Key points:

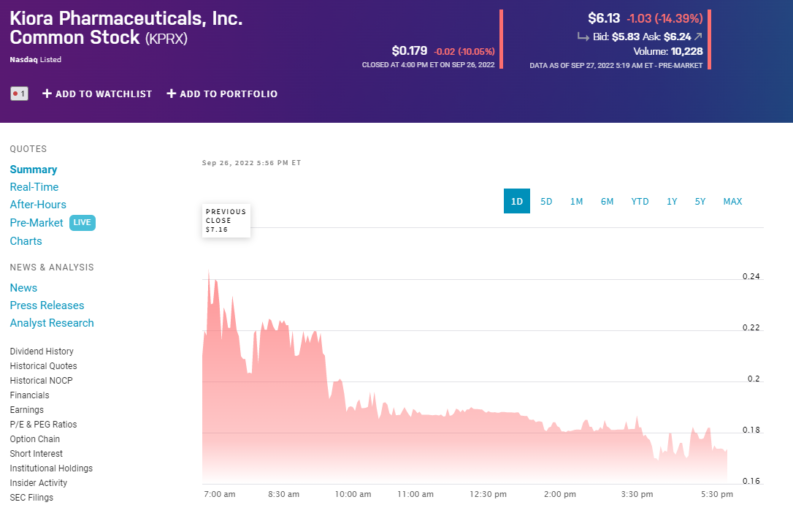

- Is Kiora Pharma up 3,190% this morning or down 20%?

- That depends upon looking at the nominal or real prices for KPRX

- It's real prices that matter to our wallets, so its down

Kiora Pharmaceuticals (NASDAQ: KPRX) is down 90% and change over the past 12 months and it's also up 3,190% premarket today. Which is nice of course, that does take it back well above that starting point, but to think that way is to miss the difference between real prices and nominal. The rise today, that 3,190%, is a purely nominal price rise. And, in fact, when we examine it closely, it's not a real price rise at all, it's a real price fall. Yes, it is true, a 32 times nominal price rise can be a real price fall.

Kiora Pharma is, as the name suggests, a pharmaceutical company. One based in the US which is what is known as “clinical stage” and develops treatments for ophthalmic diseases. They've a series of treatments variedly in Phase I, II and III testing. All of which is great, although none have come to fruition as yet. Which means that given the risks – most new drugs don't get through the whole approval system – the company has to be funded by stockholder capital. The large companies, the banks even, are only going to come in at the stage where one of these treatments is both shown to work and likely to be approved by the FDA. That's just the way the funding system works here.

Which is where the problem over the 90% KPRX stock price fall comes in. That has left the price well below the NASDAQ $1 minimum offer price and so that NASDAQ listing is in danger of being lost. Relegation to the OTC, which would follow, would make raising capital more difficult and more expensive.

Also Read: Five Best Pharmaceutical Stocks to Watch in 2022

As to what can be done about this the answer is a reverse stock split – a consolidation to Brits. Simply declare that what used to be 40 pieces of stock is now one – the 40 to 1 reverse stock split that Kiora has just done. Directly this won't change the value of the company, nor of any individual stockholding in it. It's just a change in the denominator, the number of pieces of stock in existence.

A 40 for one should lead to a 4,000% change in the nominal stock price but no change at all in the real price. But that's not quite what we can see, is it? We've that – at pixel time – 3,190% change in the nominal stock price. This is some 800% short of where it should be, or running the numbers another way it's about 20% down on where the purely nominal effects should be. Thus we are more accurate in saying that KPRX stock is some 20% down, in real terms, premarket this morning.

The deeper point to make here is that we must always distinguish between nominal and real price changes. Here it's about stock prices but it's a lesson of much wider application too – we're in an inflationary period after all. Something that goes up 5% when we've got 10% inflation is actually a real price fall, whatever the nominal numbers are telling us. The difference is important.