Speculators have suggested that the current bull run in bitcoin could easily go to $100,000 and beyond. There are some pricing models, such as the stock-to-flow model, that even suggest that bitcoin could be on its way to $1m in the coming years.

Despite this, near-term price fluctuations can be wild. Trading in bitcoin is certainly not for the faint of heart. However, as with other ‘commodities’ that have a scarcity of supply (the maximum number of bitcoin that can ever exist is just 21m), demand on the open market is just one side of the story.

There is a steady supply of bitcoin being mined, currently at a rate of 6.25 bitcoin every 10 minutes. However, the number of bitcoin being released into the network depends on the decision-making of the miners themselves.

All the bitcoins in existence are created through mining. Mining is a process whereby transactions of bitcoin are logged on a public ledger called the blockchain. Miners race to be first in the queue to verify the transactions of bitcoin users in one single block. The ‘block reward’ to the miners for doing this proof of work and for being first to do it is a payment of 6.25 bitcoin.

What the bitcoin miners then do with their block reward can be an important factor in driving near-term price moves. Miners can either sell their bitcoin reward (release bitcoin supply into the network to be freely traded) or hold on to it (preventing it from going into circulation, adding to inventory levels).

Following a series of ‘halving events’, block rewards have reduced since Satoshi Nakamoto founded the cryptocurrency in 2009. An initial reward of 50 bitcoin has now been whittled down to just 6.25 bitcoin following the third halving event on 11th May 2020. Despite the lower amount of bitcoin mined, with a price of around $50,000 per bitcoin, the reward for mining can still be significant.

Miners will often need to release bitcoin into the market to pay the bills. As part of this process, the significantly higher price of bitcoin is likely to also play a factor in their decision-making.

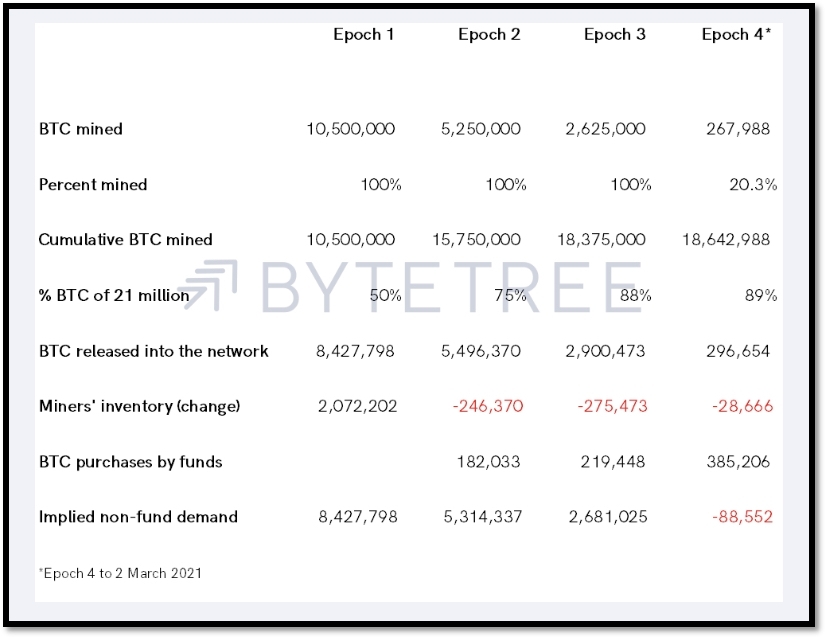

The table below from ByteTree Asset Management shows that bitcoin miners are increasingly selling their reward.

Source: ByteTree Asset Management and Bloomberg

Miners’ inventory (the total amount of bitcoin not in circulation) is declining steadily. Miners are releasing more bitcoin into the network than they have mined, drawing down on the inventory that was built up during Epoch 1. This process may accelerate if the huge rise in bitcoin price continues.

We can also add in another aspect from the demand side. Bitcoin purchases by investment funds are accelerating. Large corporate buyers such as Tesla and BNY Mellon are hoovering up the world’s most widely traded cryptocurrency. Payment solutions companies such as Mastercard and Square are also preparing to accept bitcoin. Therefore, even as the supply of bitcoin into the market is increasing, there are new sources of demand to take up this supply.

So far in Epoch 4, purchases by funds are far outweighing selling by miners. Demand is significantly outstripping supply. This will be one of the key factors that has seen the price soar in recent months.

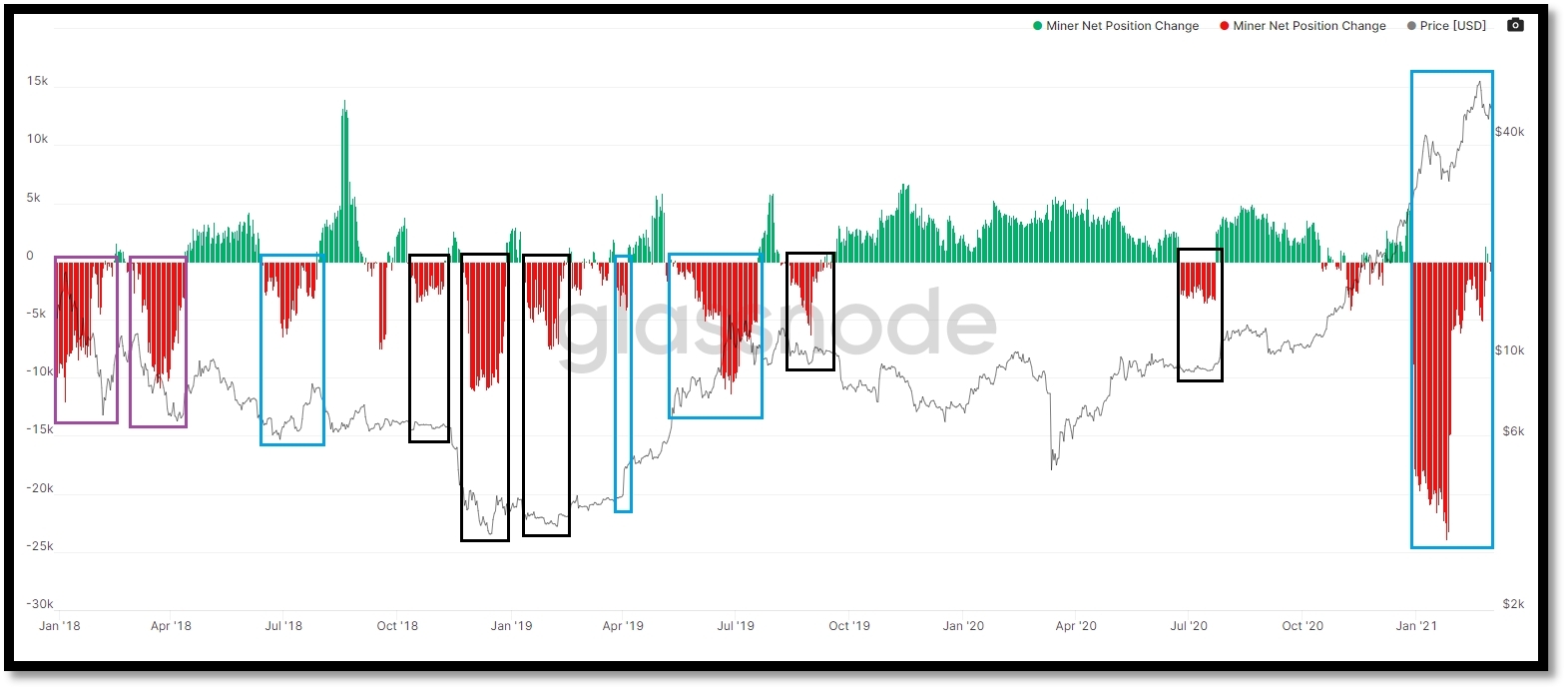

Furthermore, it is also worth looking at the changes in net selling of the miners and the impact on the price of bitcoin. The chart below from Glassnode.com shows the changes in net positions of miners dating back to the beginning of 2018. The red bars are net selling, and the green bars are net holding.

Looking at the big tranches of selling, at first glance there appears to be no reliable correlation with price moves. Only twice (in early 2018) did a big swathe of miners’ selling result in a notable price decline. All other occasions since have either resulted in no real impact (black boxes) or the increase in selling coming with the price moving higher (most notably in the first two months of 2021).

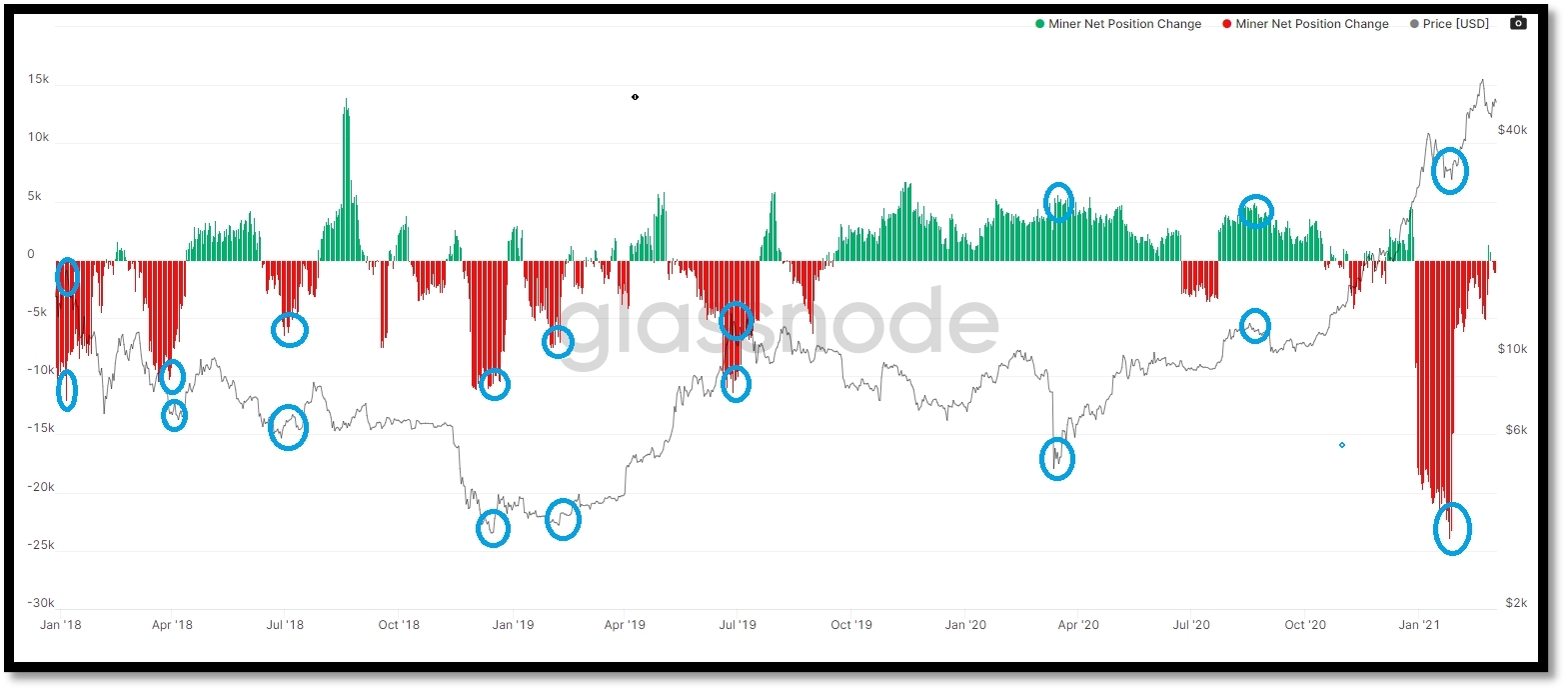

There is far more of an argument to say that troughs in the net selling (and often peaks in net holding) can help with the timing of turning points in the price. This is shown with the blue circles in the chart below.

However, there is a caveat to this approach. There are also several false signals, leaving a degree of uncertainty in identifying that a nadir in net selling has been reached. Despite this though, studying the flow of what miners do with their bitcoin can help traders to time their moves in and out of bitcoin.