Key points:

- The ProShares UltraPro Short QQQ ETF (SQQQ) and SDS stock fell 400% during premarket trading.

- The sudden move was driven by a reverse stock split announced in December.

- Investors can rest easy since there were no sudden moves in the stock market.

The ProShares UltraPro Short QQQ ETF (NASDAQ: SQQQ) stock soared 400% premarket after implementing a 5:1 reverse stock split. A similar move happened to ProShares UltraShort S&P500 (NYSEARCA: SDS) stock, which soared 400.13% following a similar 5:1 reverse stock split.

Many investors were shocked by today’s move, given that US stock markets had barely moved during premarket trading to warrant the massive moves in the inverse ETFs issued by ProShares that track market performance.

However, today’s soaring inverse short ETF prices had nothing to do with the markets but had everything to do with a 5:1 reverse stock split implemented by ProShares, the issuer of the two inverse ETFs SQQQ and SDS.

Also Read: What Are Exchange Traded Funds (ETFs)?

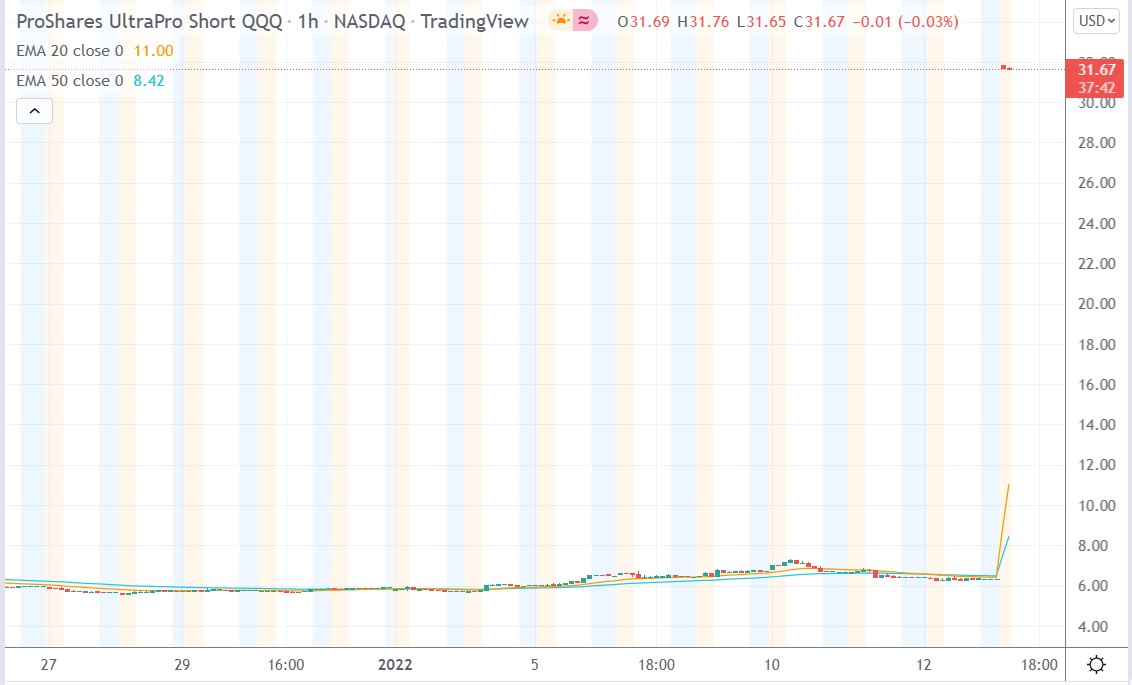

The two inverse ETFs had seen their value fall significantly after US stocks rallied higher for most of last year, driving their value lower. For example, SQQQ was trading at $6.34 at the market close yesterday but soared to a high of $31.76 after the reverse stock split.

SDS stock traded at $7.17 at the close yesterday but surged to $35.86 after the stock split. The main reason behind the reverse stock split was to make SDS and SQQQ stock more attractive to investors by raising their value.

Furthermore, given that the year just started, you can imagine where the two ETFs would be trading if the stock market kept rising, which means that they would keep falling.

There’s only so much positive ground they could lose from $6 – $7 before they went into negative territory. So, the ETF issuer had to find a way to raise their prices, hence, the reverse stock split.

Investors may already be familiar with reverse stock splits from many companies whose shares fall below $1 and are at risk of being delisted from their respective exchanges, especially the NASDAQ, where many penny stocks are listed.

Such companies usually conduct a reverse stock split to bring the value of their shares above the $1 cutoff mark. ProShares used the same technique to boost the SDS and SQQQ stock price.

However, the reverse stock split was announced on December 22, 2021, but was to come into effect today before the market opened. Therefore, investors can rest easy knowing that there were no sudden movements in the overall markets.

*This is not investment advice. Always do your due diligence before making investment decisions.

SQQQ stock price.

SQQQ stock price soared 400.94% to trade at $31.76, soaring from Wednesday’s closing price of $6.34.