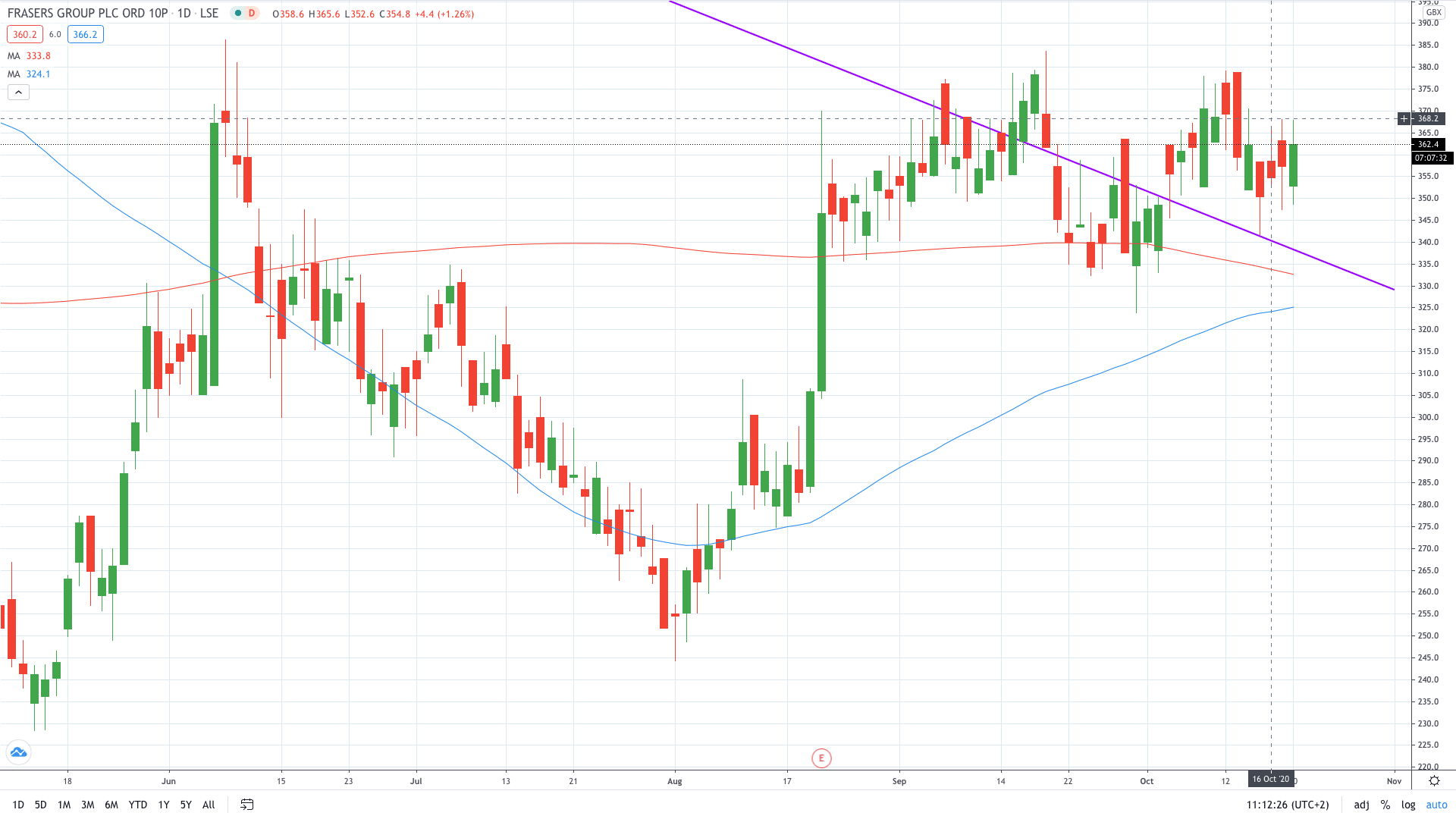

Shares of Frasers Group PLC (LON: FRAS) trade higher on Tuesday on the back of weekend reports that Mike Ashley’s company has submitted a fresh bid to buy Debenhams out of administration.

The troubled retailer went into administration in April after the pandemic shut its stores. Ashley has a history of unsuccessful attempts to acquire Debenhams.

Liberium’s analyst Wayne Brown said in a note today that Ashley’s company is rising into a diversified house of brands.

“We forecast EBITDA to rise £107mln between FY20-FY23E. We show that nearly all of this could be achieved through cost synergies on recent M&A, including a c.£50mln positive swing for House of Fraser. It means little growth in wider sports retail would be needed to hit our numbers.”

“We expect FCF of c.£150m+ p.a. from FY21E, as EBITDA grows and stock efficiencies flow via warehouse automation. Strong cash flows give investment firepower to drive the elevation strategy (incl. £100m into digital), de-lever the already healthy balance and pursue further M&A,” Brown wrote.

Frasers Group share price trades around 3% in the green today.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan