Key points:

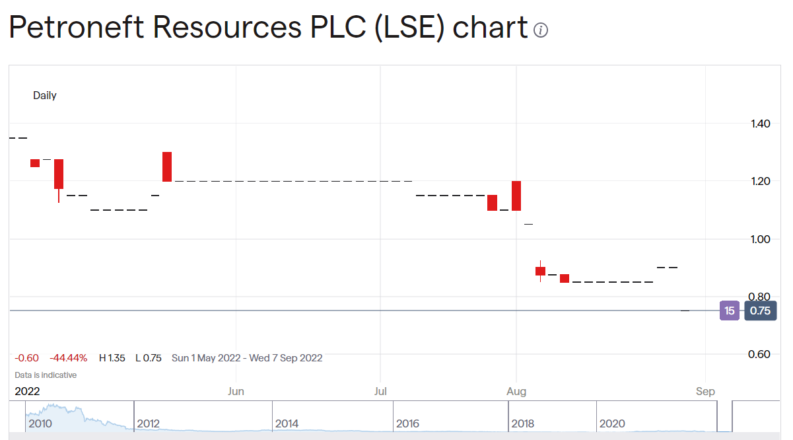

- Petroneft Resources is down another 16% this morning

- They've significant problems with their pipeline contract

- To the point that they've got to stop producing oil

Petroneft Resources (LON: PTR) shares are down another 16.67% in London this morning as they announce that contracts in Russia – contrary to many expectations – actually mean something. That's not quite how they put it but as ever when we read a corporate announcement we need to do a little reading between the lines. The basic problem is that PTR signed a contract which has turned out not to be to its advantage. Of course, it's always possible to renegotiate and all that but unilateral attempts at changes in contracts often don't work. Especially in places where people take contracts seriously.

We might not think that the Russian oil business is one where contracts are taken wholly and entirely seriously but that's another matter – reality is that sometimes they are and sometimes they're not. We seem to be in one of those where they are.

Petroneft Resources has, of course, differed terribly from recent events concerning Ukraine and so on. It has also benefitted from the rise in global oil prices, then not benefitted quite as much as it perhaps should have done given the difficulties of exporting Russian crude and so on. But all of that is already incorporated into the share price which has fallen from above 4p down to the about 0.90p of last Friday. We have this further fall of that 16% from there on their announcement today.

Also Read: The Best Oil Stocks To Buy Right Now

The actual and specific current problem is that Petroneft signed a contract that it how doesn't like. As they announce: “PetroNeft has for some time considered the terms of the contract tariff to be significantly higher than normal market rates due to US dollar denomination and a quarterly inflator which makes the contract increasingly uncompetitive. Since inception of the contract these terms have seen transportation costs increase by 4.8 times and about two and a half times faster than the increase in the Transneft national tariff rate over the same period.”

To try to deal with this they've only been part paying the pipeline fees and trying to gain access to anti-monopoly discussions. To no avail – and so the pipeline company is refusing to transit the oil and thus Petroneft is shutting down the wells.

We can have a great deal of sympathy for Petroneft management, of course we can. But then again they did sign the contract in the first place and presumably thought it was just dandy when they did so. Signing a dollar denominated – and long term – contract in Russia seems odd, adding an inflator even more so. But, they did sign it.

What makes this worse is that thing about contracts actually meaning something in Russia. True, sometimes they don't – but sometimes they do. When a Russian firm has some foreigners over a barrel being one of those times they could well be enforced. And given current wider events we're not likely to see foreign investors gaining the backing of the state really – to be mild about it.

It's not obvious where Petroneft can go from here but the thing to remember is that they did indeed sign this contract in the first place.