Key points:

- Quoin Pharma has fallen 98% over the past year

- There should be a 1,250% rise today, or at least shortly

- It will be an entirely nominal rise though, not a real one

The Quoin Pharmaceutical (NASDAQ: QNRX) stock price should rise by 1,250% today. Which will be nice for those who have held it over the past year where it has fallen 98% in value since its peak. Unfortunately, this will not in fact be a rise of any great value to those holders, it'll be a purely nominal change in price. There might be a real change in price as well, but the 1,250% will be purely nominal.

Quoin develops treatments for rare and orphan diseases – that's a good call for a small company as the authorisation process is easier and markedly cheaper. QNRX also has some distribution deals organised but those only come into effect when the actual authorisation is received. There has even been an announcement that Quoin has received FDA approval – but that was approval only to be allowed to test one of the candidate treatments.

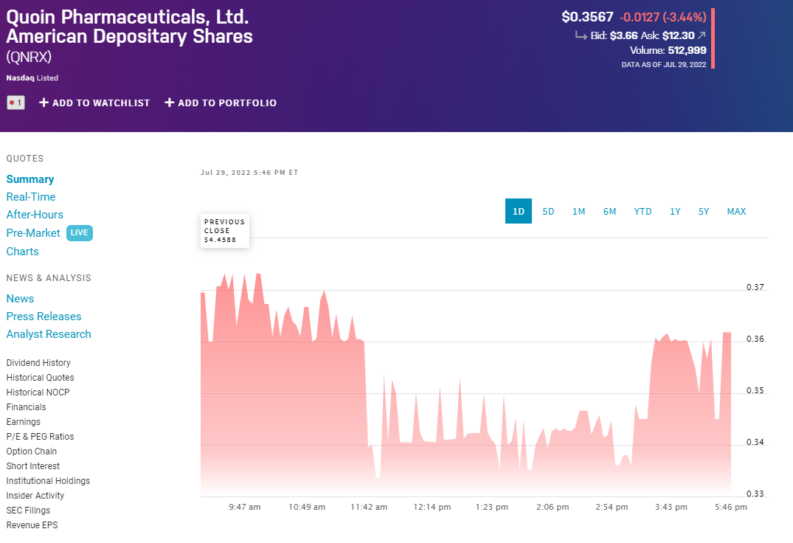

We've also seen substantial movements in Quoin stock recently. There was an 80% jump a month back for example, although that fairly quickly faded and Quoin continued its gentle decline. As we can see from this chart NASDAQ is showing the opening price as being up that 1,250%, whether it stays there we'll have to see when there's more trading to, umm, see:

Although NASDAQ has got it the wrong way around, showing the previous close as being the 1,250% rise in QNRX stock rather than what should happen, the open being that. But, you know, as we've mentioned before, don't take even stock market tickers as being 100% accurate sources of information.

Also Read: The Five Best Pharmaceutical Stocks to Watch in 2022

As to why this 1,250% predicted rise in the Quoin stock price today (and if the date for it is itself listed wrongly, soon enough) that's simply a matter of fashion. Something we can even prove. American markets tend to believe that good and solid stocks trade in the $10 to $100 range. That's just cultural happenstance, something we can prove. For the same assumption in London is the range £1 to £10. Which is why ADRs are do often 10 pieces of the London stock, to meet both fashionable ranges at the same time. Go below those ranges and the general thought is that the stock's going to be a bit racy, risky even. In the US, going down into the cents per share makes it a penny stock – which, by definition, it is of course. But that's considered very bad and where frauds and dodginess abound. So, both the NYSE and NASDAQ will cancel a listing of a stock it it's below the minimum bid price of $1 for long enough.

When a stock has had the – well, bad luck? Or trading performance? – of Quoin this leads to a problem They could lose the quote, therefore the liquidity and capital raising opportunities, simply because the stock price is $0.37 cents or whatever. So, the answer is a reverse stock split. Here the numbers are 25:2, or 12.5:1. For every 25 pieces of stock on Friday each owner now has two pieces today. That should lead to the 1,250% stock price rise.

But it is only a nominal price rise, not a real one. It's whatever variation away from that 1,250% which will be the real price change. The hope, of course, is that the price will rise more than that – remove the risk of losing the NASDAQ listing for example. But it doesn't always work out that way.