Key points:

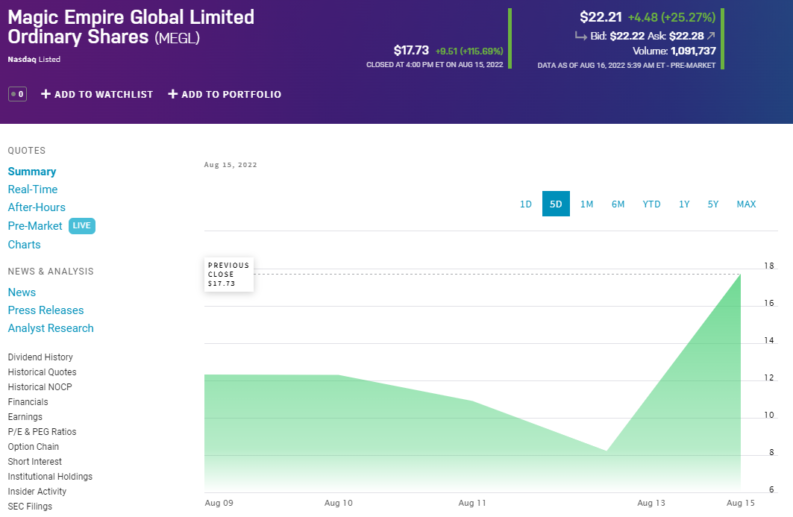

- Magic Empire Global is soaring again

- Last time around this led to a 95% fall

- Will it, again, and from what price if it does?

Magic Empire Global (NASDAQ: MEGL) stock is up 180% over the past 24 hours in what appears to be another repeat of the meme stock status it has. Or possibly it's that comparison with AMTD Digital (NYSE: HKD) and AMTD Ideas (NYSE: AMTD) again. The big question for us as traders is, well, how far is it going to go this time? After all, it went thousands of percent last time then lost 95% of its value almost overnight. Then turned around and did something similar once again. So, is this third time lucky or what?

The problem we've got here in trying to evaluate MEGL is that there's really absolutely nothing at all to justify some vastly elevated stock price. Other than the fact that some number of other people are willing – at times – to pay hugely elevated prices for Magic Global stock. That is of course what the determinant of prices is in any market – what will people pay. But when those prices become so disconnected from funadmantals we do have a problem in deciding what we think they should be.

Sure, we can treat MEGL just as a momentum play. It's going up so climb aboard and see how far it goes. The problem with that comes, of course, in that 95% value destruction which the stock has already done once. For momentum plays do, sometimes, run out of momentum and then reverse. That in itself can be a trading opportunity, of course. Going short something we're certain will fall works – but only if it does fall. Those who were previously short as it went to $214, or then again back up to $180 after a fall, had a world of pain. And the problem with being short a stock is that potential losses are in fact infinite.

Also Read: Global Stocks For Your Consideration

Here's our problem with Magic Empire Global stock. There's simply no – other than people buying it – justification for the stock price moves. The best analysis anyone can offer is the one we did back a week. That AMTD Digital company floated on the NYSE and then soared, rose some more, then really jumped. No one at all knew why or could justify it, not even the company themselves. But it was, vaguely, in the same sorta business as Magic Empire, something to do with tech and financing and banking in Hong Kong. That's about the only connection anyone does make with it. So, if one such stock soars, then why wouldn't the other? If HKD goes up then so too MEGL?

That really is about all there is to this. That makes it terribly difficult to trade because there's no bedrock information to base a valuation upon. There's simply a gambling frenzy happening meaning that to forecast the stock price we've got to read the frenzy. Which is difficult when we're all sitting behind screens – actual physical crowds are easier to read.