Shares of RPS Group (LON: RPS) have surged over 13% today despite the professional services company reporting a £34.1 million loss before tax.

The company reported that its revenue fell 11% for the first six months of 2020 down to £272.4 million.

RPS said in its statement that they had made a promising start to the year, but trading was impacted by the coronavirus outbreak.

However, they went on to state that “significantly lower net bank borrowings reduced the net debt,” and that an improving order book in the third quarter and lockdown restrictions being eased will have a positive impact in the second half of the year.

“With a strong cash position and significant available debt facilities, RPS is well placed to deal with the challenges that the continuing effect of COVID-19 will bring. The diverse nature of RPS, coupled with our expertise and global reach, positions us well for any recovery in our end markets’” said John Douglas, RPS’ Chief Executive.

The company also separately announced a proposed placing and subscription of shares, which will not exceed 19.99% of the company’s existing share capital.

RPS hopes the placing will provide them with the “flexibility to continue to appropriately match capacity to the longer-term market opportunities.”

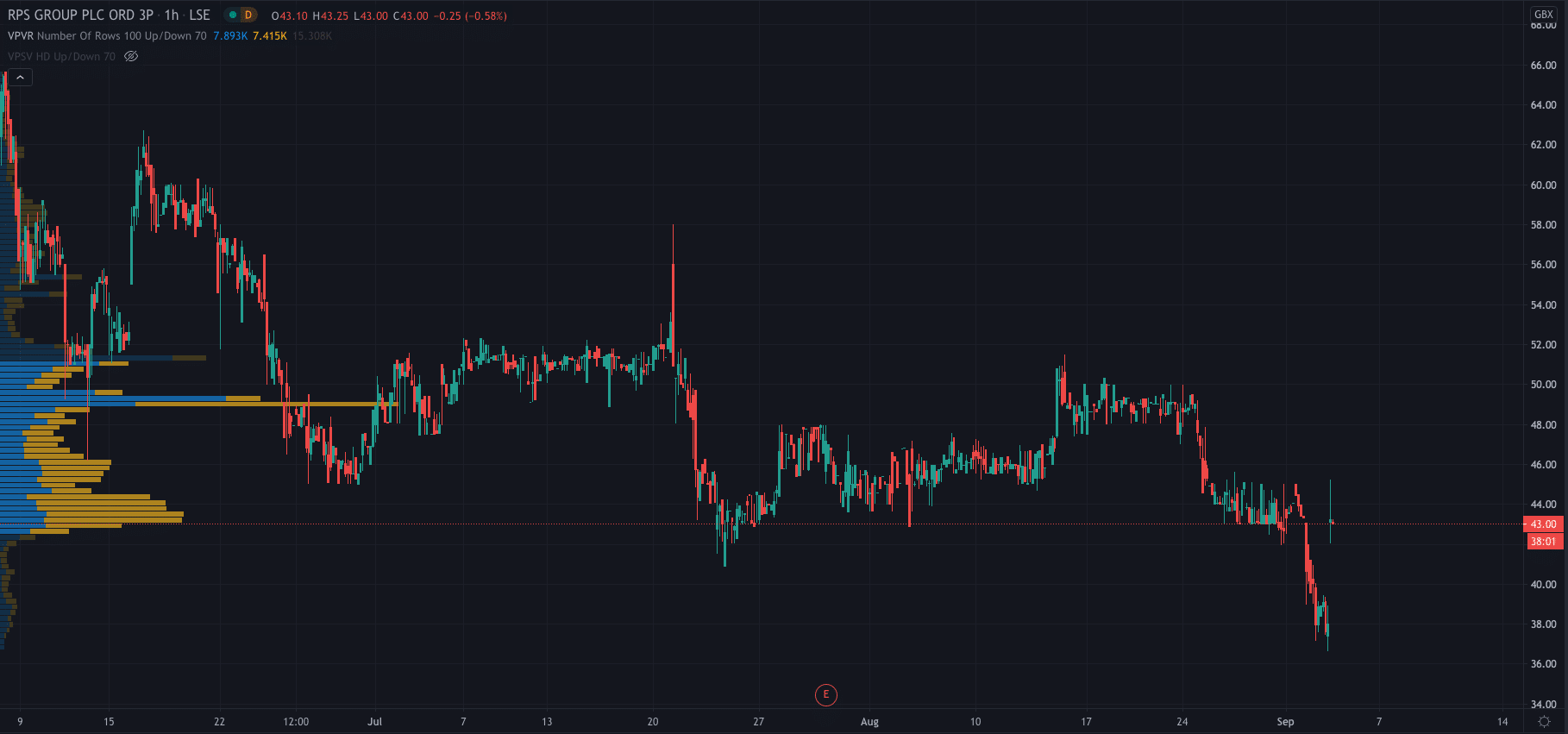

RPS Group share price…

Source: TradingView

The company’s share price surged as high as 45.20p after the report was released. It is currently trading at 43.25p per share, up 13.82% on the day.

- PEOPLE WHO READ THIS ALSO READ: HERE’S WHY HAMMERSON SHARE PRICE SURGED 387.6% TODAY

- TRADE SHARES WITH PERSONAL CAPITAL

- COMPARE THESE TOP STOCK BROKERS