Key points:

- The pound's dropped horribly over the weekend but FTSE100 is slightly up

- The key point here is that the FTSE100 is an index of companies listed in London

- A lower pound makes foreign profits worth more in sterling

The pound sterling (GBP) has dropped substantially in the Asian reaction to the tax cuts announced last week – but the FTSE100 index (UKX: INDEXFTSE) is slightly up this morning. What is happening here? Isn't the FTSE a measure of how well the British economy is doing? Meaning that if the pound slumps because everyone thinks that economic policy isn't going to work then so also the FTSE100 should drop?

The answer here being that no, this isn't how it works. We've in fact three different price movements here this morning, all interrelated and we need just a couple of observations to make sense of them. Yes, it's true that the pound has fallen this morning/over the weekend. But that's also not wholly and quite right. The euro has also fallen over the weekend. True, GBP has fallen by more than EUR, so GBP has fallen against EUR, but it's still also true that the euro has fallen too. Both have fallen – by their different amounts – against the US dollar of course.

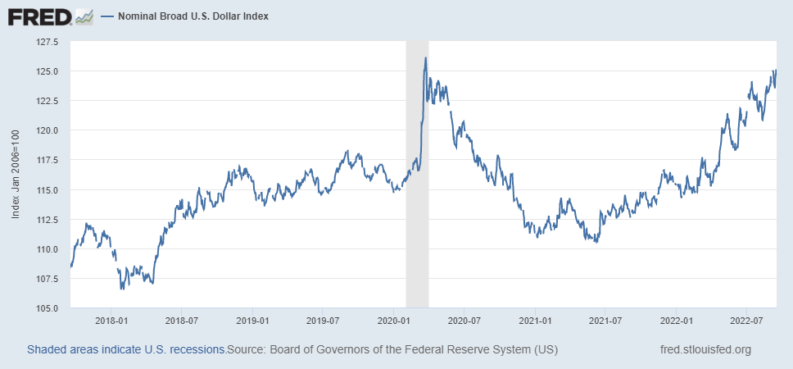

Which means that the other way we can think of this is that the dollar is getting stronger. Which is indeed the case:

That's the trade weighted dollar exchange rate, the one that actually matters for the deeper economic reasons. And as US interest rates climb faster than those elsewhere the $ rises – that's just what happens.

It is, as with the GBP/EUR rate, true that the pound sterling is also falling – but the change in the USD/GBP rate is only partly because of the sterling fall, as opposed to the more general dollar rise.

It's that specific GBP fall which then explains our next two price changes:

Also Read: How To Invest In The FTSE100 – 2022

But this leaves us with the puzzle. If the tax reforms are so terrible that sterling slumps as a result then why is the FTSE100 marginally up? Isn't FTSE the index of UK PLC? The answer there being no, it isn't. It's the index of companies listed in London, not an index of the British economy. As it happens some 75% of the revenue represented by the FTSE100 index comes from outside Britain. Which means that so are the profits and what happens when sterling slumps? Profits originally counted in foreign currencies become worth more when converted into pounds sterling.

Thus, in the short term, a falling pound increases the value of the FTSE100. We can use a similar explanation for why the FTSE250 (the index of the next set of smaller companies listed in London) is slightly down today. For there only 50% of the revenue is from abroad, 50% from within the UK. So, if the UK economy is going to pot then the impact on the FTSE250 will be larger than that on the FTSE100,

It does sound perverse but when looking at exchange rate effects and only exchange rate effects then the FTSE100 should rise as sterling falls, the FTSE250 should be less so affected. Simply because of the different weightings of foreign profits represented by the two indices.