- After a week of dramatic news reporting, it was the markets themselves making the headlines toward the end of the week.

- Global equity indices break new ground as buying pressure continues to dominate despite geopolitical tensions between the US and Iran.

- At the same time, the US Dollar appears unable to break its long-term pattern of weakness as traders move out of more secure assets and embrace risk.

- Global growth and economic fundamentals are the drivers of the move with bulls factoring in positive news regarding trade talks, job numbers and earnings reports.

Despite a catalogue of developing geopolitical risks, the equity markets on Thursday posted record all-time highs. The three main US indices, the Dow Jones Industrial Average, the S&P500 and Nasdaq all printed at new levels as bulls took control. Traders are taking the view that the Middle East risks are present, but known, and are instead basing their optimism on economic fundamentals.

Item number one on the bull's wish-list for 2020 is the signing of ‘phase one' of a trade agreement between the US and China. Thursday saw the China negotiating team confirm they will be accepting the invite from the US to attend a signing ceremony in Washington D.C.

Gao Feng, a Beijing government spokesman, confirmed to the press that China's Vice-Premier Liu He, the head of the country's negotiating team, will visit the US and sign the deal on 15th January. More good news came as Washington confirmed a delegation, headed by the president, will in the near future travel to China to kick-off talks relating to ‘phase two'.

Donald Trump may, in many ways, be an unconventional president. But even those keeping one eye on the Gulf skirmishes may agree he'd be unlikely to push on with any anti-Iranian military action while the Chinese delegation is in town.

The view of FXStreet Senior Analyst, Senior Analyst, Joseph Trevisani is that:

“The deal… will remove that concern from business planning even if it does not solve all of the problems between the two nations.”

Source: FX Street

Iran

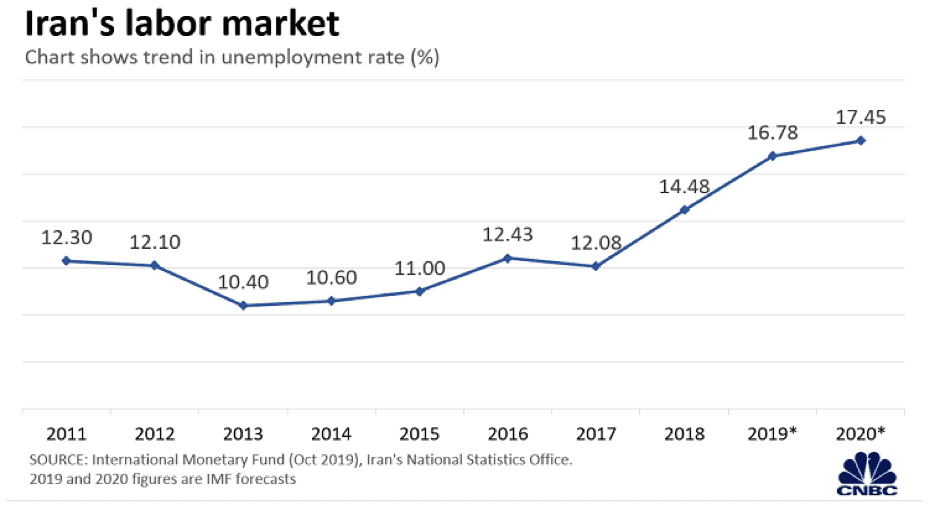

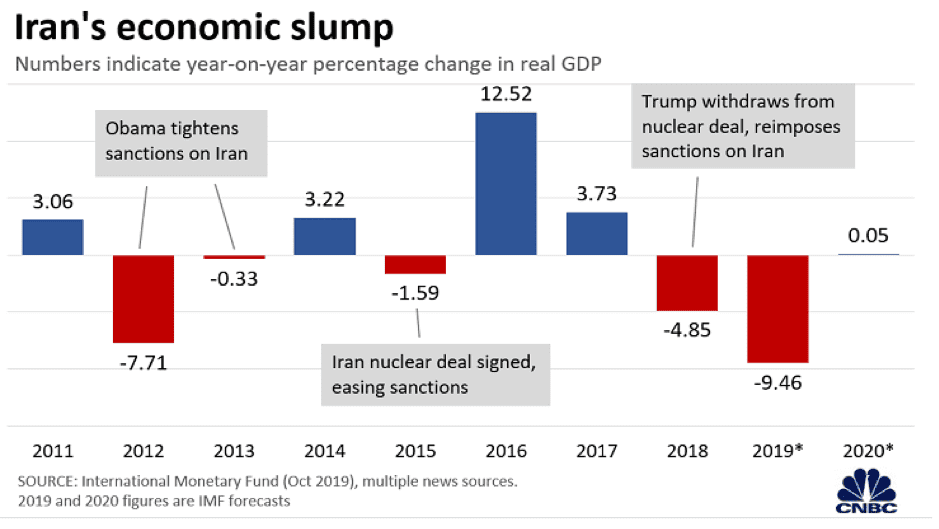

In economic terms, Iran is ill-prepared for war. The country's GDP fell almost 10% last year, and unemployment is in the high-teens and rising.

With evidence building that Iranian surface-to-air missiles were responsible for downing the Ukraine International Airlines commercial passenger jet on Wednesday, it might be that officials in Tehran consider the best option, for now at least, is to keep a low-profile.

Job numbers

In the US market, non-farm payroll numbers released on Friday revealed a December increase of 145,000 — somewhat lower than the forecast of 164,000 and November’s gain of 266,000. Unemployment in the country remains at 3.5%, which represents a 50-year low. Meanwhile, hourly earnings rose by only 2.9%, representing the lowest annual rate since 2018. While the numbers are ultimately disappointing, the US labour market has formed a positive trend in the run-up to 2020 and even these misses may not cause too much selling activity as analysts look forward to the US Q4 earnings season kicking off next week.

The morning session in Europe saw equity markets flat-line with some profit-taking ahead of the release of the US jobs figures. David Madden, analyst at CMC Markets in London, said.

“We’ve had a good run, up at all-time highs, sentiment is probably positive – the Iranian issue appears to be put to bed – people are just sitting on their hands ahead of the report.”

Source: Reuters

Earnings

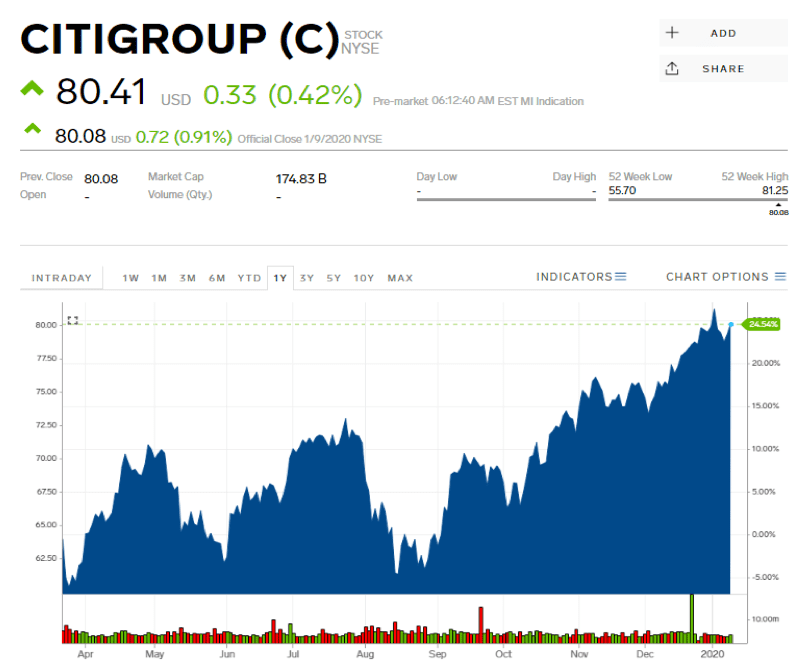

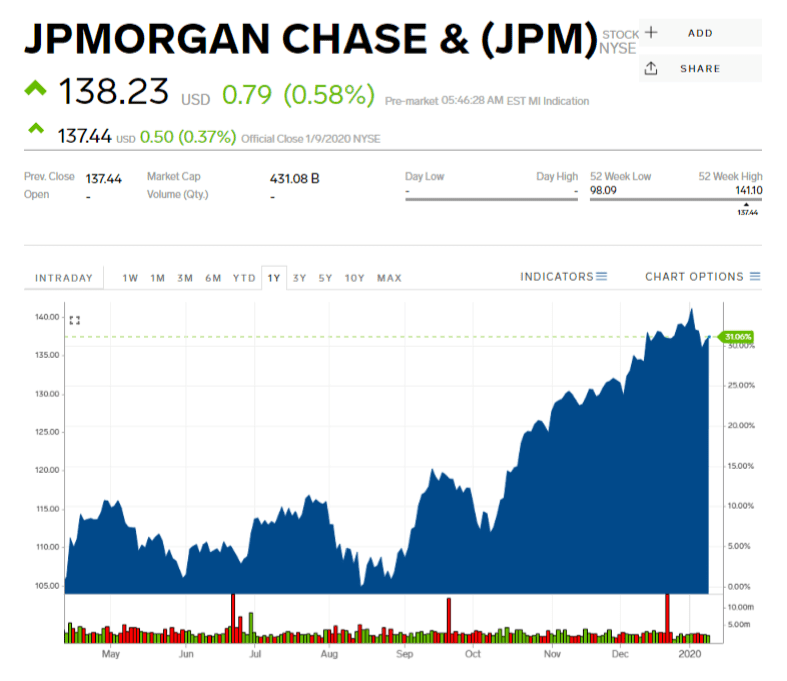

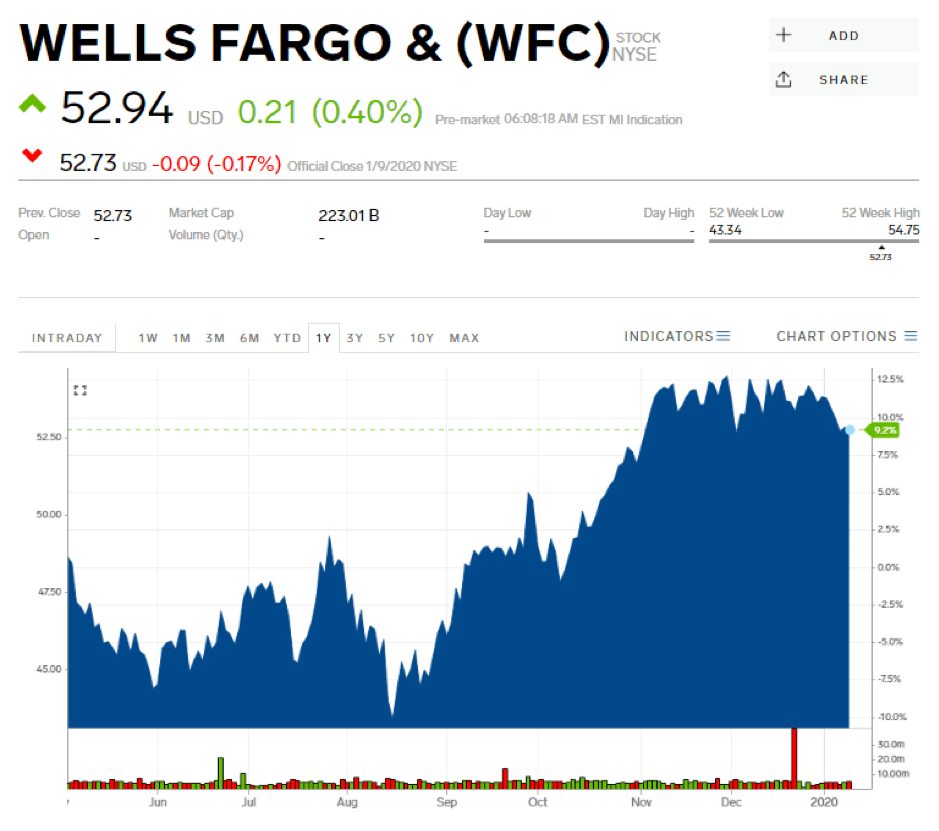

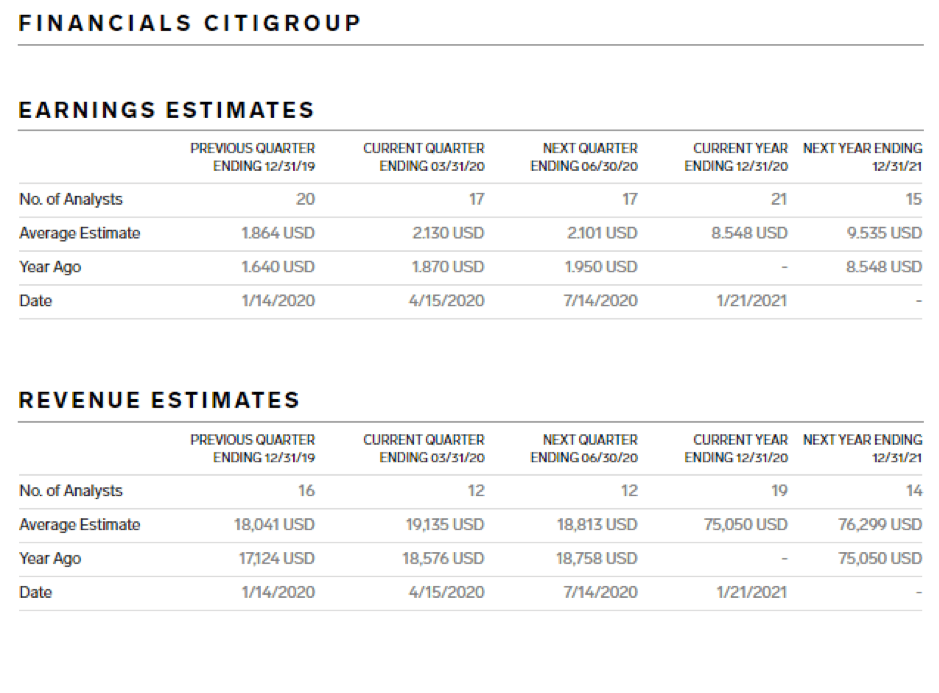

Tuesday 14th January sees large cap financial firms, Citigroup Inc (NYSE:C), Wells Fargo & Co (NYSE:WFC) and JPMorgan Chase & Co (NYSE:JPM) open the US Q4/Annual earnings season.

The 2019 price charts for the three stocks shows how the financials have supported the rising indices, banking strength being a crucial feature for rally.

Industry site Markets Insider provides a detailed breakdown of current analyst forecasts of the three banks. All are important bellwethers of the economy and any ‘beat' on estimates could well see markets push on even higher.

Other firms due to announce figures on 15th January include Goldman Sachs (NYSE:GS), US Bancorp (NYSE:USB) and Bank of America Corp. (NYSE:BAC), but by the end of the week, figures should start appearing from sectors other than financials. United Health (NYSE:UNH) is due to report on Wednesday, Australian firm Woodside Petroleum Ltd (ASX:WPL) reports on Thursday and the Australian listing of miner Rio Tinto Plc (ASX:RIO) posts on Friday.

New equity highs and dollar confirmation

The three major US stock indices all posted both intra-day and closing highs on Thursday. The DJIA, gained 211.81 points, or 0.7%, to close at 28,956.90. The S&P 500 index was up 21.65 points or +0.7%, closing at 3,274.70 whilst the Nasdaq Composite Index gained 74.18 points to finish at 9,203.43, a gain of 0.8%.

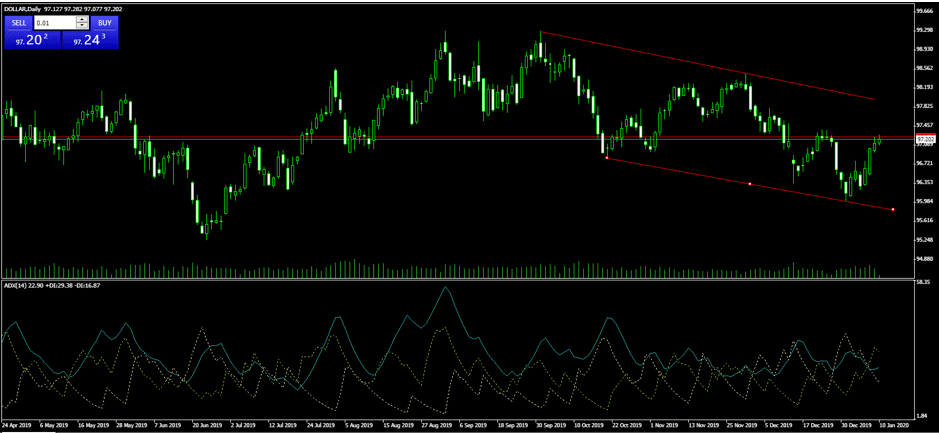

Providing confirmation of the move into riskier assets, the US Dollar (MetaTrader:DOLLAR) index has failed to take sufficient strength from political tensions to break out of its downward trend.

DOLLAR (MetaTrader) — daily candles — April 2019–January 2020:

While there is room to debate how low the dollar might go, the analysts at Australian broker FPMarkets are bearish on the greenback.

“The weakening of the USD continues to play out. The confirmation from Beijing that phase 1 of the trade deal will be signed this coming week coupled with rising expectations for an economic recovery in 2020 have started to see DXY breakdown.”

Source: FP Markets

Nothing is certain, but the equity and forex markets are both supporting each other’s move into riskier asset classes. The benefit to analysts and traders is that the fundamental data that is about to be released is literally black and white and far easier to interpret than political posturing.