Shares of Rolls-Royce PLC (LON: RR.) slipped lower today despite the company’s announcement of the pricing of its £2 billion bond offering. The embattled giant seeks ways to boost its finance amid the pandemic.

Rolls-Royce will issue corporate bonds in three tranches of senior unsecured notes. The first will comprise of $1 billion with a coupon of 5.75%; the second of €750 million at 4.625% and the third at £545 million at 5.75%.

The bonds are due to mature in 2026 and 2027, while the offering will close next week on October 21.

The company said it had to double the size of the bond offering after witnessing strong demand. This is a part of the bigger refinancing package, worth £5 billion. Besides this £2 billion, Rolls-Royce is also planning a £2 billion rights issue and a new £1 billion loan facility.

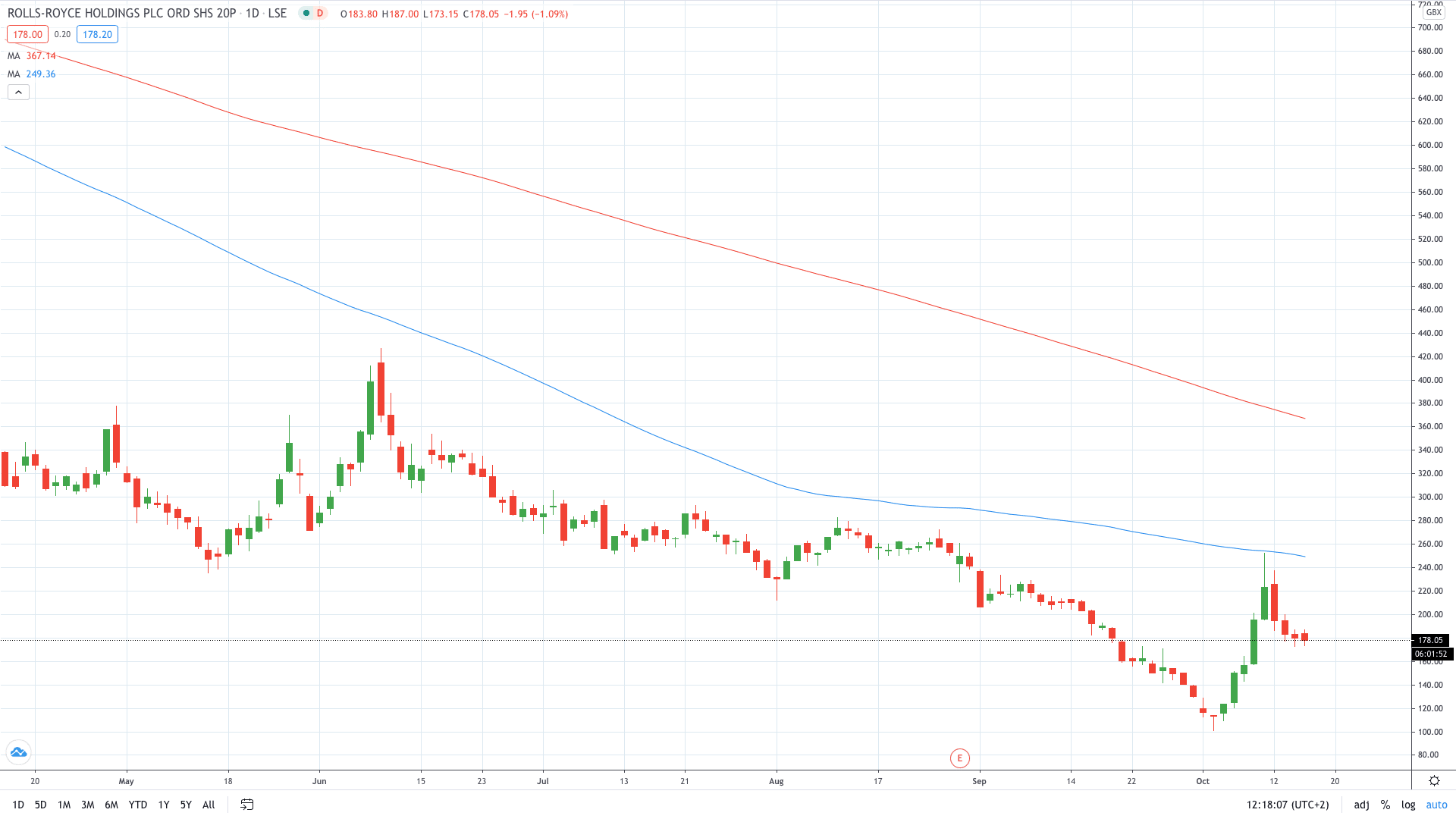

Rolls-Royce Share Price currently trades 1.24% in the red, at 177.75p, after falling nearly 4% earlier in the day.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan