Key points:

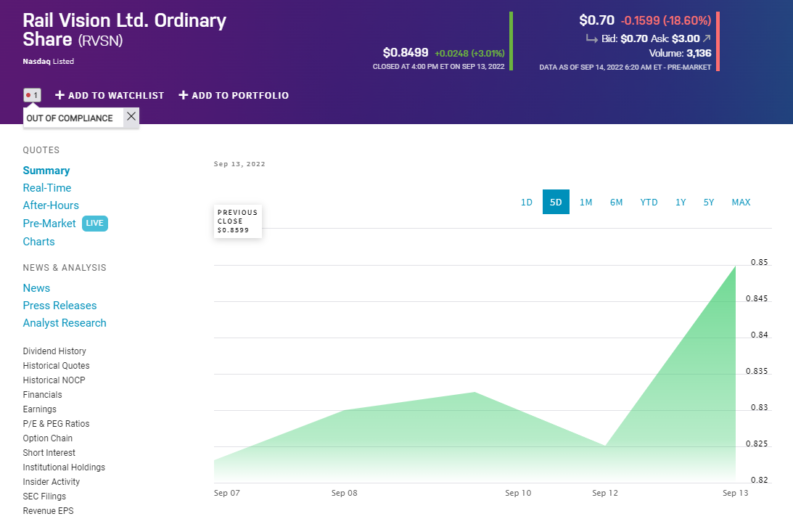

- Rail Vision stock is down 18% this morning

- There's no news to explain it – other than the projected railroad strike

- But while it's a Rail company the strike won't affect it

Rail Vision (NASDAQ: RVSN) stock is down 18% or so (17.64% in fact) this morning premarket and there's no obvious reason it should be. There's no corporate announcement to back it up. The question therefore has to be, well, why is it down? For if we can work that out then we can try to decide whether it's going to revert or not – or, of course, carry on sinking.

Now Rail Vision isn't going to be everyone's favourite stock, this is obviously true. The IPO was back at the end of March at $3 and it's been a precipitous fall followed by a rally and yet more falling ever since then. Which is how we get to a stock well under a $. That then falls foul of the NASDAQ listing rules which demand a minimum $1 offer price. So, something is going to have to be done about that. The normal solution – in the absence of being able to create a turnaround in business activity – is a reverse stock split, a consolidation as the Brits call them. We might want to be prepared for that in time.

As to what Rail Vision actually does, it provides digital safety equipment to trains. This is a little like providing digital military equipment but do note this is an analogy, not a direct comparison. The digital bits and pieces some from the wider electronics industry. It's the operating environment that is different. So, Rail Vision ruggedises their equipment so that it can stand the operating environment of being inside vast diesel engines and locomotives. It's one of those little niches in the economy that most of us never think about. But none of that explains why the price is down another 18% this morning.

Also Read: What Would Warren Buffett Invest In Now?

One possibility – and we stress this is just a possibility – is that people have slightly misunderstood the Rail Vision business. For there's the threat of a railroad strike – a rail freight – strike in the US right now. Which, presumably, would mean a dent in the likely profits of those involved with the US freight rail world. But Rail Vision's major business line is in Israel – which is rather less affected by a US rail strike. It's true, RVSN does have some sales activity in the US but then that's not really going to be affected by a disturbance in freight movements. Purchases or not of safety equipment tend not to be greatly impacted by a few days – or weeks – here or there of strike activity.

If this is true – and we emphasise the if here as being hugely important – then it's possible to take the stance that Rail Vision stock will revert as people realise this. But never forget, the market can stay irrational longer than you can stay solvent.

The real lesson here is not the prediction of why Rail Vision stock has moved as it has, nor what it will or will not revert to. It's that unless we know the reason for a stock price move it's very difficult for us to predict the next move in price of that same stock. So, why is Rail Vision moving? That has to be the data we need to predict the future of the RVSN price.