Key points:

- Oracle Power shares are down 20% on a share issue

- The issue is to pay for the green hydrogen project

- The green hydrogen project that pushed the shares up 20% on announcement

Oracle Power (LON: ORCP) shares are down near 20% on the announcement of a placing to fund the green hydrogen project. What might rub a little salt into shareholder skins there is that the ORCP shares jumped 20% and change on the announcement of the green hydrogen project. Clearly folk weren't expecting the company to come back for more capital to fund that project. Almost as an aside we do have to make very clear that this is nothing at all to do with Oracle (NYSE: ORCL), the computing company, despite the similarity in names and tickers.

Oracle Power isn't really in the power business, despite the corporate name. It describes itself as a “international natural resources project manager” which is something a bit different. ORCP shares react to news about their gold projects in Australia for example. But within the list of projects is a green hydrogen project in Pakistan. As we've pointed out before this has a very high gearing. By which we mean that if you prove one gold mine then, well, you've a gold mine. But if you could prove the economics of green hydrogen then you've something that can be – and would be – replicated in many parts of the world. The difficulty of transporting H2 means that there will – assuming there are any – be many plants in many places.

Also Read: The Best Energy Stocks To Trade

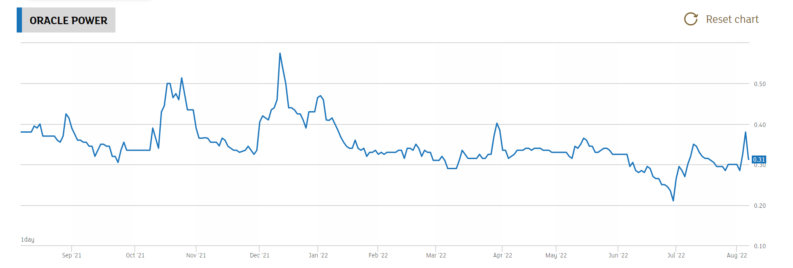

As we can see from that chart there was a little boost to the share price a couple of days back. As we pointed out, Oracle Power shares reacted to the news about signing the LOI for the green hydrogen plant. They've come right back down again on the news of raising more capital to pay for it. Which is a useful lesson really – plans do have to be paid for, so when plans are announced we should think about how they're going to be paid for.

As the announcement points out the new ORCP shares have been issued at 27.5 pence. That's – by chance, the numbers just work out this way – a 27% discount to the prevailing price yesterday. That's a fairly chunky discount to be fair and that's part of why the share price has fallen so much on the announcement. On the other hand, raising £500k on an £11 million market capitalisation isn't too, too, much dilution.

Carrying on from here the share price will depend, in the short term, on where those new shares are placed. If to short term investors then any rise might be met by a wave of selling. But once they're securely in long term holdings then a sustained rise in the price is possible. Only possible of course, for the task here is now to prove that green hydrogen will be economic. If it can be made so then there's a very large market both for the technology itself and also the knowledge of how to implement it. But the risk is, of course, that it might not turn out to be economic.

Trading positions need to be determined on that balance of the short term technical factors and the long term risk.