Shares of (NYSE: NKE) have plunged 4% in premarket trading after the sneaker-maker said its sales declined 38% in the fourth quarter. The Oregon-based giant posted a loss of $0.51 per share, substantially lower than a profit of $0.07 expected from analysts.

Nike recorded revenue of $6.31 billion, more than $1 billion lower than $7.32 billion expected from Wall Street.

“Our fourth quarter results were significantly impacted by physical store closures across North America, EMEA and APLA, where 90 percent of NIKE-owned stores were closed for roughly eight weeks in the quarter to protect the health and safety of teammates and consumers and help slow the spread of the COVID-19 pandemic,” Nike said in a statement.

Looking at the same period last year, Nike earned $0.62 per share on $10.18 billion.

The North American business underperformed substantially with sales plunging 46%. Nike’s Converse brand witnessed its sales go 38% down as well amid the COVID-19 outbreak.

These losses were partially offset by booming online sales. Nike reported its digital sales soared 75%, mostly on sales of sneakers and workout gear.

“We are continuing to invest in our biggest opportunities, including a more connected digital marketplace,” Chief Executive John Donahoe said.

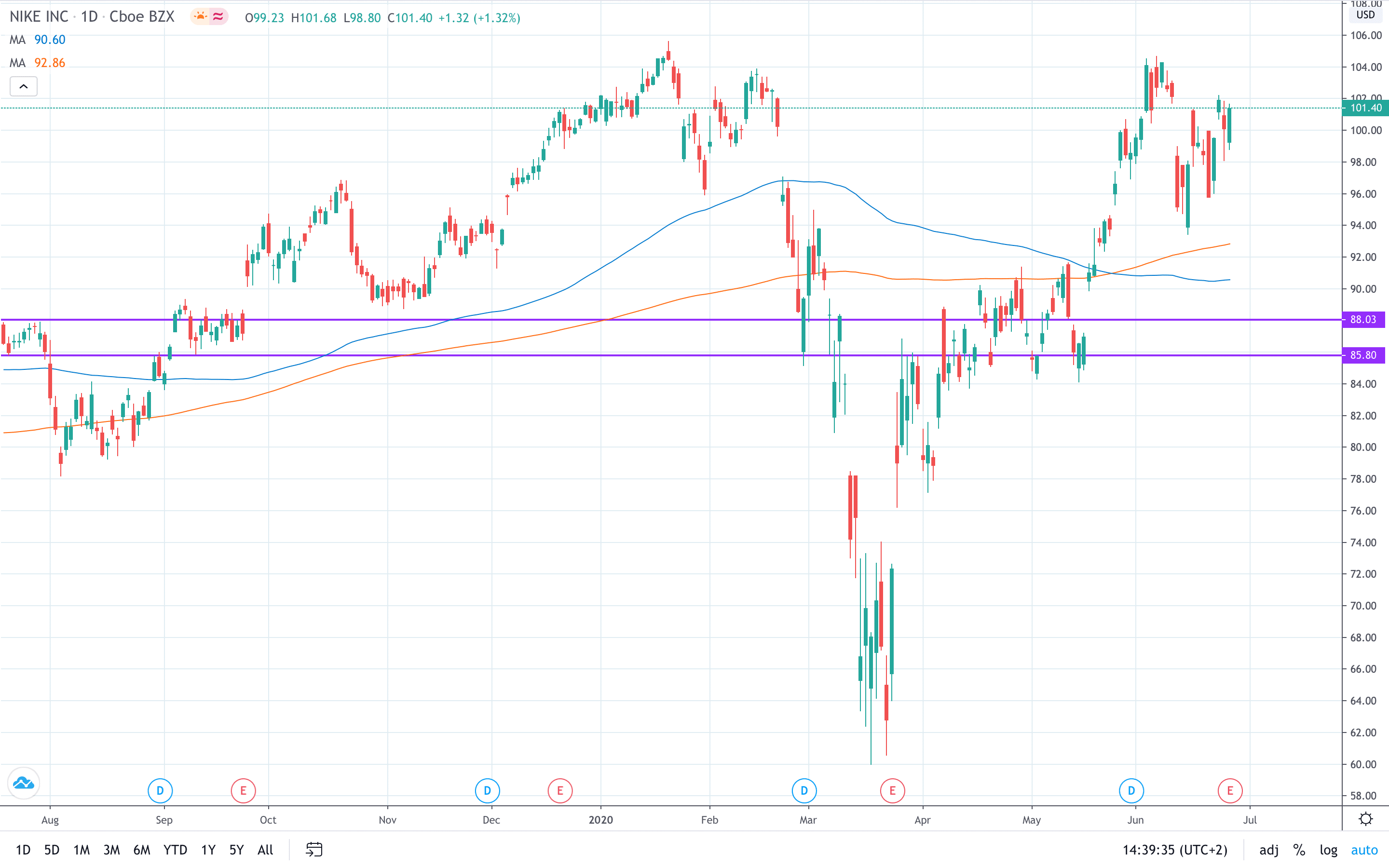

Nike stock price dipped 4% in premarket trading to trade around the $97 mark.