Key points:

- Missfresh stock is up 122% this morning

- Working out why is difficult given they've closed most of the business

- They've apparently run out of the capital necessary to keep operating

It's possible to think that Missfresh (NASDAQ: MF) is something of a passed it and gone experiment but if that's so then why has the stock just jumped 122% overnight? Only by working that out can we even think of whether we'd like to trade in the stock.

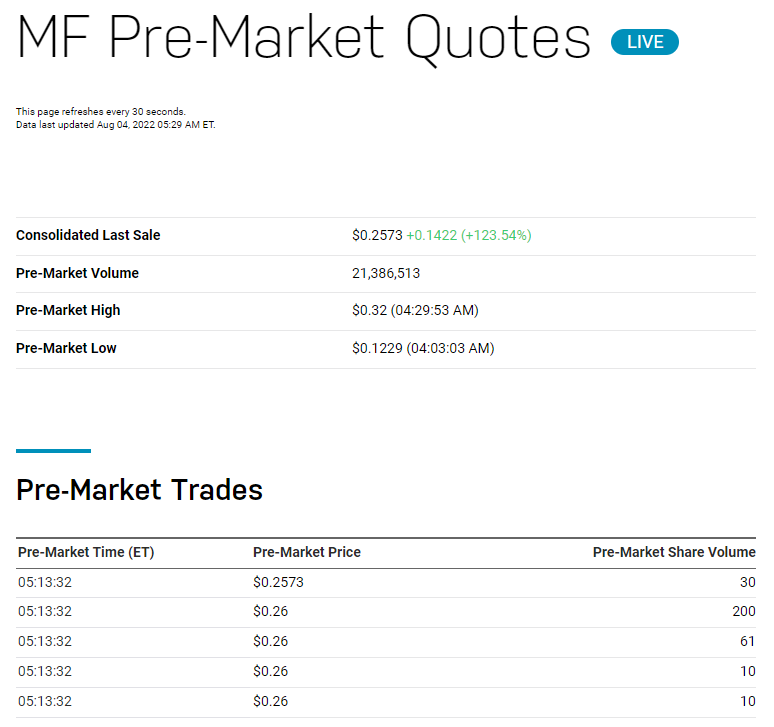

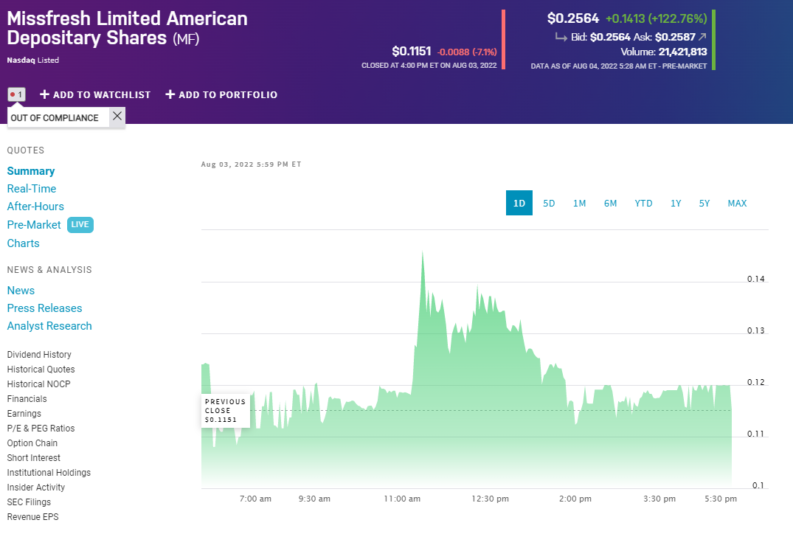

Missfresh is a Chinese ADR listed on NASDAQ, it arrived in the fall of last year and has declined 98.7% since its IPO as a SPAC. That's not one of those stock price performances we'd be proud of having bought into to be frank about it. But as traders our question is always, well, what's next? The past is passed and it's the future we're interested in. MF stock is indeed up that 120% and change this morning. So, our first test is to see whether this is real trade or not, something we can look at NASDAQ to check:

Not that volumes are hugely high – recall that a 1,000 stock trade is still only $250 worth – but this isn't a fat finger or one solitary well out of market pricing trade. One thought could simply be that this is a dead cat bounce – drop even a dead cat from high enough and it will bounce at least the once. But that doesn't look right either, as the MF stock price decline isn't some sudden and recent event.

Also Read: 30 Global Stocks That Warrant Your Consideration

As to what it is that Missfresh actually does, it's attempting the last mile delivery of groceries and consumer goods in China. Speedy deliveries that is – order and 15 to 30 minutes later someone turns up with your goods. Missfresh has also decided to try and do this the capital intensive way, owning the specific warehousing units, rather than teaming up with extant retail and convenience stores. That would boost earnings as and when there are any but it also massively increases the capital required to get the network up off the ground and producing revenue.

A reasonable read of this is that Missfresh simply hasn't got enough capital to be able to do this. There might have been $300 million from the IPO but if reports in the FT are correct then that's all gone. In fact, the company itself says that it's not got the money to keep operating “including a temporary shutdown of its on-demand Distributed Mini Warehouse (DMW) service and staff optimization. It is expected that these significant adjustments will have a material and adverse impact on the Company’s financial performance. The on-demand DMW business contributed approximately 85% of the Company’s total net revenue for the nine months ended September 30, 2021.”

So, Missfresh has shut down 85% of its revenue generation. There was going to be a cash infusion from Shanxi Donghui but that apparently hasn't turned up.

So quite why there's that MF stock price jump is difficult to work out. Perhaps there's a rumour that the Shanxi money will arrive. Or some other source has been found. But given the difficulty everyone has had in making low value delivery, and speedy delivery, work in a financial sense it's not obvious that there's a business to save here at Missfresh.