Shares of Frasers Group PLC (LON: FRAS) rose 23% on Thursday after the retailer reported a 5% jump in 2019-20 core earnings.

Frasers Group, formerly known as Sports Direct, is owned by the British billionaire Mike Ashley, who has a controlling 64% stake. The Group saw its revenue surge nearly 7% to £3.96 billion, helping to reduce the net debt to £366 million.

EBITDA earnings came in at £302.1 million, around 5% higher than £287.8 million in 2018-19. Moreover, Ashley’s business has projected growth between 10% and 30% in 2020-2021.

“We consider we are well placed for the future,” said Chairman David Daly in a statement.

The Mail on Sunday reported earlier this month that Mike Ashley is looking to buy 30 stores from rival retailer Debenhams. This news came after Ashley failed two times in acquiring Debenhams. Frasers Group also owns Sports Direct and House of Fraser brands.

“We continued to follow the further demise of Debenhams during the year with much frustration and disappointment as it entered administration for a second time,” the company said in a statement.

“We raised our concerns and gave numerous warnings about what we were seeing there, much of which has materialised. Our offers of help were repeatedly disregarded and it is scandalous that this business has now been in administration twice.”

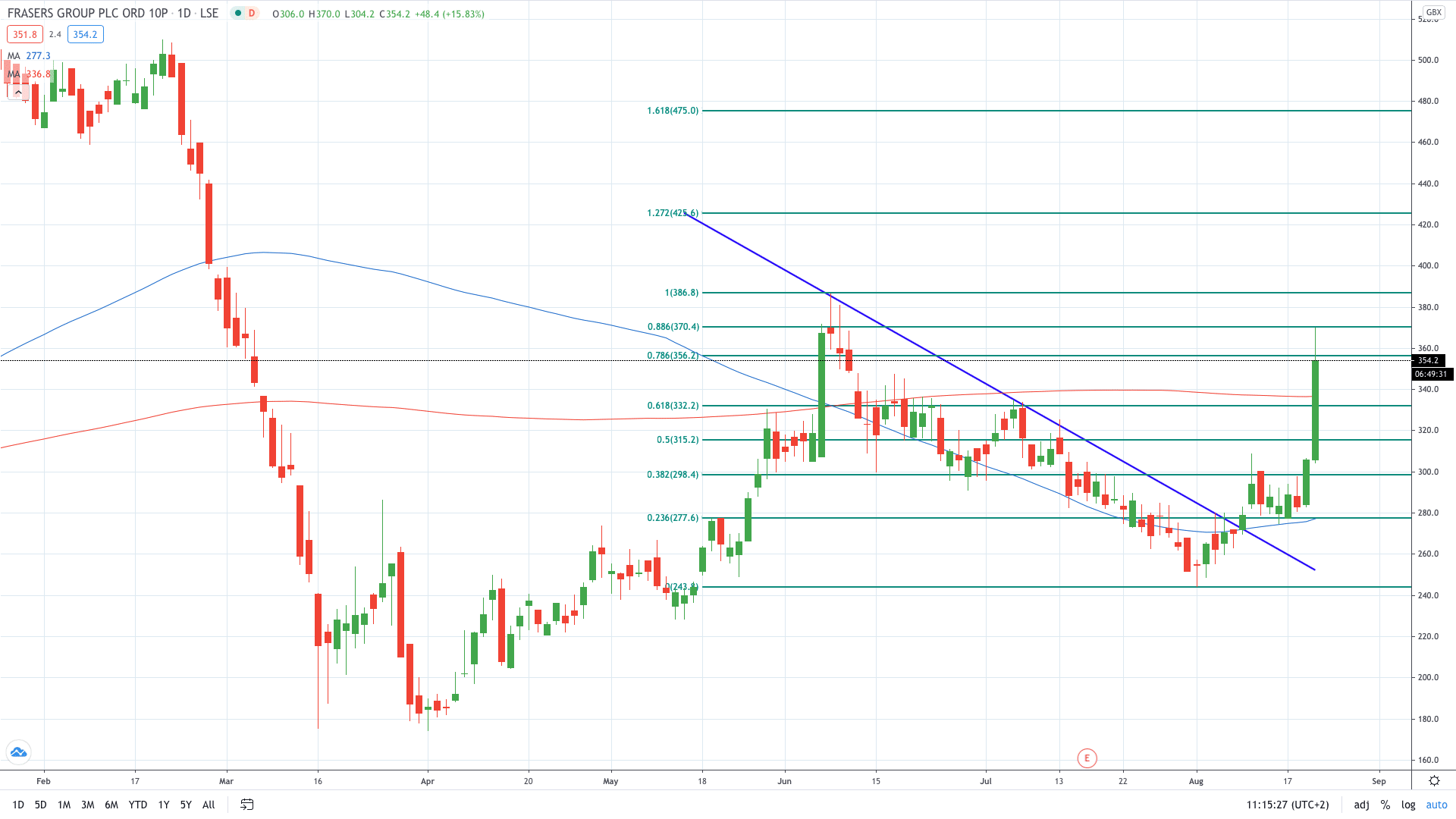

Frasers Group share price has gained over 20% today, a day after surging more than 8% to hit a new 2-month high.

- Read more about why Frasers Group share price plunged last week

- Explore stock trading strategies

- Learn from experts on risk management in trading