- The easing of the lockdown will be a challenging time for businesses. Some smaller operators face the risk of not even making it back into the game.

- The share prices of firms that have benefited from the COVID derived changes may still have some room to run.

- Spotting the next trend though is always beneficial, and some contenders are emerging for the title of the next big thing.

When the Sunday Times business section is quoting the British Toilet Association (BTA), you know something strange is going on. Weekend analysis of the health of the business community included a deep-dive into how the ‘new normal' might throw up winners and losers. The plausible and well-established reasoning for ensuring Raymond Martin of the BTA was involved in that debate is, as he explained:

“One thing often overlooked is that toilets bring money. There is an economic value because they keep people on the premises.”

Or as Peter Evans of the Sunday Times put it.

“Lavatories could become a commercial advantage for some companies.”

Source: The Sunday Times

When lockdown measures are gradually eased, the existential question for thousands of businesses is how to keep customers comfortable and safe? Reputations and footfall levels are at risk. The darker side of the risks involved was outlined by Sir William Blair, a former Judge at London's Commercial Court. It specialises in business disputes and thinks business contracts in the future will be written differently due to the coronavirus pandemic. Others point to the likelihood of future litigation from infected customers being a new and highly concerning threat. These are factors to consider even before the meeting of sales targets set at levels so low that they only just keep the lights on.

Online

Businesses with established and attractive online offerings have thrived in the pandemic. Distribution warehouses manned by trained and experienced staff are easier to manage than customer-facing operations. The greater the uncertainties about the easing of lockdown, the more embedded new consumer habits become.

Amazon (Nasdaq:AMZN) has been the go-to destination for those investors who spotted the ‘paradigm shift' towards online businesses. The firm's market cap is more than $1.2bn, and while the share price appears to be finding that the $25 price level is a point of resistance, the supporting trend line is still holding. Since the March lows, the stock is up more than 50%, but it is worth remembering it never bottomed out as much as the rest of the market. A better gauge is the year-to-date share price increase which is currently a 33.47% gain.

Other stocks have rallied from their March lows but holders of those have had to endure a white-knuckle ride. Amazon offers a lower risk-return ratio and that looks set to continue. Current considerations of downside risk tend to broadly focus on COVID-19 and a potential second-wave of infections later in the year. For holders of Amazon stock, that event might appear to be a trigger for topping up rather than selling stock.

Those looking to maximise their returns on their position might want to consider visiting broker eToro by clicking here because the commission-free trading in equities is currently available on that platform.

Amazon – Daily candles – Year to date

A more significant threat to Amazon may come from other retailers that are finally fully embracing the world of online sales. UK retailer Halfords Group Plc (LSE:HLF) has also had a good pandemic. It has been unable to meet customer demand for cycles as the nation takes to two wheels.

Describing how bikes have been great sellers with shops unable to keep up with the unprecedented demand, Graham Stapleton, the chief executive said:

“There has been a huge increase in cycling during the lockdown, but even so there are millions of people in our towns and cities who have bikes they never or seldom use. For the good of our health, the environment and the NHS, now is the time for commuters to change their habits and start cycling to work.”

Source: The Guardian

Halfords share price is, like Amazon's, trading at year-to-date highs. It might be one to treat with caution as the share price rally has been led by bike sales and they could ultimately run out of puff. Cycles, like smartphone handsets, are big-ticket items with a long life span. It's unlikely that purchases will be repeated with regularity. The servicing operation by the stores may generate some repeat business but the bonanza in sales must have some kind of shelf-life.

Halfords – Daily candles – 12th Feb–2nd June

The home furnishings retailer Dunelm (LSE:DNLM) is less likely to be concerned about finding its market is saturated. The firm has taken the COVID lockdown as an opportunity to overhaul its online business and the share price is benefitting as a result. The firm might also benefit from a housing market boom as the population reassesses its lifestyle choices and considers relocating.

The next trend

Analysing traditional sectors does throw up the possibility of finding diamonds in the dust. It could well come down to critical mass, and larger companies have made much of their ability to draw down on their credit lines. They also have economies of scale with the administrative costs of rolling out new measures spread across a higher number of outlets. McDonald's (NYSE:MCD), Greggs (LSE:GRG) and Pret A Manger have already re-opened hundreds of stores. The larger firms are first out of the blocks and are making use of their budgets to prepare their workplaces for their staff and customers to return. Social distancing in kitchens, investing in plastic screens and organising frequent cleaning coming easier to them than their smaller independent rivals. The grim reality for the smaller firms is that it might be a race in which many don't even take part. If they do get back up and running the ground lost to the big chains may mark a long-term shift in consumer patterns.

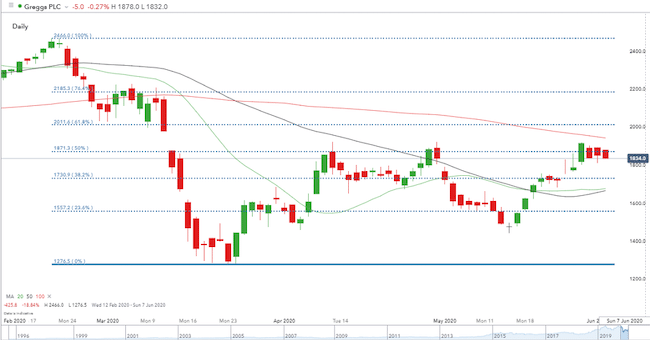

Greggs Plc – Daily candles – 12th Feb – 2nd June 2020

Greggs share price is sitting below its 50% Fib retracement. The firm generates a lot of press attention, but for those looking to go long, a price close above that level at 1871p would be the cherry on the cake. The broker ratings on the firm are wide-ranging. At least investors will be able to make their mind up by seeing how much footfall the re-opened stores receive.

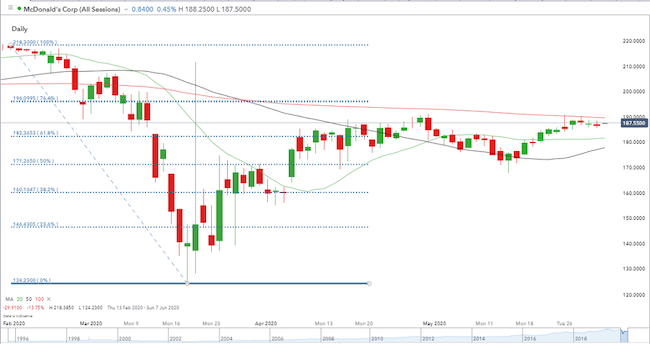

McDonald's – Daily candles – 12th Feb – 2nd June 2020

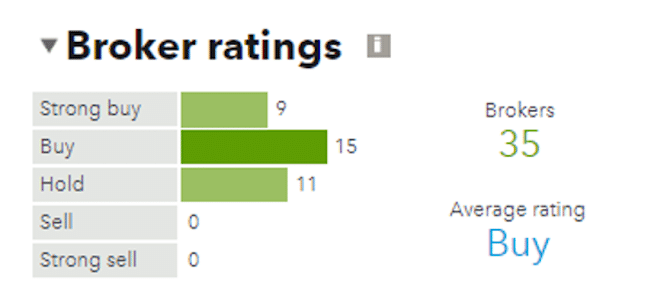

McDonald's share price has cleared all the major retracement Fibs except the 76.8% level. Price on the daily charts is also taking support from the 100-day SMA. The slightly stronger share performance is possibly due to the firm's extensive drive-thru service, which appears a better fit for the post-COVID world. Of the 35 analysts covering the stock, none have a rating lower than ‘Hold'.

It's also worth remembering that some institutional funds have to have exposure to the retail/catering sector. Those that have such conditions as part of their investment mandate have to put the money somewhere. In that instance, relative performance becomes as crucial as the absolute performance with the least-bad firms attracting attention from big investors.

Big is beautiful

The borrowing rates being experienced by the big firms are reassuringly low so having access to the cash is a priority. The total debt will have to be paid off at some date and that time may come after global interest rates have risen.

Up-front costs are easier to estimate but there is also the need to consider the inefficiencies the measures bring to day-to-day operations. Despite all these potential problems, the fact that ‘chains' are opening for business means they can ensure their survival and benefit from the barriers to entry that are facing smaller firms.

The costs of COVID refits, compliance and inefficiencies of scale, weigh particularly heavily on smaller firms. Providing some perspective, The Sunday Times analysis referenced Berkshire Aesthetics, which offers cosmetic treatments. The small operation has only ten staff but has spent £26,000 on equipment, including a ventilation system that changes the air seven times an hour and powered respirators for clinical staff. A hefty price to pay but at least they are in with a chance, unlike some.