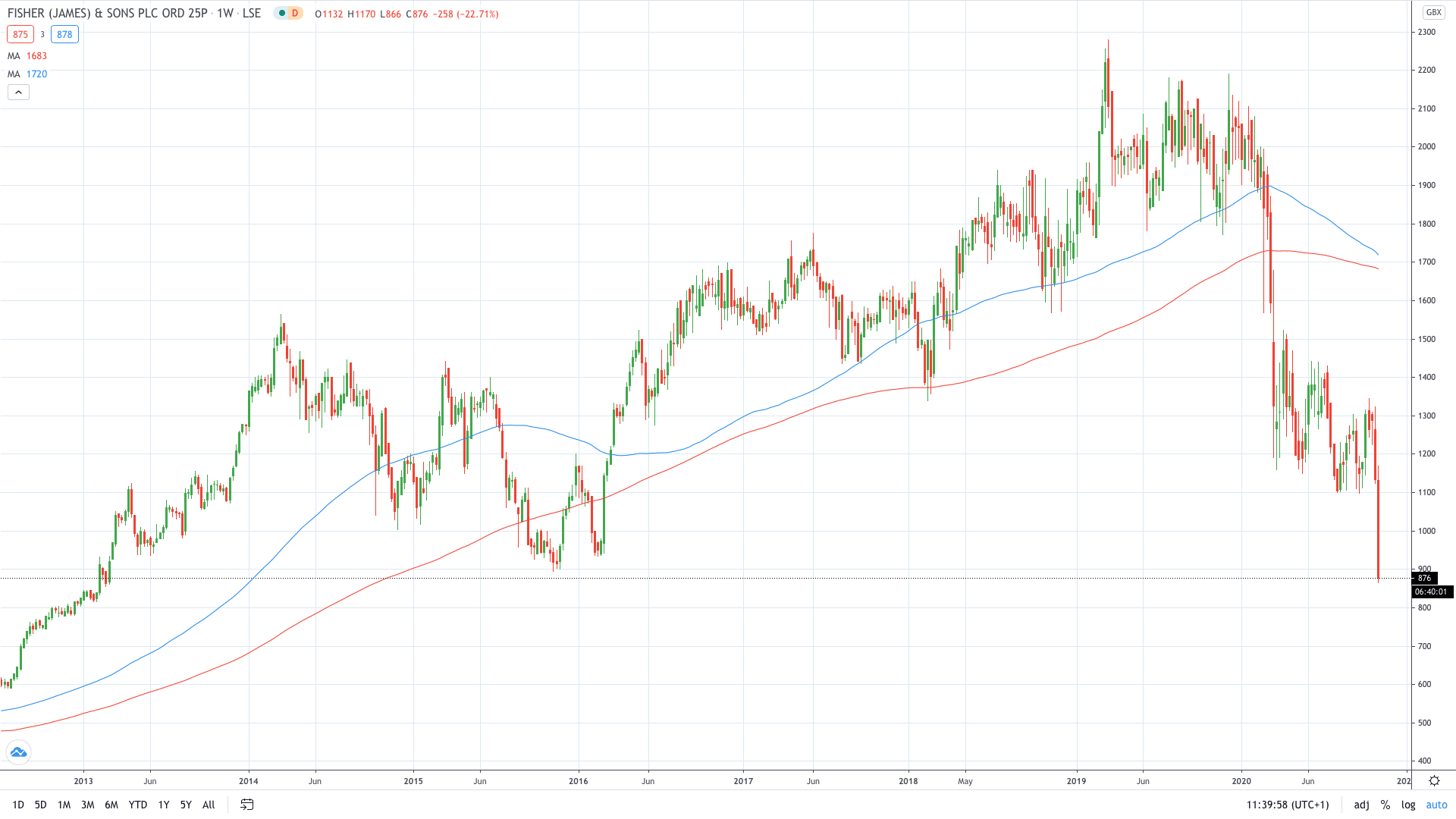

Shares of James Fisher & Sons PLC (LON: FSJ) collapsed around 20% after the engineering firm said it has continued to face challenges in the third quarter.

James Fisher said it didn’t manage to materialize an improvement in its trading activity in three months to end-September 30. Revenue fell 17% for the first nine months of the year compared to a year-ago period.

“Trading in the third quarter continued to be challenging as the Group did not see the improvement to trading conditions and the seasonal uplift it had been anticipating at the Half Year Results,” the company said in today’s statement.

Project delays and cancellations in oil & gas and renewables sectors hampered the firm’s Q3 performance.

As a result, the company said it now forecasts that a full-year underlying operating profit will come in the range of £35 million to £40 million.

James Fisher share price plunged 20% to 866p and print the lowest levels recorded since 2013.

PEOPLE WHO READ THIS ALSO VIEWED:

- BRITISH AIRWAYS: HERE’S WHY IAG SHARE PRICE SOARED TODAY

- Learn more on how to open a demo account

- Learn what is a Pip in trading