Key points:

- Pressure Technologies is facing delayed orders in both major businesses

- But delayed orders in defence and oil and gas, right now?

- The bigger problem is then breaching banking covenants

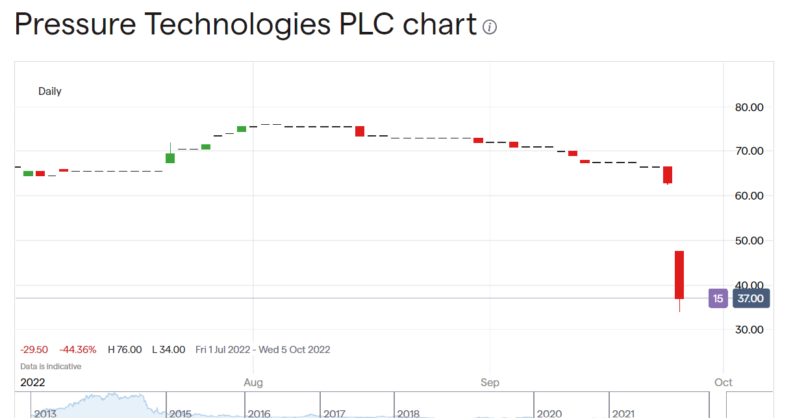

This is not how we would normally think of things – Pressure Technologies (LON: PRES) is down 41% on delayed orders, logistics problems and the subsequent breach of banking covenants. Now of course it's not actually true that we are at war and yet it would still come as something of a surprise to think that defence orders are down or being delayed. But that does seem to be what is happening. Add to this a slow down in orders from the oil and gas industry to really start to confound expectations.

This really isn't the sort of macroeconomic background where we'd expect to see these sorts of problems. But it is happening and so that's what has to be dealt with. Reality always does trump expectations after all. Pressure Technologies has several different operating subsidiaries and the problem seems to be they're getting hit at the same time. For example, CSC works with defence products, which have been hit by ” a combination of unexpected customer delays, supply chain disruption and the unplanned outage of key equipment” OK, machines breaking, supply chain disruption, happenstance and the recovery from lockdown. But finding that customers are delaying orders in the defence sector right now?

Or in the business supply the oil and gas industry: “there was an unexpected slowdown in order placement from oil and gas customers over the summer period” again, not quite what we'd be expecting to happen. The world oil and gas prices are high, we'd sort of expect it to be all guns blazing in the supply chain for that industry.

Also Read: The Best Oil Stocks To Buy Right Now

What's of much greater importance here is the resulting effect from these delayed orders. It costs something to keep a company open, waiting, of course it does. Which means that Pressure Tech is now in breach of its banking covenants: “will not be able to meet the requirements of the two existing financial covenants contained within the current facility.”

Now, being in breach of covenants can range from being naughty boys who have to pay a higher interest rate right through to having to pay that money back in full, right now – something that can be a killer blow to a company of course. It's not at that second state for PRES as yet, they're not really even in breach as yet. They're not going to be able to meet the covenants in the future – end Oct – rather than they're missing them right now. But this does mean that some refinancing is going to be necessary. Either a renegotiation – a higher interest rate perhaps – or another bank. Or there's always that possibility of a rights issue to provide more working capital.

No wonder the stock's down that 41%. The big question becomes, well, can they refinance? If they can, at reasonable rates, then those delayed orders do come through then this lower price could be an interesting bargain. But that's what the trade would be – on this being a temporary blip that can be recovered from.