Key points:

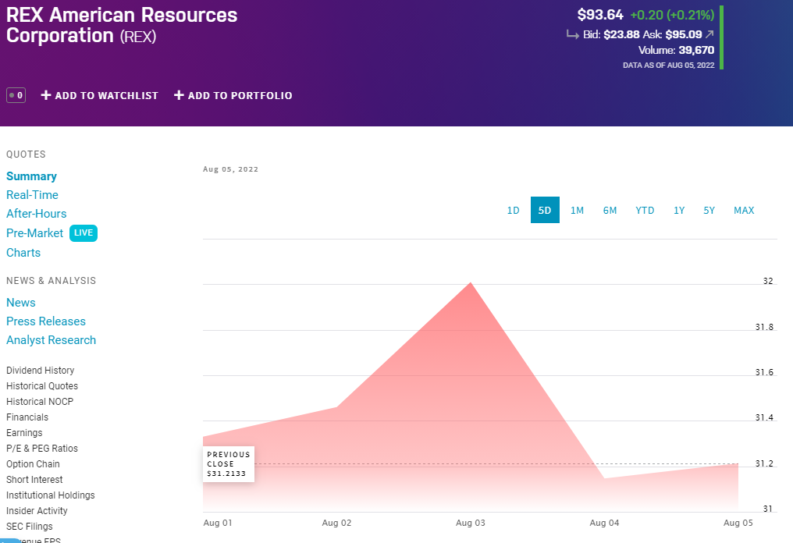

- Some tickers have Rex American's price down 200%

- Some tickers are even more wrong at up 200% for REX

- The real price of REX has hardly changed – it's the nominal price that is down 200%

Some tickers have Rex American Resources (NYSE: REX) as being down 200% today. Some others have Rex American as being up 200% which is an even weirder mistake. Actually, there has been a nominal change in the Rex American stock price but the real price is pretty static actually, under 1% different from Friday. What's confusing everyone is that our old friend, a stock split, has happened. Some are getting the split the wrong way around, thinking that it's a reverse, rather than forward, split.

Rex American was around the $95 to $100 level, is now around the $31 and change level, but every holder now has 3 pieces of stock instead of the one they started with. This is simply a straighforward stock split. Not, at all, one of those reverse splits – consolidations to Brits – even if some reporting tickers are showing it that way. We've even seen some stating that REX used to be around $30 and is now $100, a 200% rise. This is just people having entered it into the system the wrong way around.

As to why such a stock split this is just fashion. There really is no other reason than that. The thing is it's a long standing fashion, so it remains even as the reasons for it have faded away.

Also Read: How To Invest In Metal Stocks

We can show that this is purely fashion as well. In London it's thought that – for whatever reasons – the “correct” price for a serious share is in the £1 to £10 range. In New York that same “serious” range is in the $10 to $100 area. Under a $1 is into such levels of penny share infamy that a company can actually lose its listing if the price says down there. That's what drives most reverse stock splits – consolidations – which is to try to get the nominal price up so as to keep the NASDAQ or NYSE quote. That this is all fashion is proven by the fact that the price ranges are different on the two equally serious markets. We could even call it custom instead of fashion if we wished.

So, we've seen companies like Tesla, Alphabet and so on slice their stock into pieces – do a stock split. As share prices were heading toward the thousands that might seem reasonable. People could get that idea that they're “expensive”. But there used to be good technical reasons. For example, someone might not want to put thousands into just the one company – many small investors would not be happy with that sort of concentration. So, a lower nominal price might well lead to more shareholders. That used to be true but is no longer – it's possible to purchase fractional shares these days after all.

Still, stock splits do happen and they're thought to lead to a greater marketability of the shares. And really, if they make people happy then why not? The only thing we've really got to keep an eye upon is when they happen. For they're not always reported properly at first even if matters do settle down eventually.