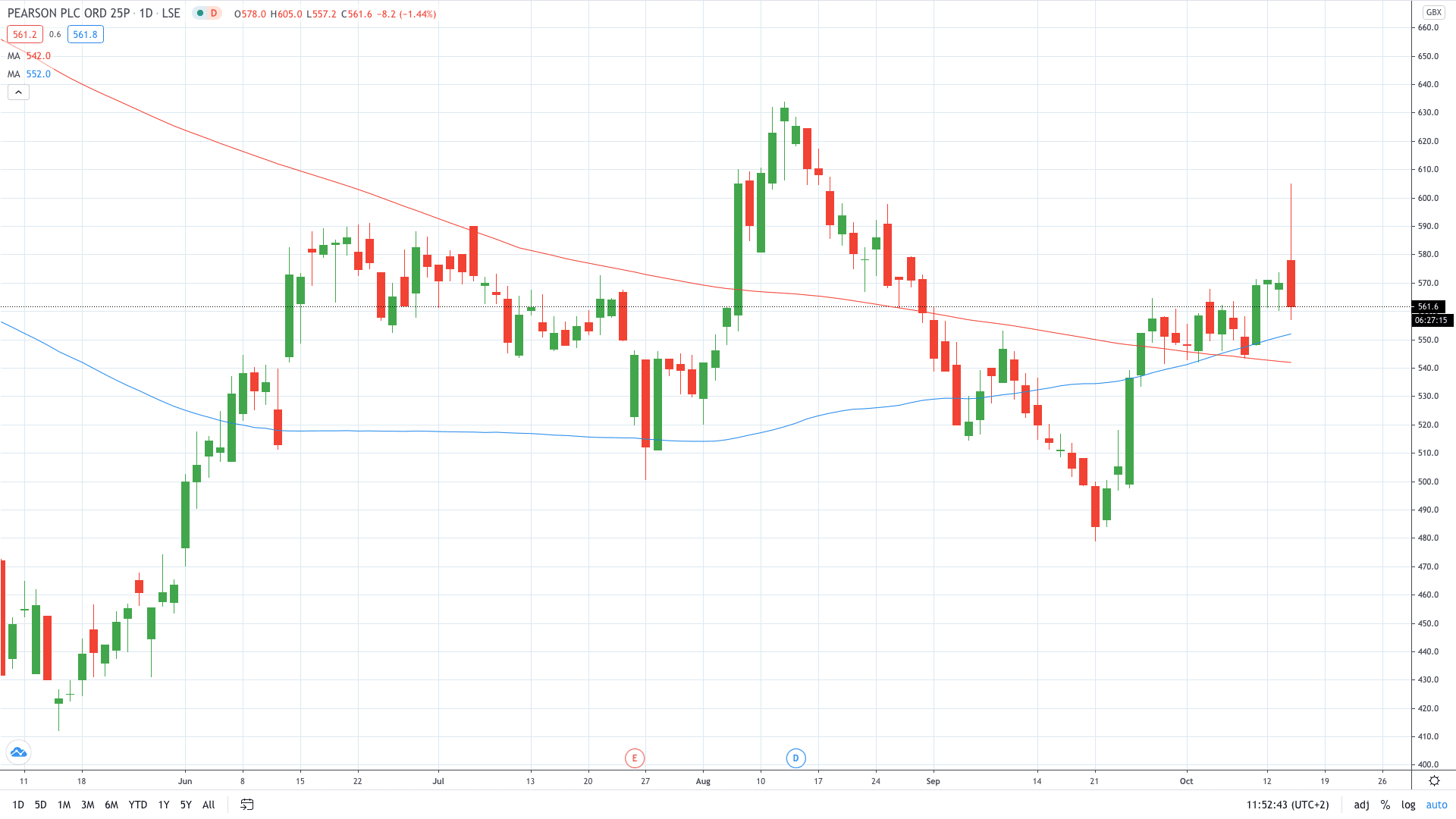

Shares of Pearson PLC (LON: PSON) have erased this morning’s gains to trade 1.5% in the red after the company said revenue fell 14% in the first nine months of 2020.

The education company says third-quarter sales tumbled 10% on a year-on-year basis, which is still better than a 28% decline in the second quarter. The better performance came as the online learning unit saw its sales jump by 32%.

“Our digital performance is very strong,” Chief executive John Fallon, before noting “a challenging transformation. He added that the company is “starting to see the benefit of all our work to ensure Pearson becomes the winner in digital learning.”

Analysts’ consensus is for the group to post adjusted operating profit of £332 million this year. The long-term stability of the company is intact due to the available liquidity of around £1.6 billion.

Fallon will be replaced by the former Disney executive Andy Bird from next week.

Pearson share price now trades about 1.5% in the red after the sellers have managed to erase as much as 6% of gains made in the morning.

PEOPLE WHO READ THIS ALSO VIEWED:

- Aston Martin share price up 15% in two days. Here’s why

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan