Key points:

- Hummingbird Resources shares are down 19% this morning

- This is off the back of the production update

- How bad is this result and will it recover?

- Gold Trading: The Essential Guide

Hummingbird Resources (LON: HUM) shares are down 19% this morning off the back of the Q1 2022 production update report. The oddity in the result is that they’re managing to lose money mining gold at a time of rising gold prices. That’s not a good look, but there is reason behind it.

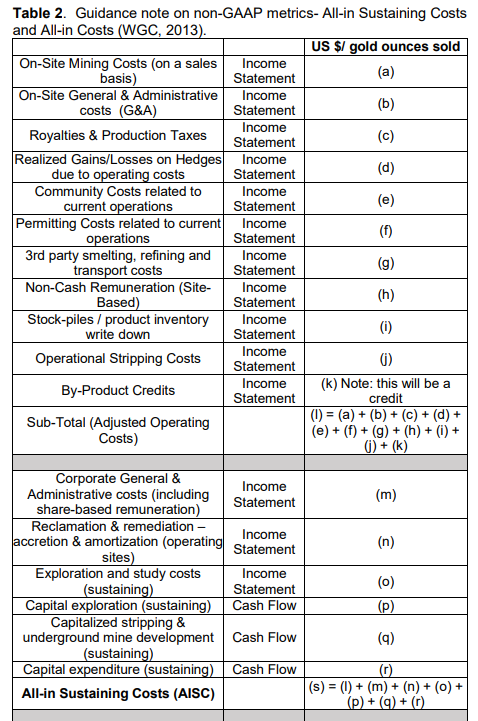

Ti understand this it’s necessary to grasp some of the accounting used in gold and other precious metal miners’ accounts. There are two different ways of counting profit, that is. One is to look at operating costs and revenues, the other the “all-in sustaining cost”. It’s this second which is really of interest with gold miners specifically. That’s the one the market generally looks at, at least.

The Q1 2022 production report gives Hummingbird’s AISC (that all-in sustaining cost) at $2,235 for each ounce of gold mined. Given that the sales price was $1,837, this means that, by this measure, there’s a loss. This isn’t what we want to see, of course.

On the other hand, we need to understand what ASIC actually means. Here’s a nice chart to show this.

Also Read: The Five Best Gold and Gold Mining Stocks to Buy Now

The more normal thing we’d think of as an operating profit is that first subheading there, revenues minus adjusted operating costs. This gives us something comparable to gross margin in other types of company.

However, what we’d like to know is what are the long-term costs of mining? Long-term producing something of a problem for we’re all aware that any particular deposit has its lifetime, its time in the Sun. So, how much does it cost to both mine ore this year and also go and find enough ore to replace what has been mined? This is really what the “sustaining” part of Asic means here.

For the long-term value of the company, that’s also what we’re interested in as well. Or, perhaps, we need to know what it is. For if we know that when this deposit is mined out then the company will stop then that’s fine, we just have to know that. We can value it as being something that will last for 10 years, or 50, whatever it is, rather than it being something that will last forever.

For Hummingbird Resources, those Asic costs are higher than revenues simply because production fell. This was known about, that it was going to happen, for they’d already told us that the processing plant required significant maintenance work. But you don’t – and they didn’t – cease exploration and development work for such a single quarter reduction in revenue. So, overall there’s that Asic cost higher than per ounce sales revenue.

This being one of those things that should sort itself out as production levels rise again.

This leaves us with the question of why, if this was known about, did the Hummingbird share prior fall 19% on the announcement? Possibly simply investors not paying attention to the earlier information, possibly HUM not making enough noise about it.

Any trading position is likely determined by whether we think this is just that passing effect of the maintenance or something more deep rooted.