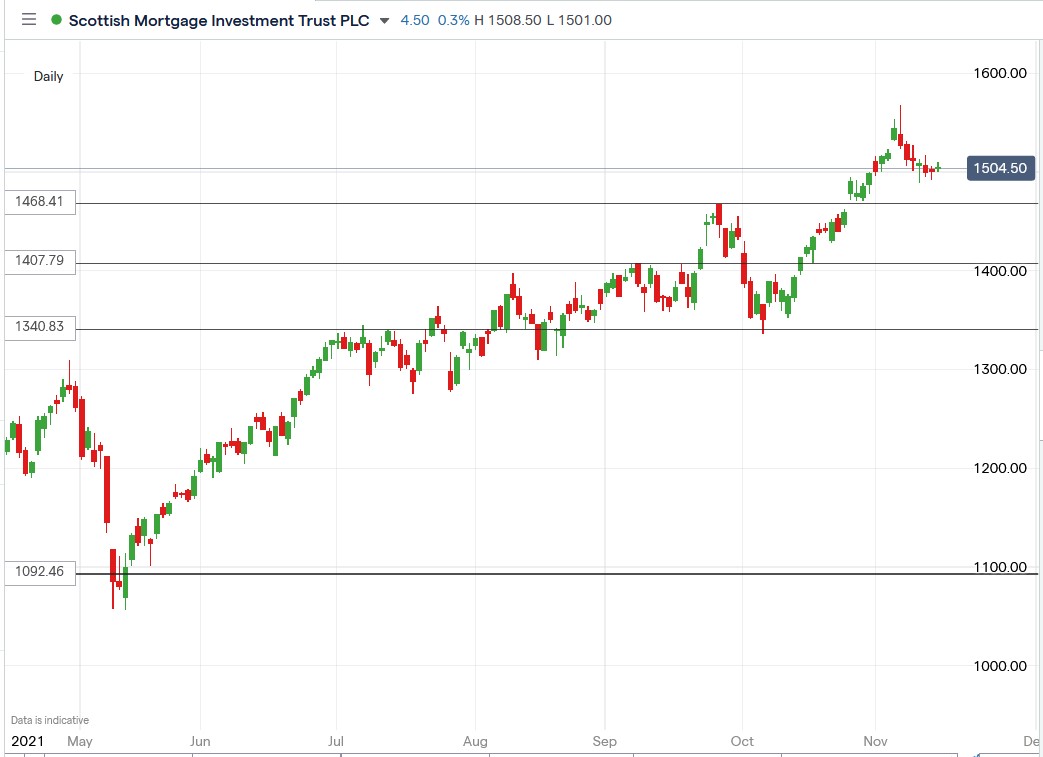

Scottish Mortgage Investment Trust PLC (LON: SMT) share price has risen 5.46% in the past month. So what’s next for the investment trust? Will its shares keep rising?

Well, stocks tend to go up over time; hence, we can expect SMT shares to keep rising over an extended timeframe. Now that we have got that out of the way let’s look at a few specifics.

Firstly, the investment trust is well known for investing in companies developing innovative technologies such as Tesla and biotech stocks working on breakthrough technologies like Moderna.

Almost every investor now knows that growth stocks have outperformed the broad stock market by a wide margin over the past decade, and this seems unlikely to change anytime soon.

Therefore, we can expect Scottish Mortgage Trust shares to keep outperforming other funds in tandem with the surging growth stocks.

Recently, the trust has been criticised for its positive outlook on Chinese stocks, given the Chinese government’s rapid regulatory changes that have led to many western companies leaving the country.

SMT has maintained that the opportunity for Chinese companies to keep growing is still there despite the recent regulatory changes that have made the business environment quite challenging.

James Anderson, the outgoing SMT fund manager, recently defended the trust’s exposure to China, saying that the recent changes had not wholly cut off the golden goose of building businesses in the Asian giant.

Another bet that seems to be going awry for SMT is its bet on Moderna, whose share price has fallen recently. However, Anderson defended SMT’s bold bet on the biotech company, saying that it is currently developing a broad portfolio of treatments.

Scottish Mortgage’s investment in Moderna is based on its proprietary mRNA technology targeting diseases such as HIV, ZIKA virus and cancer, among others.

Tom Slater, the current co-fund manager, will take over once James Anderson leaves in April 2022 is likely to keep running the fund in the same way Anderson has been for the past 20 years, which should reassure investors.

SMT shares recently pulled back, giving long-term investors an opportunity to invest in the fund. However, I was hoping for a deeper pullback before jumping in, which is yet to materialise, so I’m still out.

Investors must remember that there are no guarantees that we’ll get a deeper pullback any time soon.

*This is not investment advice. Always do your due diligence before making investment decisions.

Scottish Mortgage (SMT) share price.

Scottish Mortgage (SMT) share price is up 5.46% in the past month. So what’s next for the investment trust?

Should you invest in Scottish Mortgage shares?

Tech stocks offer some of the best growth potential, but time and time again, traders and investors ask us “what are the best tech stocks to buy?” You've probably seen shares of companies such as Amazon and Netflix achieve monumental rises in the past few years, but there are still several tech stocks with room for significant gains. Here is our analysts view on the best tech stocks to buy right now.