Key points:

- Rockfire Resources has announced their maiden JORC complaint numbers for Molaoi

- There is significant zinc, lead, silver mineralisation

- This is a valuation point for Rockfire

Rockfire Resources (LON: ROCK) shares are up near 9% this morning on their announcement of the maiden JORC resource at Molaoi. To those not used to the jargon of mining shares that might require a little explanation. To put it very simply indeed they're saying that there's a certain level of proof that there's something worth mining there. Which is good for a mining company, to know that they've got something worth mining.

To put it with a little more detail. A resource is a mineral deposit that we're really quite sure we can mine, using current technology and at current prices and make a profit from doing so. JORC is the set of rules we use – how much testing has been done, by people of what level of competence etc – to decide whether that information is all in fact true and valid. A mineral reserve is when we've done the extra work to prove this contention. Within resources we've also got inferred and indicated. The second is a stronger level of proof than the first.

So, what Rockfire is saying today is that there's an Inferred Mineral Resource at Molaoi. This is our first level of certainty about the information. The actual amount there is 2.3 million tonnes at 11% ZnEq. Which again can be unpacked. The deposit is zinc and lead and solver (not an unusual mixture) and there's some indication of germanium as well. That last isn't a surprise given that the mineral is sphalerite. What we generally do with multi-element resources is convert them all to an “equivalent”. So silver is worth this much and there's that much of it, same with lead, so what would be the equivalent value for zinc, the primary material? Thus we get ZnEq, zinc equivalent. Just a handy way of totting up all the values to the one number.

Also Read: The Best Copper and Mining Stocks to Watch in 2022

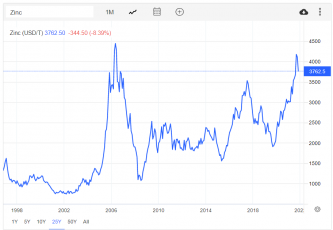

Effectively what Rockfire is telling us is that to a pretty good level of certainty there's a decent deposit there that's worth mining. Which might be thought of as a bit of a surprise for Greece, a place that has been mined for several thousand years already. But zinc is one of those metals folk haven't really been searching for all that much in recent decades. This chart shows why:

There was that big boom in 2005/6 as China's growth became apparent but then that faded as zinc consumption didn't seem to rise that much. As those prices aren't inflation adjusted they just weren't high enough for people to think it worth looking for more. Now we're seeing many other parts of the world developing and zinc is in much greater demand than it was. Zinc is thus a good metal to be looking for right now.

It's easy to get too excited. Am indicated resource is several years away from something being mined. The work to upgrade it to a reserve needs to be done, then the capital raised to actually mine. But having a JORC resource is indeed a valuation point. Molaoi is worth more than it was before we had this level of proof.