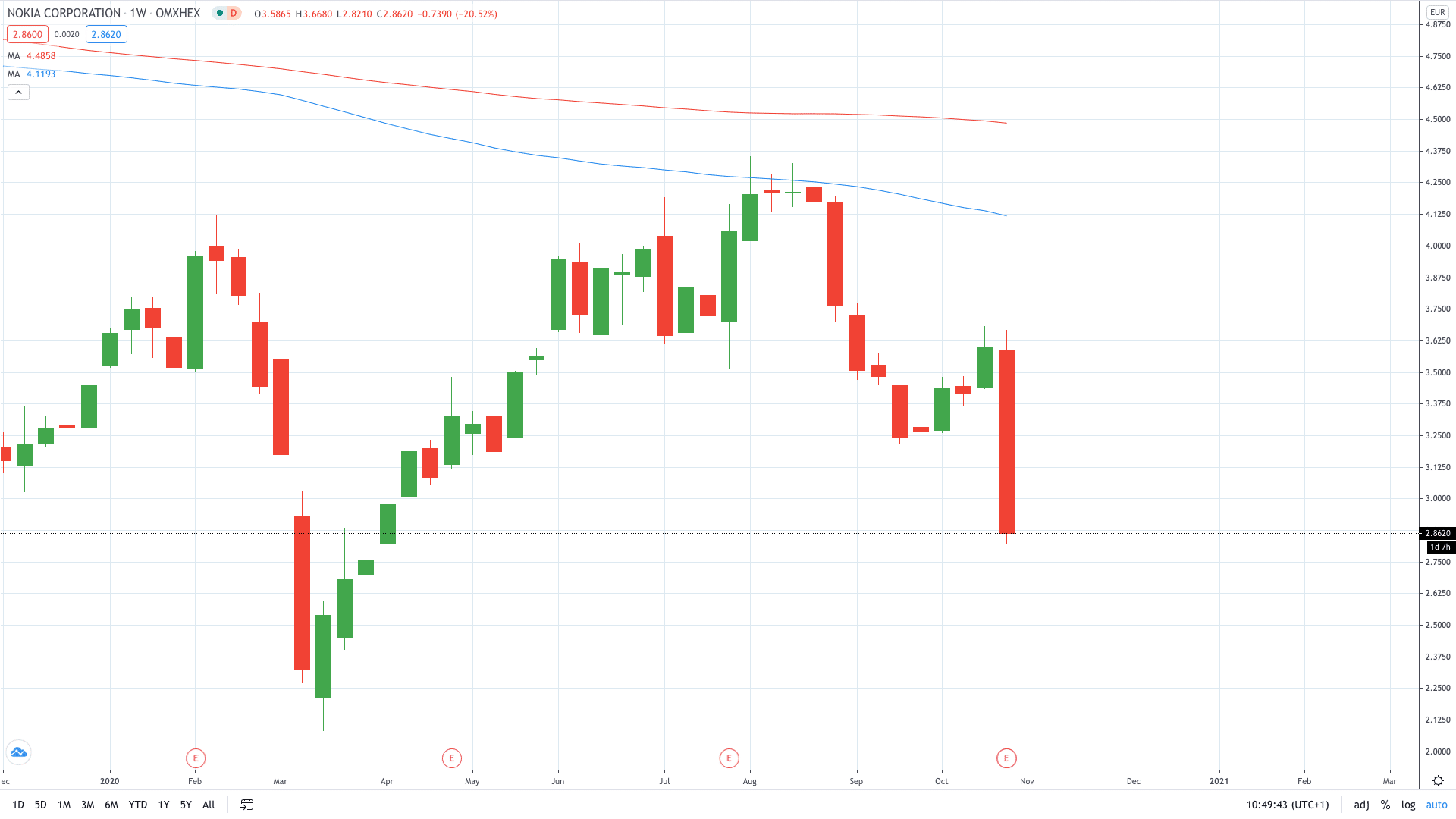

Shares of Nokia (HEL: NOKIA) fell almost 20% on Thursday after the Finnish telecom giant slashed its 2020 operating margin guidance.

Nokia now expects the full-year operating margin to come at 9%, lower from prior 9.5%. As for the next year, the firm forecasts 7-10%. The company reported in-line EBITDA at 0.05 euros per share for the quarter ending September.

The full-year profit outlook range is also cut by 0.02 euros to a midpoint of 0.23 euros per share.

“We expect to stabilise our financial performance in 2021 and deliver progressive improvement towards our long-term goal after that,” CEO Pekka Lundmark said in a statement.

“We have lost share at one large North American customer, see some margin pressure in that market, and believe we need to further increase R&D investments to ensure leadership in 5G.”

The telecom giant also announced a reorganization of its business to focus on four key areas: mobile networks, IP and fixed networks, cloud and network services and Nokia technologies.

Nokia share price fell to 2.82 euros to revisit the pandemic lows from April. Shares of Nokia are now down over 20% on the weekly basis.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan