Key points:

- NASDAQ had McEwen Mining as being down 90%

- Actually, McEwen was up 1000%

- All purely nominal price movements of course, a data error

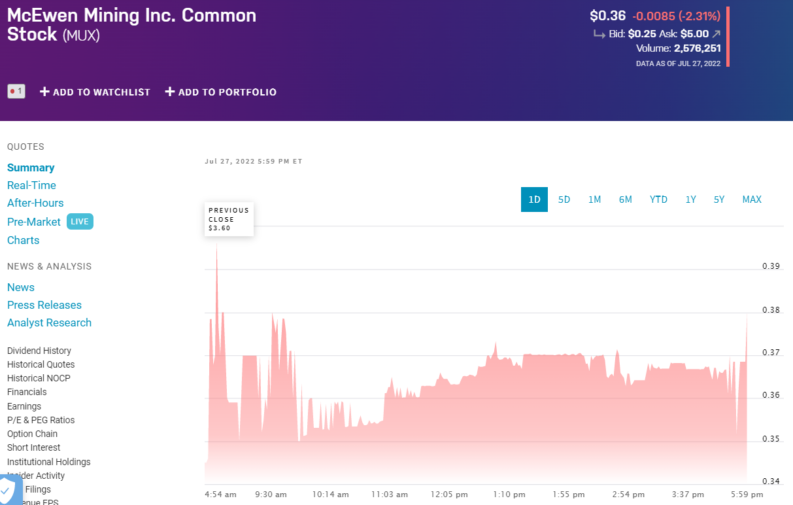

NASDAQ has McEwen Mining (NYSE: MUX) as being down 90% this morning, something that will come as something of a shock to many. For the expectation was that McEwen should in fact rise 1000% this morning. We can also think of it as being rather amusing if we put aside those shocks that are going to happen to quite some few readers and holders of the MUX stock.

As to why this has happened, well, it's human error – or possibly one of those glix in the matrix things. It's also something that will no doubt get sorted soon enough but is fun and interesting all the same.

McEwen is a gold and silver miner which has been having a hard time of it lately. The basic problem is just that the ores aren't all that good and they're becoming that little bit scarcer. As a result of that the stock price is down 86% over the past 5 years. Hey, this happens when a mine becomes lower grade. The volume of output dips even as extraction costs for each unit of that output rise and eventually there comes a point where mining is no longer worthwhile. There's a side effect of this though. The NYSE, as with NASDAQ, has a minimum unit price for listed stocks. Fall below $1 for a length of time and the quote can be lost. That means relegation to the OTC markets with their lower liquidity and more difficulty in raising capital. Something therefore needs to be done.

Also Read: The Five Best Gold And Gold Mining Stocks To Buy Right Now

That something is a reverse stock split – in the absence of being able to increase profits and thus the real share price that is. If the stock was at $0.36 cents before, and everyone now has only one share instead of their previous 10 shares, then the stock price should become $3.60. Or even, more than that, perhaps $4? Because that risk of being thrown off the NYSE has now faded for MUX and a reduction in risk does increase value. That is also what has in fact happened this morning to McEwen Mining. The stock was at about 36 cents yesterday, it is at about $4 now, there was indeed a 10 for 1 reverse stock split which took effect overnight.

The fun thing though is that NASDAQ, at least initially, recorded this the wrong way around:

That is just a glitch in the system and no doubt someone quite junior is going to get a talking to later. They've entered a reverse stock split as a stock split. Ah well, mistakes happen and all that.

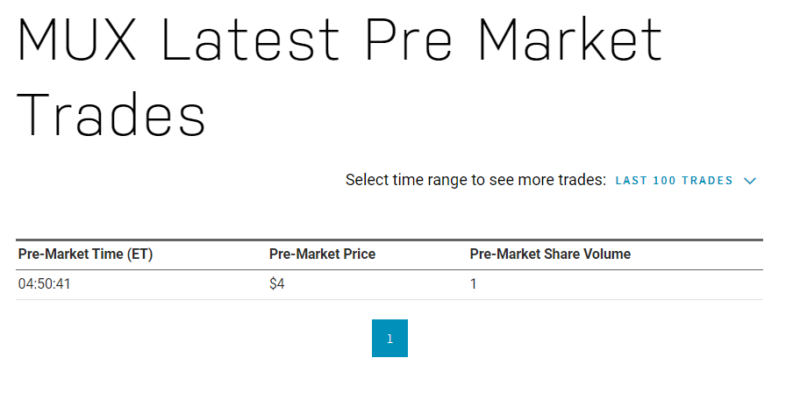

We'd also not think that much harm has been done. On the actual market trade so far today has been just the one instance. Of one share.

So no grand harm done here but this is a lesson for us as traders. It simply is not true that, second by second or even hour by hour, the information that crosses our screens is correct. Vast price anomalies need to be investigated before being traded upon. For this also happened to Greenpro Capital this morning.