Key points:

- Greenpro Capital is listed as being down 90% today

- GRNQ is actually up 1000% or so today

- NASDAQ has made a boo boo

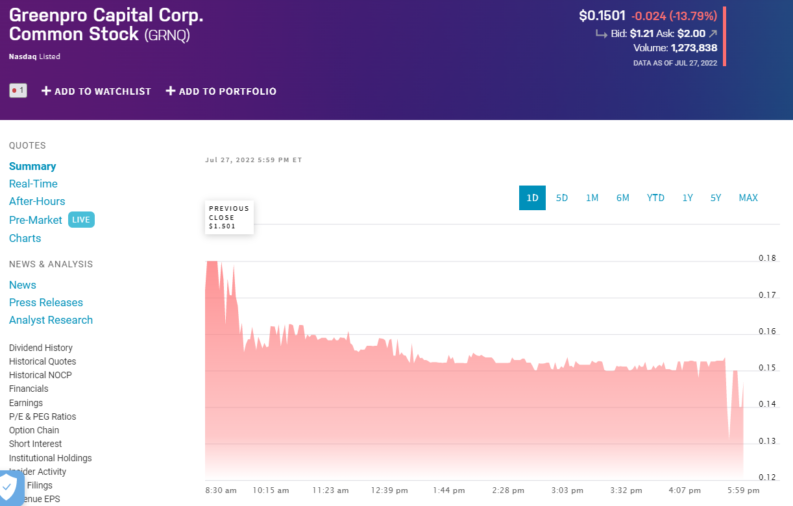

Greenpro Capital Corp (NASDAQ: GRNQ) stock is listed on NASDAQ as having fallen 90% overnight. This is not so – in fact, the nominal stock price is up something like 1000%. What we have here is a glitch in the matrix. It's actually the stock exchange itself getting this wrong and that's then feeding through to all of the tickers that feed off those automated feeds. What's actually happened is that the exchange itself has got the effects of the stock issuance change the wrong way around. This will no doubt be corrected when everyone is up and in the office but there's an amusement to it at present.

What Greenpro actually does is financial consulting and corporate services to small businesses out in the Far East. Fairly standard small business services in fact, advisory and the nuts and bolts of accountancy and so on. Given the problems out there with lockdowns and so on perhaps not surprising that recent results haven't been all that good. That doesn't explain the 97% fall in the stock price since the peak of course, over the past four or five years. It's simply a business that hasn't been doing very well. This happens.

However, as we know, NASDAQ has minimum pricing rules. A stock price goes below $1 for more than a certain time (usually 180 days) and the NASDAQ listing will be lost. That means relegation to the OTC markets where there's less liquidity and capital is much more difficult to raise. Therefore there's usually action taken when the stock price, like that at GRNQ, has been bumbling along at 15 and 20 cents. The reverse stock split, or consolidation to Brits.

Also Read: NIO Stock Forecast

So, the reverse stock split – which is what Greenpro has done – should get that price back up above $1. And yes, a 10 for one consolidation, or reverse split, should do that. But here's how NASDAQ has listed it:

NASDAQ has calculated this as a one for 10 stock split, when it should be a 10 for one reverse stock split. That's why they're showing GRNQ as being down 90% when in fact it should be up 1000%. All most amusing of course, even if disturbing for those checking their positions this morning.

As to the real value of either the company or stock holdings, of course no change has taken place. Stock splits don;t – not in the first instance – change market valuations, they just change the number of shares that make up that valuation. They're purely nominal changes that is, not real ones.

As to why they take place that's just fashion. In the American markets the “right price” for a good solid stock is taken to be in the $10 to $100 range. Something $1 to $10 is a bit lightly perhaps, and in cents it's a “penny stock”. Something that's viewed as risky and not to be allowed on proper markets. Thus the manipulation of stock numbers in order to get the nominal price into one of those more acceptable ranges.

Greenpro is actually up some 1,000% today from that reverse stock split – it's NASDAQ which has the reporting the wrong way around at a 90% price fall.