Shares of Man Group PLC (LON: EMG) soared over 9% on Friday after the hedge fund manager reported a 4% rise in assets under management to $113.1 billion.

Strong demand for alternative assets resulted in a $1.7bn inflow in this portfolio. The group added that favourable foreign exchange movements additionally contributed with $1.4 billion, while long-only funds added $1.7 billion.

“We are pleased to report good performance in the third quarter and strong growth in funds under management.

“This was driven by robust net inflows into alternatives as anticipated, as well as performance gains across both alternative and long-only strategies. Engagement with clients remains good, although there is increasing uncertainty due to upcoming political events and current COVID-19 trends,” said Luke Ellis, Man Group's chief executive, in a trading update.

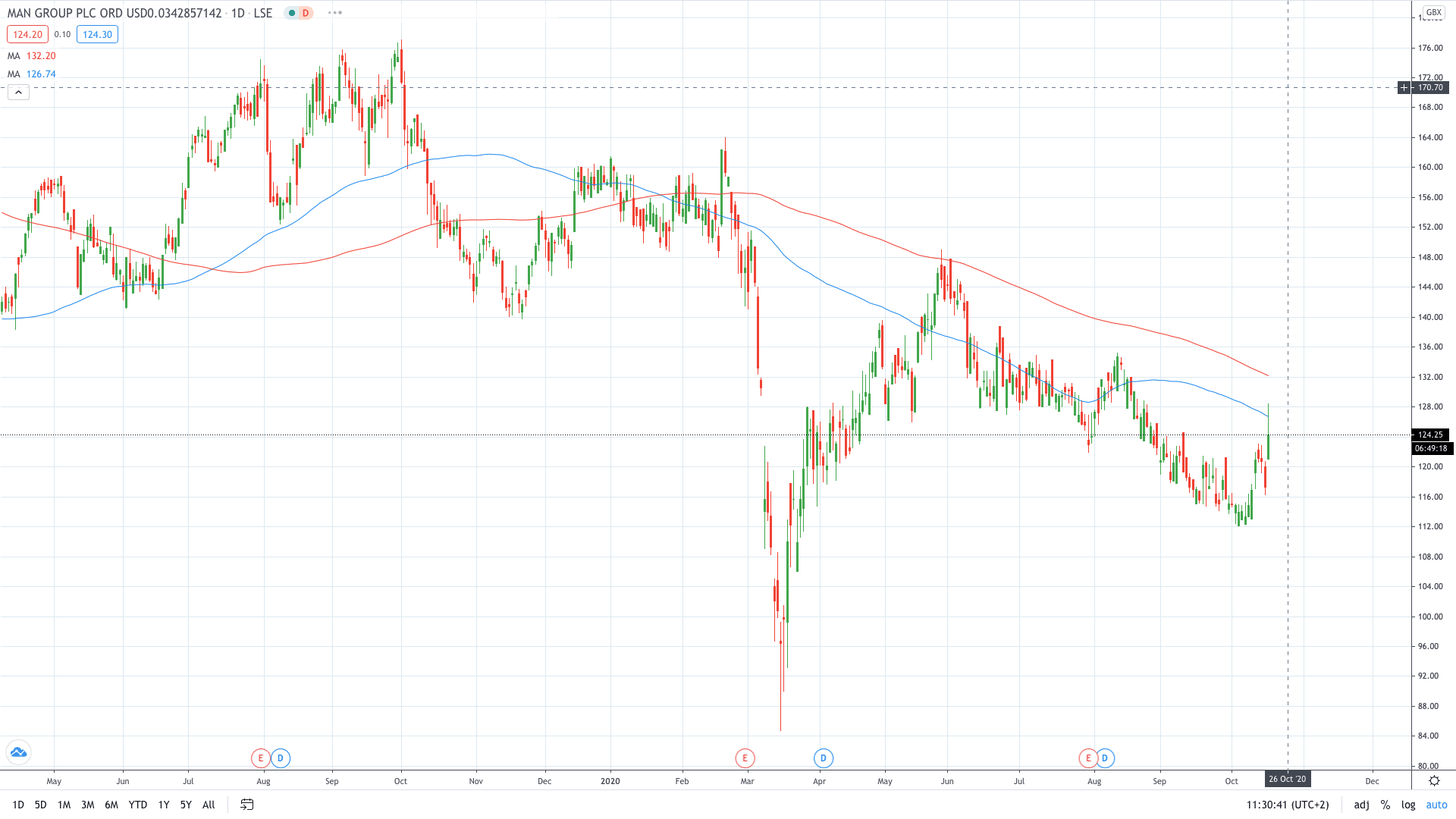

Man Group share price rose over 9% to 128.45p, the highest EMG traded since August.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan