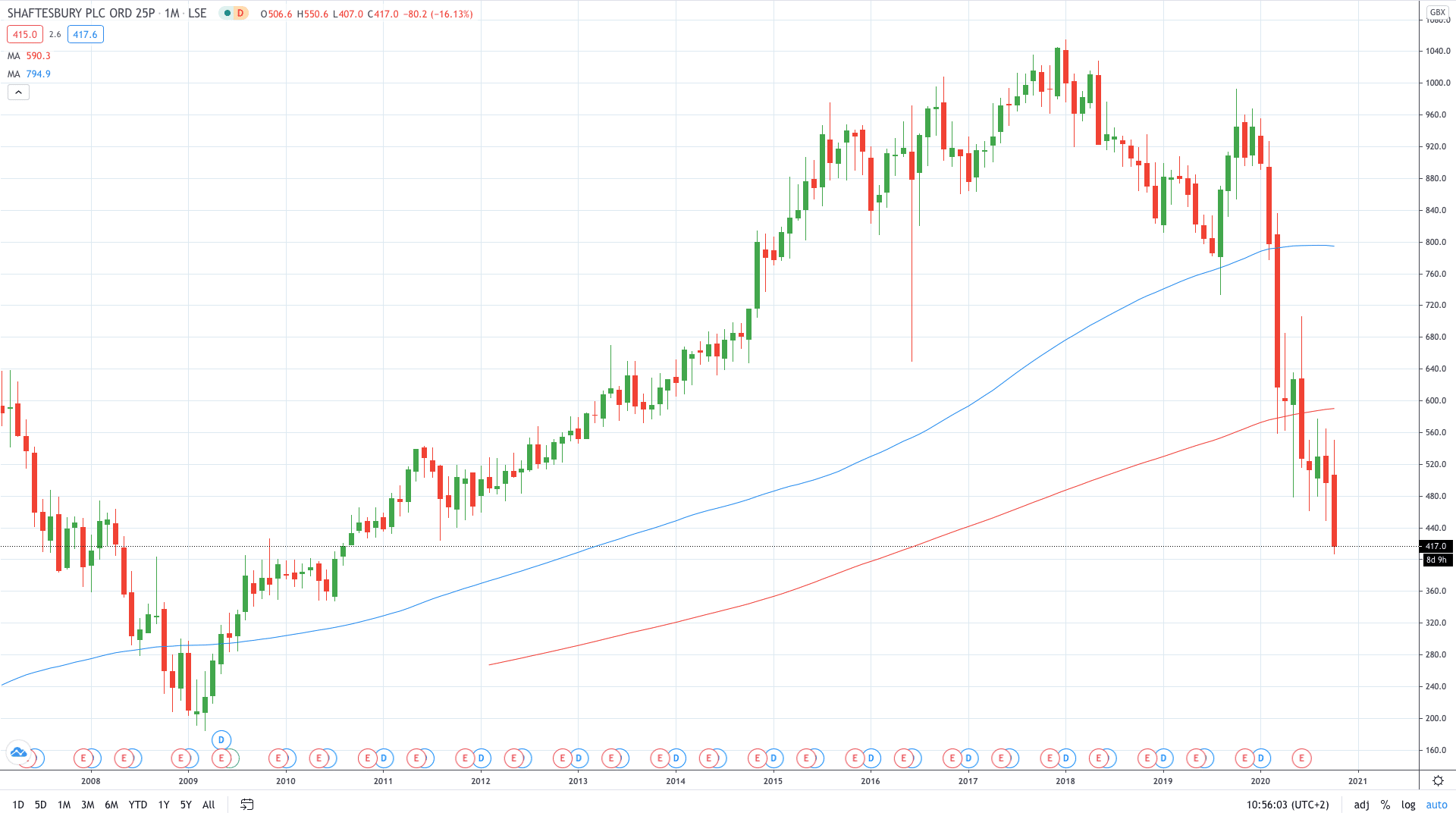

Shares of Shaftesbury PLC (LON: SHB) fell more than 18% on Thursday after the UK-based real-estate investor said it intends to raise up to £307 million to improve its liquidity.

Shaftesbury, which owns properties mostly in London’s West End and Chinatown, saw its share price fell sharply today as the offer is based on a heavily discounted placing of new shares.

“The capital raising announced today will ensure the group maintains the financial flexibility and resources to navigate the unprecedented near-term operational challenges caused by the COVID-19 pandemic,” chief executive Brian Bickell said in a statement.

Shaftesbury will offer its shares at 400p a piece, which is about 20% lower compared to yesterday’s closing price of 498p. Two of the biggest shareholders, Capital & Counties and Norges Bank, both decided to increase their stakes in the real-estate operator.

Capital & Counties has increased its stake to about 26% after agreeing to invest a further £65m as part of the deal. Similarly, Norges Bank will invest £77 million in the company. It already owns 26% of the business.

A month ago, Shaftesbury said it had received only 41% of the rent for the six months ending 30 September. As a result, it had decided not to pay a final dividend.

“With the continuing uncertainty, many of these overseas tenants have chosen not to return to the UK for the time being and have vacated permanently.”

Shaftesbury share price plunged nearly 19% to hit 407p, a new 10-year low for the stock.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan