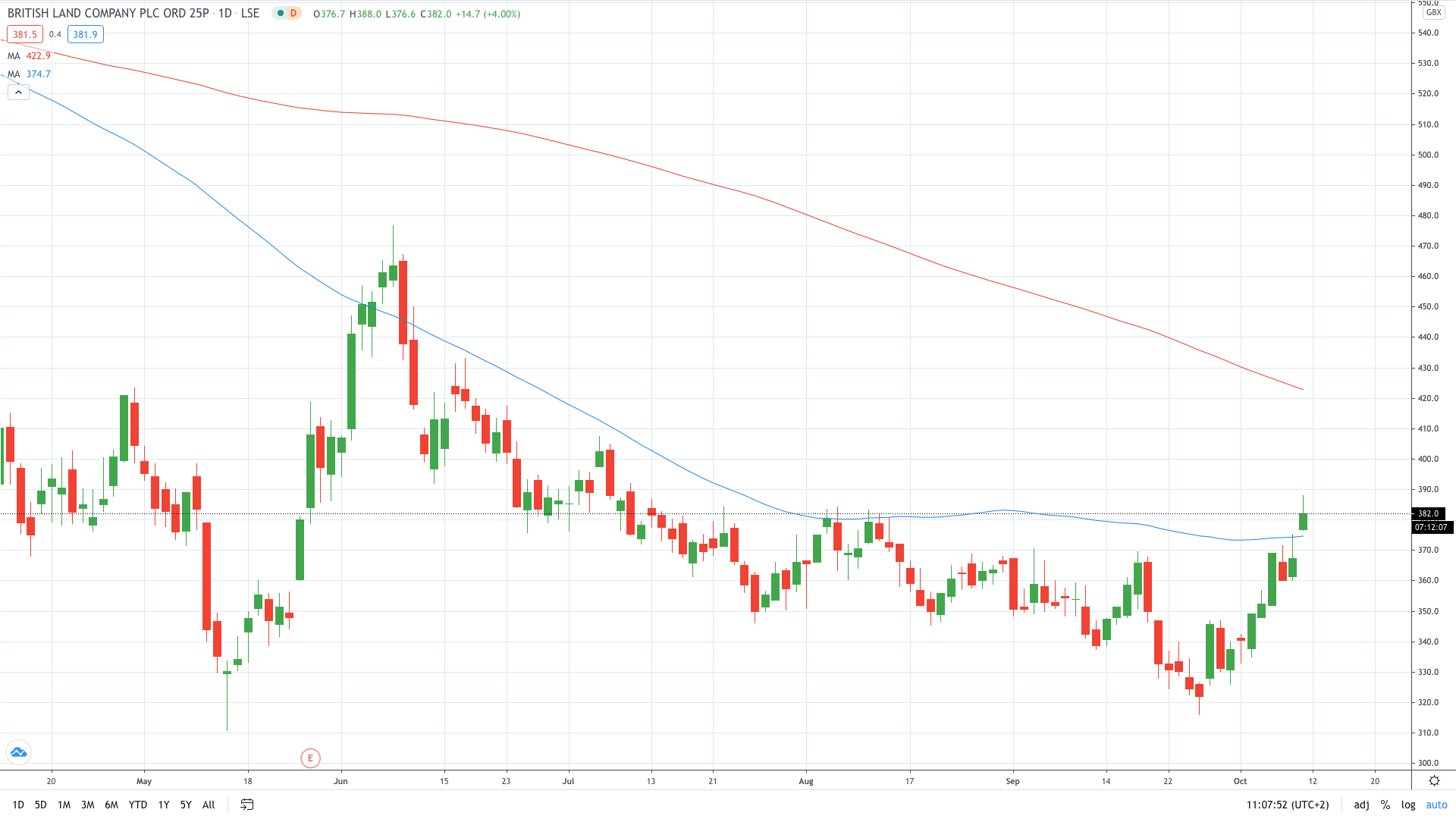

Shares of British Land Company PLC (LON: BLND) jumped more than 6% today after the property giant reported better-than-expected rent collection for September.

The company received 57% of retail rents and 98% of office rents for the second quarter, which is better than 36% and 88%, respectively, previously reported in July for the second quarter.

The owner of Meadowhall shopping center said it has collected 69% of rents it was owed for the third quarter. It collected 50% of retail rents and 91% for offices.

“We are continuing to engage, on a case by case basis, with customers who have strong businesses but have been disproportionately affected by Covid-19 to agree solutions which help them to manage their rental obligations.

These have typically involved moves to monthly rents, deferrals and partial settlement of outstanding rents for the period of closure in return for lease extensions, reduced incentives, commitments to additional space and the removal of lease breaks,” the company said in today's operational update.

As a result, the mall and office owner said it will restart dividend payments next month with payments made semi-annually compared to the previous practice of issuing dividend payments on a quarterly basis.

The negative aspect of today’s operational update is that 16% of its retail clients arranged CVAs or administrations since April, costing British Land £11.6 million in annualised rents.

British Land share price gained over 6% to trade at a fresh 3-month high at 388p.

PEOPLE WHO READ THIS ALSO VIEWED:

- Aston Martin share price up 15% in two days. Here’s why

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan