Key points:

- InMed Pharma stock is up 2,422% this morning

- Or we could say INM is down 4%, even 84%

- Are we interested in real or nominal prices, over what time period?

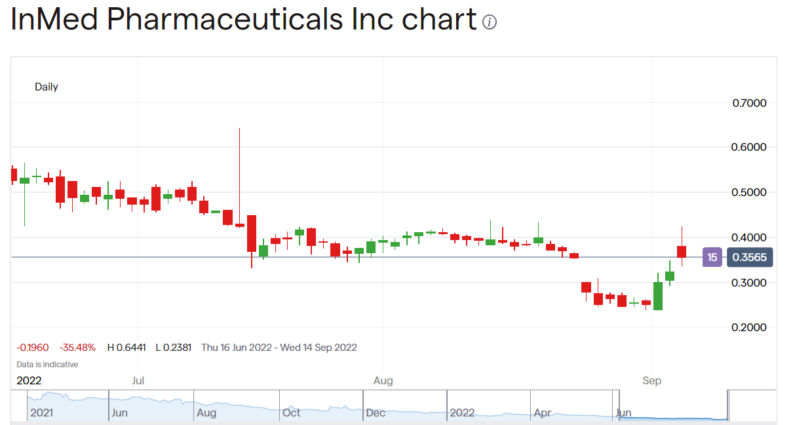

InMed Pharmaceutical (NASDAQ: INM) stock is listed as up 2,422% this morning premarket. It's also generally listed as being down 84.51% over the past 12 months. Also, 96% down since peaks in 2018. That's a lot of changes there but some are only nominal, some are real. We can also say that InMed is down about 4% today, around and about. The trick is working out which of these price changes is real, which is purely nominal.

As to what InMed Pharma does it's, as the name would suggest, a clinical stage pharmaceutical company. It's in the business of developing cannabinoid therapies which doesn't look like an obviously odd place to be. We know that cannabis has interesting effects upon humans after all, we've millennia of experience of that. We also know – or at least strongly suspect – that it has beneficial effects on things other than merely mental states. As an appetite booster for example, also in reducing nausea. There's even reasonably good evidence about certain eye problems – glaucoma for example. So, investigating in a proper clinical setting what those beneficial effects might be seems sensible. It's also true that laws around who may research what among recreational drugs have been considerably relaxed in recent years.

The problem for INM is that they've not got a product yet, despite decades of work and existence. Yes, pharma development is a long and drawn out process but hopes might well be higher, that something would have emerged from the research by now.

Also Read: Five Best Pharmaceutical Stocks to Watch in 2022

The particular point today is that the long term stock price performance has led to InMed being substantially below the NASDAQ $1 minimum offer price. That would, if it continued, mean that the NASDAQ quote is lost and INM relegated to the OTC markets – where it's even more difficult to raise capital to continue to research. So, something must be done.

As to why there's this minimum price necessity that's just fashion. The New York markets just think that the right sort of price for a dependable stock is in the $10 to $100 range. That this is just fashion is shown by London thinking the same range is £1 to £10. Which is why ADRs of London stocks are so often 10 units, to be in that fashionable range in both markets.

New York also thinks that penny stocks are the home of manipulators and charlatans – therefore you can't retain a listing on the Big Boy markets if you're a penny stock.

So, something must be done, that something is a reverse stock split – a consolidation to Brits. For every 25 shares yesterday there is now one. That means the price should rise 2,500%, obviously. But that's the purely nominal price rise – of itself it makes no difference to the market capitalisation of the company, nor of any individual stockholding. The real price change is the amount by which the nominal price doesn't change by 2,500%. As we've got a 2,422% change here, that's some 80 percentage points short, or – roughly you understand – about a 4% decline in real terms.

Working out this difference between nominal and real price changes is important.