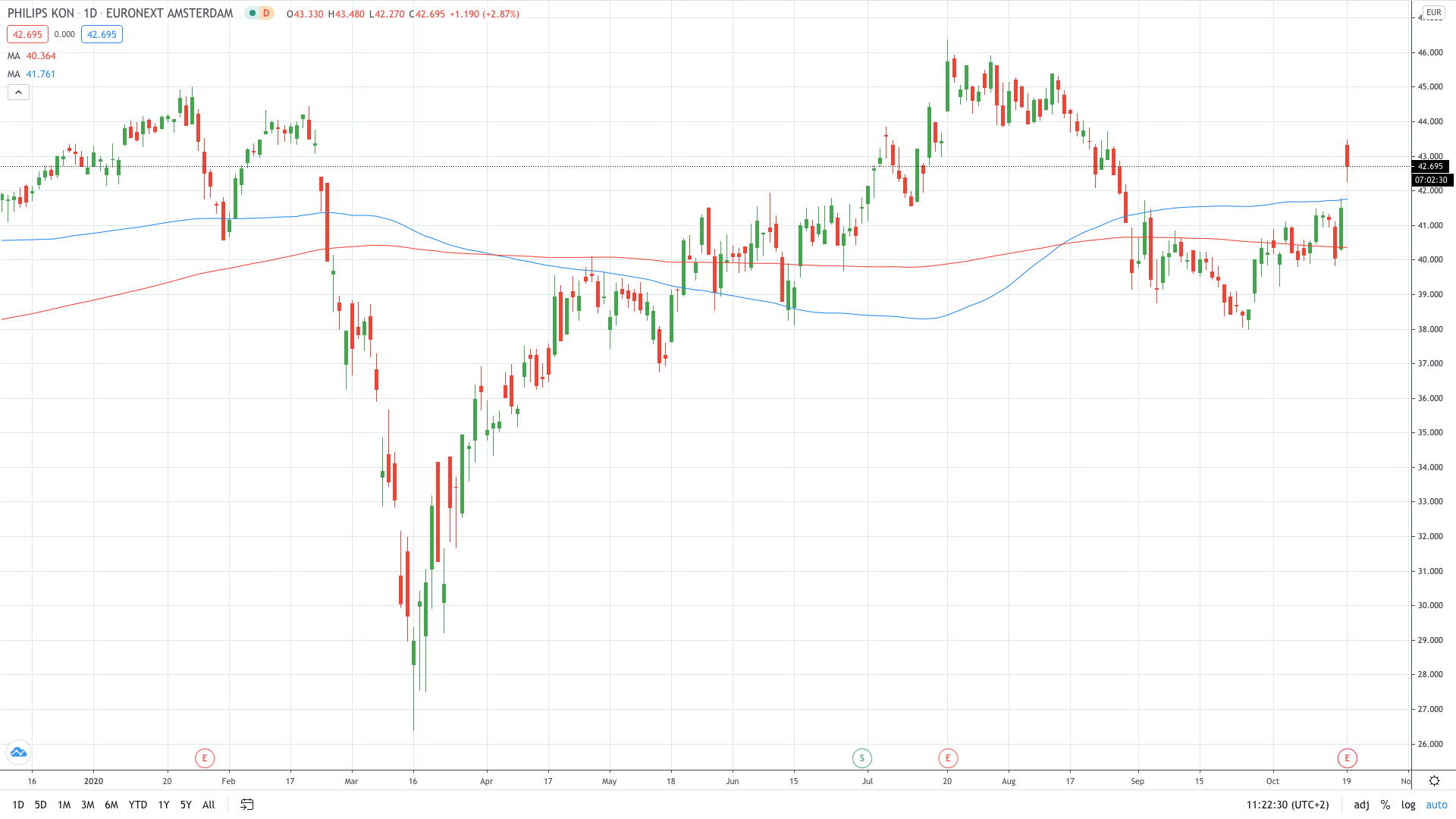

Shares of Philips (AMS: PHIA) gained over 4% today after the Dutch giant reported its third-quarter core profit surged 32%.

The COVID-19 outbreak increased demand for hospital equipment, helping Philips increase their sales by 10% to 4.98 billion euros. The health unit recorded a 42% jump in sales of the connected care division, which, among other things, produces intensive care devices needed for COVID-19 patients.

The firm posted EBITA profits of 769 million euros ($900.1 million) for the quarter ending September 30. Analysts expected core earnings of 630 million euros on 4.82 billion euros of sales.

“It is clear that the COVID-19 pandemic is far from over, and our teams remain fully focused on delivering against our triple duty of care: meeting critical customer needs, safeguarding the health and safety of our employees, and ensuring business continuity.

“Driven by the successful conversion of the Connected Care order book for patient monitors and ventilators, and a robust rebound of demand for our Personal Health portfolio, Philips recorded a strong 10% comparable sales growth and delivered an Adjusted EBITA margin improvement of 300 basis points to 15.4%,” the company said in a statement.

Philips said it now expects to record average sales growth between 5% to 6% annually in the next five years starting 2021.

Philips share price rose more than 4% to hit €43.48, a new 2-month high for the stock.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan