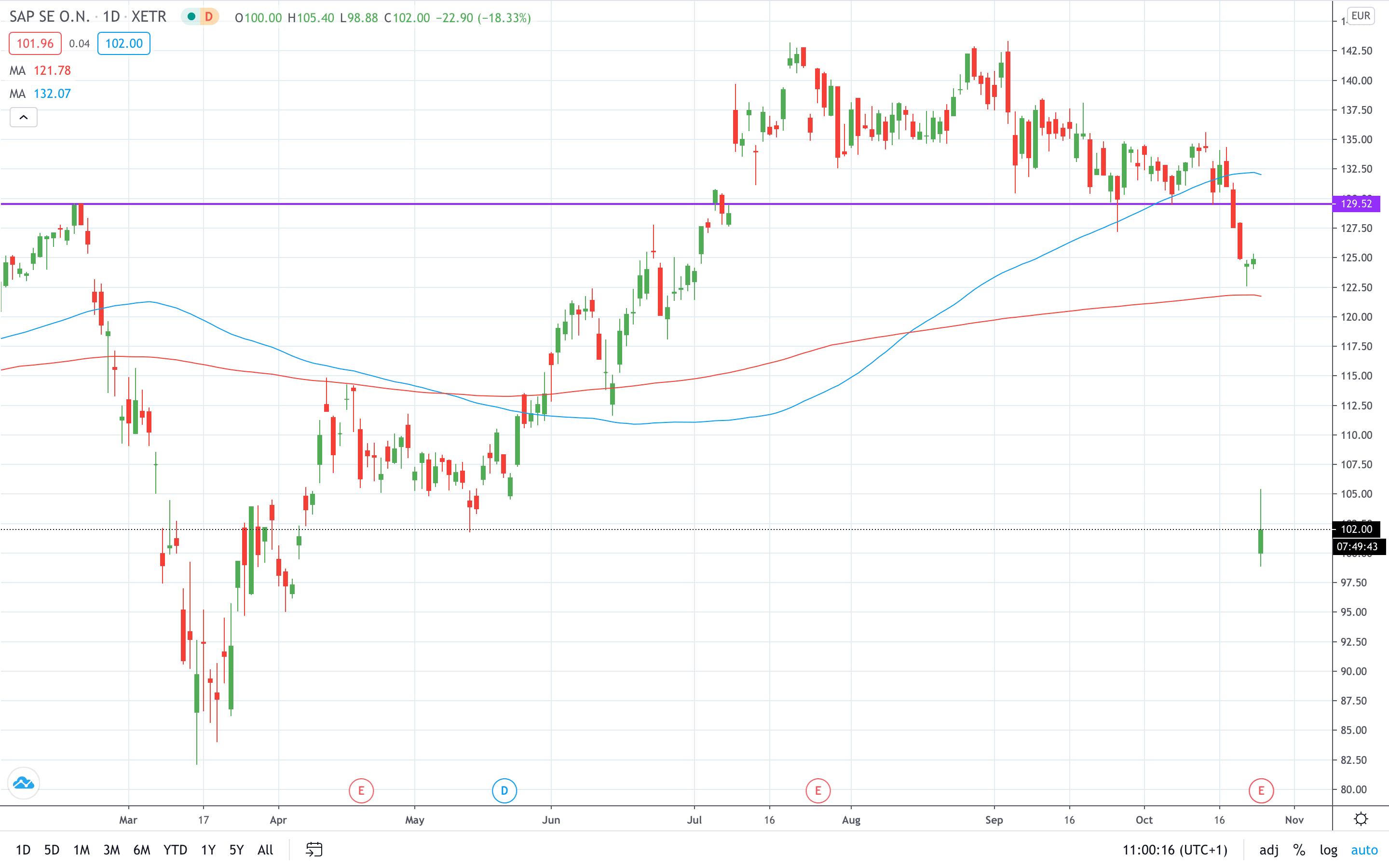

Shares of SAP SE (ETR: SAP) collapsed over 20% to trade below the €100 mark after the German tech giant scrapped mid-term margin goals as it struggles to recover from the pandemic.

Margins will decline over the next three years, Chief Financial Officer Luka Mucic said. Instead, the software firm doubled down on its shift to cloud computing.

“We are at an inflection point,” CEO Klein told journalists.

“I am not willing to trade value to our customers for short-term margin optimisation.”

SAP said its adjusted total revenue dropped by 4% while operating profit plunged 12%. On an adjusted basis, profit jumped by 4%.

Following its shift to cloud computing, SAP expects to generate €22 billion from its cloud unit by 2025. In five years, adjusted revenue is expected at €36 billion, while adjusted operating profit is projected at €11.5 billion.

Following today’s results and announcement, J.P. Morgan analysts slashed SAP stock rating to “Neutral” from “Overweight”, cutting the price target from €160 to €120 per share.

SAP share price now trades at €101.88, which is 18.43% lower on the day. Today’s low of €98.88 represents the 6-month low for the stock.

PEOPLE WHO READ THIS ALSO VIEWED:

- Here’s Why Just Eat Takeaway Share Price Just Soared to Fresh Record Highs

- Experience stock trading with a reliable demo account

- Implement Divergence Trading strategy in your daily trading plan