- Oil giants Royal Dutch Shell and BP have announced plans for large scale restructuring of their operations.

- Their enormous balance sheets mean they have wriggle room that smaller rivals may not.

- Strong medicine, taken early, may prove a strategy that helps them beat the coronavirus crisis.

- Getting into shape as early as possible is required if they are to swerve the already building fears of a ‘second wave' that is bogging down the price of crude and the whole sector.

An outbreak of coronavirus infections at a Chinese food market has been linked to 106 cases, including 27 reported on Tuesday. Authorities have described the city's coronavirus outbreak as ‘extremely severe’. Parts of the city have been fenced off, roadblocks put in place and some residential areas put into quarantine. The authorities are attempting to stem the rate of infection from a site which has had 200,000 visitors since the 1st of April.

Sound familiar? The reports refer not to Wuhan in January but Beijing in June.

Concerns about a second wave have been creeping up on the markets. However, it is the oil markets that appear particularly exposed. The one lesson from 1H 2020 and one that is still being learnt is that lockdowns are easy to implement but hard to lift. The lesson for the second half of the year may well be that lockdowns aren't binary. Even if the global economy avoids once more going into an induced coma, the go-to method of containing the spread is to restrict travel.

Last week, the US reported an increase in infection cases in several states, including California and Texas. Jessica Justman, professor and attending physician in the division of infectious diseases at the Columbia University Irving Medical Center, gave her opinion on the risk of a second wave. It also implied more bad news for the transport and airline sectors. When asked what was the likelihood that second waves in states like Texas and Florida would carry over to other states? She replied:

“There's much less air travel now, so the chance of a second wave in some states carrying over to other states is lower.”

Source: Guardian US

The drip-feed of new cases is turning investor sentiment one person at a time. Unlike the attack on the world trade centre in 2001 or the occasional military flare-up in the Gulf, there is no whipsawing of price. It is more a hesitant shift. The extent of the impact of the virus on the oil markets is becoming a very grey area. Oil prices factoring in that complexity have halted their bull run from March lows and have failed to hold any break over the psychologically important $40 per barrel price level for Brent Crude.

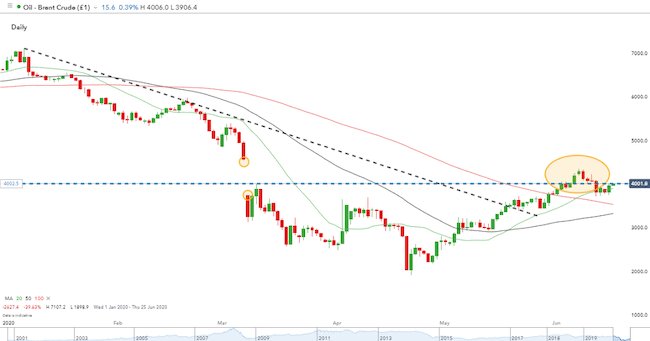

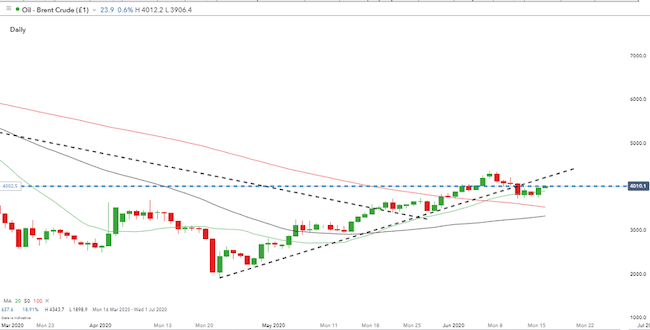

Brent Crude – Daily Candles – 2nd January – 16th June 2020

The 20 SMA on the daily chart has recently become a key factor in guiding price action. Four of the last five trading sessions have hovered on that level – currently $38.94, and if the daily candle can avoid intersecting it on Tuesday, then we could have a bullish indicator.

Brent Crude – Daily Candles – 16th March – 16th June 2020

The $40 per barrel price barrier still offers a lot of resistance to upward price moves. Any continuation of the longer-term bullish trend requires the resistance level at $40 per barrel to be breached on rising volume. Is this high volume likely with the risk of a second wave lingering in the air? Justman explained the size of the stakes involved:

“During the Spanish flu, it started in the spring and came back with a vengeance in the fall and winter. So everybody is bracing for that. I think a modest second wave is coming, and then contact tracing and other measures will be put in place to get on top of it. The real question is what's going to happen in the fall.”

Source: Guardian US

Down below the $34–$35 price level offers support. The price consolidation pattern in that region during the recent rally illustrated the significant resistance at that time, which should now provide a base level for Brent crude prices.

Market fundamentals protect the lower range. The most significant OPEC Plus production cut in history is being adhered to by cartel members. By delivering on the plan to reduce global supply by 10%, the group has surprised many who questioned the willingness for members to comply. This offers the opportunity for continued or even further reductions into the end of the year.

The markets look set for a period of price congestion and range-bound trading between these two regions.

Share prices

The oil giants that operate in the sector may be glad of some price stability. Though the level at which crude is trading sideways remains a challenge for them, at least it offers a chance to re-organise their operations in line with the ‘new normal'.

BP (LSE:BP) has recently announced plans to cut 10,000 jobs from its global workforce. Chief executive Bernard Looney outlined the harsh realities of oil prices at record low levels. In a note to workers he said:

“The oil price has plunged well below the level we need to turn a profit. We are spending much, much more than we make – I am talking millions of dollars, every day. And as a result, our net debt rose by $6 billion in the first quarter.”

Source: Energy Voice

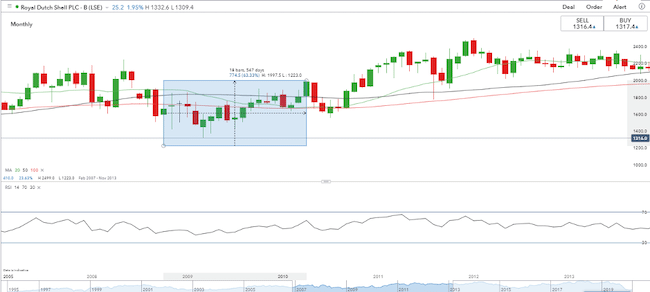

The process of offloading staff is a painful one, but given the situation, BP appears to be following the restructuring guidebook of 2009. Cut early, cut deep. Doing so can bring long-term gain. Between September 2008 and March 2010, the BP share price rallied by 77.89%.

BP – Monthly Candles – Sep 2006 – Mar 2012

Royal Dutch Shell has also announced plans to strip back its workforce. In a note to staff, chief executive officer Ben van Beurden wrote:

“Over the coming months we will go through a comprehensive review of the company. Where appropriate, we will redesign our organisation to adapt to a different future and emerge stronger.”

Source: Rigzone

Comparing the RDSB share price to that of BP back in the 2008–2010 period shows that the immediate recovery in the Shell share price was less marked. Between September 2008 and March 2010, the Shell share price rallied by 63.33% but did, after that time interval, continue to rise while the BP share price fell away.

It's clear that forced redundancies are still on the cards at Shell. However, the more organic rotation of staff, which comes with voluntary redundancies, may make the Shell share price the one to watch for those with a longer holding period. The tone of the comments from the Shell board suggests that a lot of the restructuring has already taken place so that Shell will reap the benefits of the re-organisation earlier than BP.

Shell (RDSB) – Monthly Candles – Sep 2006 – Mar 2012

This possible trend, which points to favouring Shell over BP, is borne out by the price charts. Comparisons of the BP share price with that of Shell over different periods is throwing up some interesting indicators.

On a year-to-date basis, the BP share price has outperformed the Shell share price by just under 10 percentage points.

BP vs Shell share price – year-to-date

The monthly five-day and one-day price charts both point to relative strength in the Shell share price.

BP vs Shell share price – monthly

The relative performance of the Shell and BP share price over the last five days shows a difference of almost three percentage points. That is a significant margin considering how the firms have traditionally closely tracked each other.

BP vs Shell share price – Five-day

Edmund Jackson, writing in Interactive Investor called a ‘contrarian' buy signal earlier in the year. Updating on the 1st of May he said:

“I expect quite a tussle of sentiment, with the balance tipping to sellers in the short run. Some investors will be disillusioned, Shell's yield is no longer anything special, moreover its story remains substantially ‘dirty'.”

He continued:

“Others will take the view that oil and gas will remain essential to the global economy and, once we are through the worst of this pandemic, oil prices will at least recover to enable progressive dividends.”

Source: Interactive Investor

Like the crude price it is so reliant on, the Shell share price may be in for a period of sideways trading.

Strangely though, this doesn't mean it's not a buy, not at least until central banks and governments stop releasing extra liquidity into the market. The headlines on Tuesday suggest that may still be some way off.

“Dow futures jump amid report that Trump is preparing $1 trillion infrastructure proposal.”

Source: CNBC

The dividend paid out on Shell shares may have been cut, but it still compares well to the zero offered on savings by high street banks.

Trading note on Royal Dutch Shell Class A (LSE:RDSA) versus RDSB – the two classes of Shell's stock which are listed on the same exchange, the London Stock Exchange. The business operations and share listings are split between the UK and the Netherlands. ‘A' class shares, listed in the UK have a Dutch source, which means they are subject to a 15% withholding tax on dividends. The ‘B' shares are a UK source, hence there is no withholding tax.