Key points:

- Palo Alto Networks Stock Is Down 66% This Morning

- Do not panic about this, this is a purely nominal price change

- Any real price change will become apparent after market open

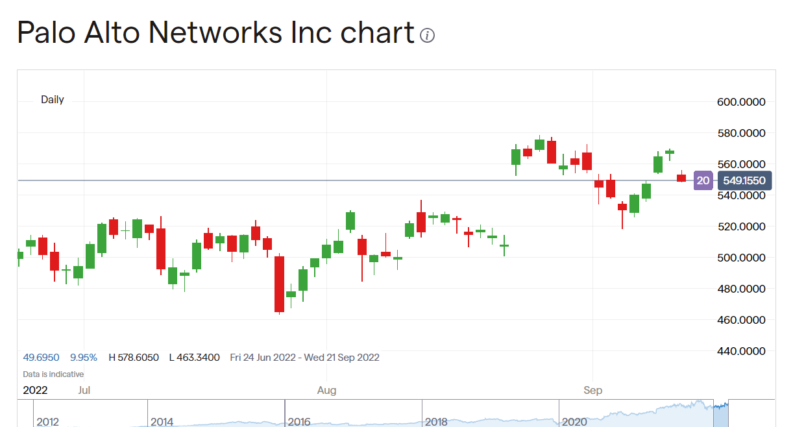

Palo Alto Networks (NASDAQ: PANW) stock is down 66% this morning by the ticker. This is one of those times not to panic over a stock price move. The PANW stock price was $551.06 at 3.30 pm yesterday, it's at a premarket price of $186.08. That looks like a fairly punishing loss – which of course it is in nominal terms. But the real price yesterday – to make it comparable to today's premarket that is – was $183. 67. So, there has in fact been a small price rise overnight. Possibly $2.41 as the price increase, or 1.3% or so.

Even that's not all wholly true for as is normal in the thin overnight trading the spread blows out. We'd normally expect to be trading something as liquid as Palo Alto Networks at close to no spread at all in fact. As small investors we'd be expecting to trade at the market that is, without a difference between buying and selling prices. Currently that spread looks like around $8. A spread of 4% on a $56 billion capitalisation stock is huge for these current days. Some part of that is that overnight illiquidity, some part of it is the other change that has happened. But the price change is less than that current spread which means it's not something to take wholly and hugely seriously.

As to what has happened at Palo Alto there's been a three for one stock split. For every piece of stock there was yesterday there are now three. The market capitalisation of PANW hasn't changed – it's the price changes subsequent to the split that might do that – and the value of any one holding of Palo Alto Networks stock hasn't changed either. It's a purely nominal price change that is.

Also Read: How To Buy Google Shares

As to why companies do this it's really just a matter of fashion, of custom. The New York markets tend to believe that the price of a solid and dependable stock should be in the $10 to $100 range. That this is just fashion is shown by London thinking the same range should be £1 to £10. Which is why ADRs of London stocks are so often 10 pieces of the London stock – to be in that price range in both markets.

So, when share prices rise well above this range people tend to start thinking of them as “expensive”. This is purely the money illusion but then we know that humans are prone to that – that's why prices end in .99 cents and $99 and so on. We know, intellectually, that the last cent, or last $, makes no difference but then act as if it does. So too with stocks being viewed as “expensive”. Changing the number of shares in issue should change the real price not one whit. But it does, often enough, which is therefore why corporations do it.

Yes, it's true that Palo Alto Networks‘ stock price is down by 66% this morning. But that's a purely nominal change – and the real price will only be known when the markets are back to full liquidity after open.