is that this is the vanguard of being able to conquer the market and there's much more to come.

Choices on which of those is right will be the basis of any trading strategy. What can be said with some certainty is that the FDA test approval of Parsortix has increased investor interest. That's why we're seeing individual share buying in some volume. That will likely lead to volatility in the Angle share price. Which means that the task is to get on the right side of price movements.