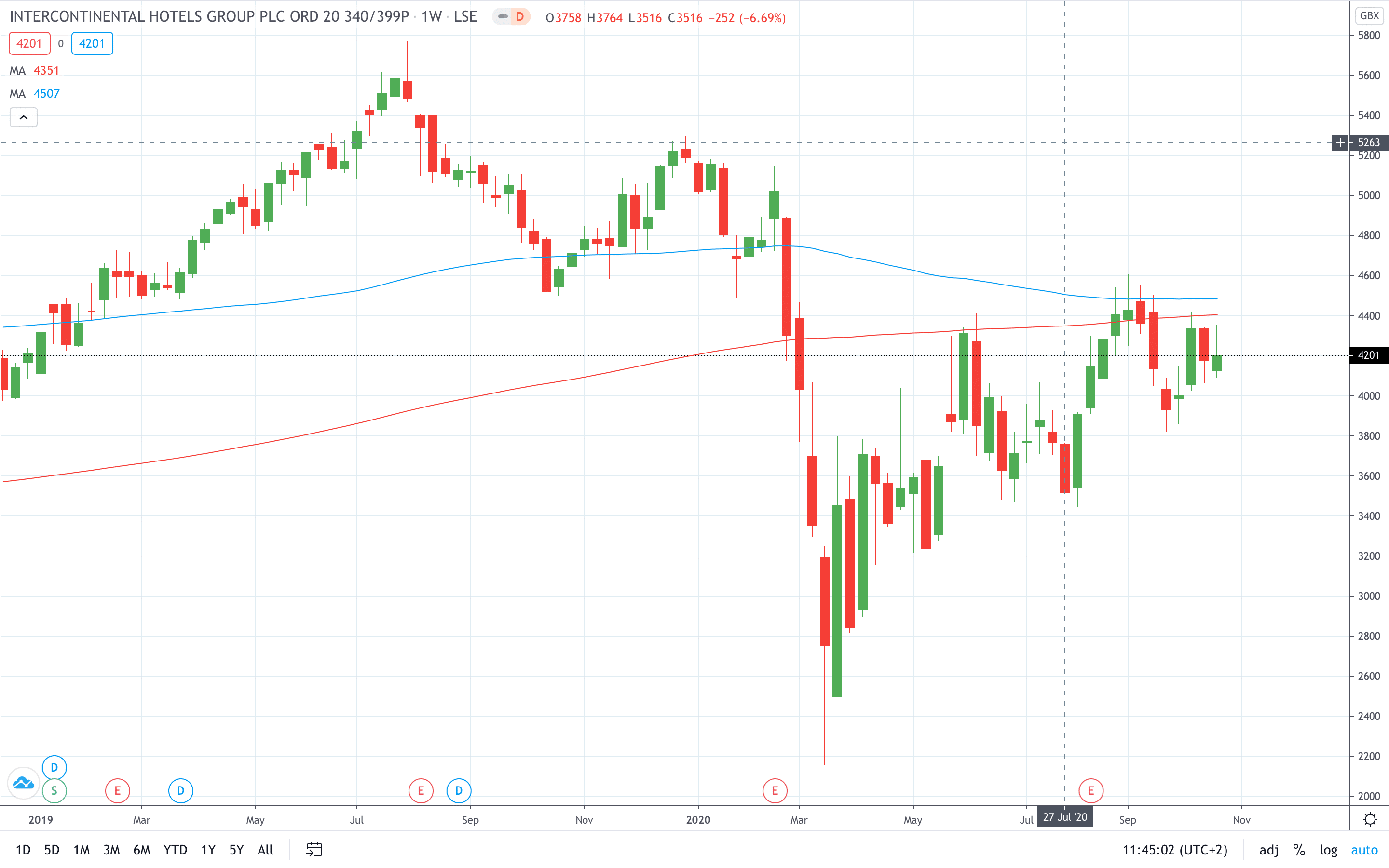

Shares of InterContinental Hotels Group PLC (LON: IHG) fell 1.45% on Friday after the company reported that its revenue crashed 72% compared to 2019.

Revenue per available room (RevPAR), which is a focus for investors as far as the hospitality sector is concerned, fell by 53.4% for the last three months to end-September.

Still, this is better than a decline of 75% posted in the second quarter of 2020. Overall, the number of bookings per room increased to 44% from 25% in the previous quarter.

“Trading improved in the third quarter, although progress continues to vary by region,” Keith Barr, CEO of the hotel chain operator which owns InterContinental and Holiday Inn brands, said.

“Our actions have resulted in ongoing industry outperformance in our key markets, and we remain focused on leveraging the strength of our brands, scale and market positioning to recover strongly and drive future growth.”

IHG share price closed 1.45% lower on Friday but still managed to secure a green weekly close (+0.65%).

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan