Scottish Mortgage Investment Trust PLC (LON: SMT) share price just printed a new all-time high of 1516.25p and seems to be headed higher.

Many investors who do not own SMT shares wonder whether it is too late to buy the investment trust’s shares at their current highs.

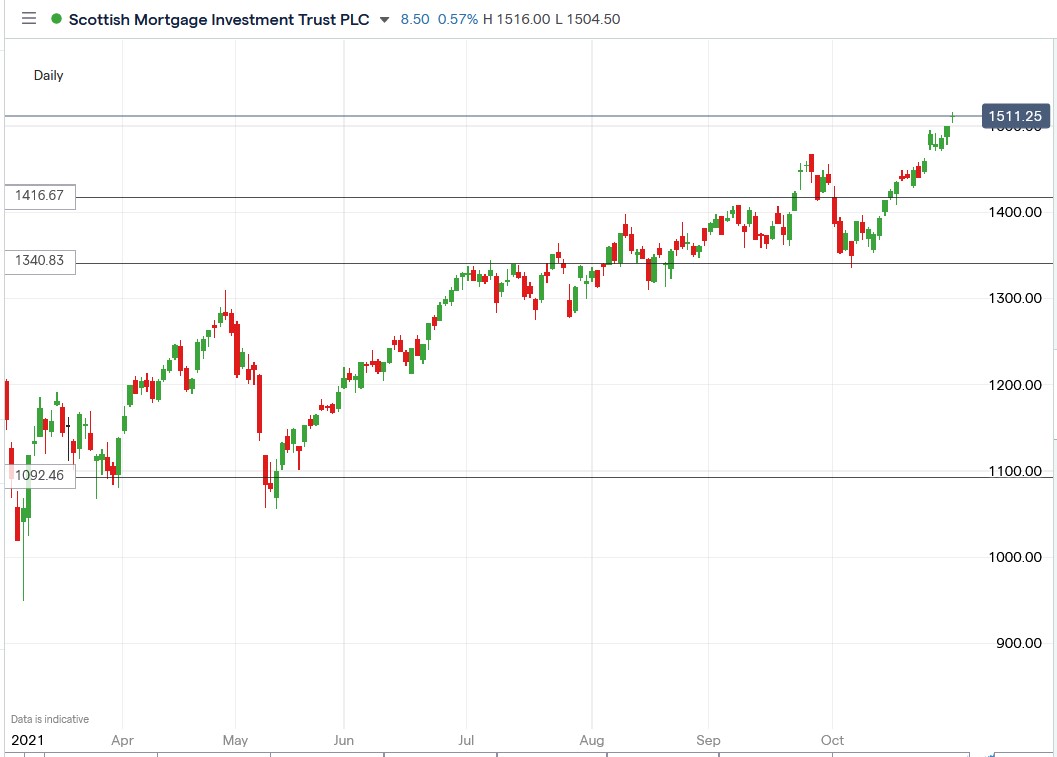

While we cannot give personalised investment advice, SMT shares have had an impressive run so far, given they are up 24.32% since January with total 12-month gains of 50.32%, so should you buy?

I know you might be itching to buy SMT shares at current prices, but buying at current prices goes against the very fundamentals of being a good investor, and I wouldn’t buy SMT shares now. Hear me out…

When you buy an asset at its all-time high, you immediately take on a significant risk that the shares will start falling soon after you buy, because as we all know, nothing goes up in a straight line, not even house prices.

As you can see from the SMT daily price chart below, SMT has had periodic pullback after running up higher, presenting investors with excellent buying opportunities.

Unfortunately, we cannot predict when the next pullback will be, but one thing we can be sure of is that there will be a pullback sometime in the future.

SMT shares have been rising, driven by gains in some of its key holdings, such as Tesla shares, which just crossed the $1,000 mark valuing the company at $1.1 trillion.

The investment trust has also been boosted by recent gains in Moderna’s share price. The biotech company is now valued at $139 billion after its COVID-19 booster shot was approved by the US Food & Drug Administration.

While it may seem like the recent rally in growth stocks such as Tesla and Moderna is unlikely to end, stocks are likely to pull back once the US Federal Reserve starts tapering its bond purchases.

The Fed’s easy-money policies single-handedly rescued the US equity markets from the March 2020 crash.

These are some of the macro factors that you have to pay attention to as an investor. We are likely to get a significant pullback in stocks if the Fed decides to start tapering its asset purchases at its meeting on Tuesday and Wednesday.

I would buy SMT shares on a decent pullback, but not at current prices for the outlined reasons.

*This is not investment advice. The writer is simply expressing his opinion of a specific stock. Always do your due diligence before making investment decisions.

Scottish Mortgage share price.

Scottish Mortgage share price has risen 24.32% this year and is at all-time highs. Should you buy it?

Should you invest in Scottish Mortgage shares?

If you’re a smart investor, you will know that having large-cap stocks in your portfolio is vital. They are more mature companies, considered safer investments, trade with less volatility, have greater analyst coverage, and in most cases, have a steady dividend stream. Due to the current market environment, we think now is the perfect time to add large-cap stocks to your portfolio. But which large-cap shares should you buy? Our stock analysts regularly review the market and share their picks for some of the best large-caps to invest in.