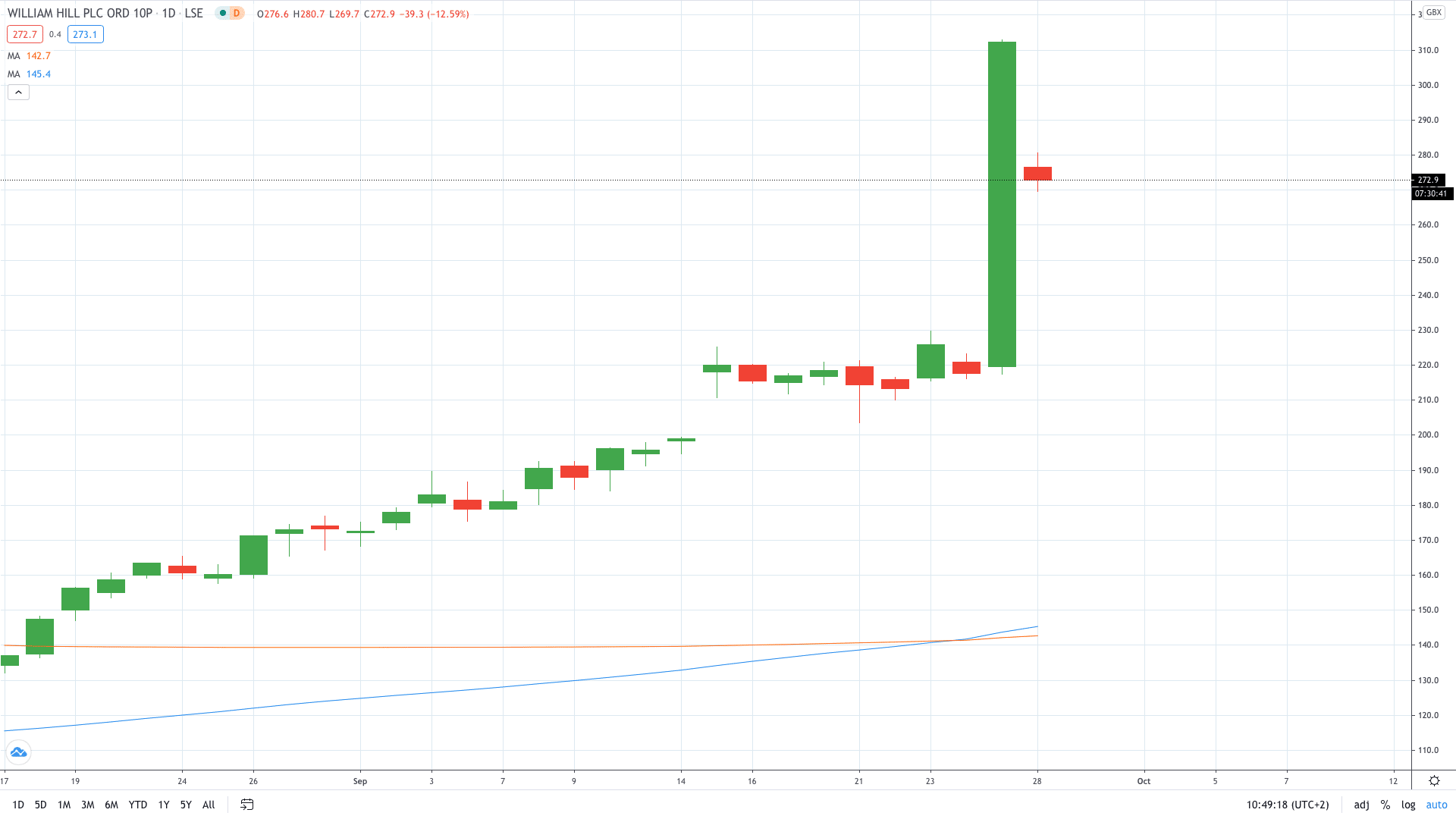

Shares of William Hill PLC (LON: WMH) fell 13% today after the casino giant Caesars Entertainment confirmed it is currently in advanced talks over a £2.9 billion takeover of the company.

The valuation discussed with Caesars is lower than initially anticipated £3.3 billion. It comes after the casino giant made a cash offer of 272p per share, lower than 312p where the stock price closed on Friday. However, this is still around 25% higher compared to Thursday’s closing price.

William Hill's board of directors recommended to shareholders to accept the offer from Caesers as it is “at a price level that they would be minded to recommend”.

Caesars chief executive Tom Reeg said: “The opportunity to combine our land-based casinos, sports betting and online gaming in the US is a truly exciting prospect.

William Hill's sports betting expertise will complement Caesars' current offering, enabling the combined group to better serve our customers in the fast growing US sports betting and online market”.

The betting company has witnessed a difficult 2020 year as the pandemic forced it to close 119 more shops, just a year after shutting down 700 shops.

William Hill Stock now trades at 272p, down 12.7% on the day.

PEOPLE WHO READ THIS ALSO VIEWED:

- Aston Martin share price up 15% in two days. Here’s why

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan