Shares of Serco Group PLC (LON: SRP) tumbled over 10% on Thursday despite a 53% rise in profits for the first half of the year. The outsourcing giant benefited from a surge in demand for its services amid the coronavirus pandemic.

The Hampshire-based firm saw its revenue jump 24% to £1.82 billion. As a result, the underlying trading profit soared by 53% to £77.6 million.

“As a result of the significant investments we have made in recent years, our management teams, business processes and systems have shown themselves to be capable of responding at great speed and effectiveness to governments' needs,” Chief executive Rupert Soames said.

A focus on public sector services helped Serco to weather the private sector crisis.

“We commissioned the UK's first drive-through test centre in two days; in Australia accommodation was provided for more than 1,300 quarantined travellers on one week's notice and as part of the NHS Test and Trace programme we mobilised 10,500 contact tracers in a four-week period,” Soames added.

Serco said it will decide on a dividend at a later stage. The company declared a dividend earlier this year before withdrawing it amid the uncertainty stemming from the pandemic.

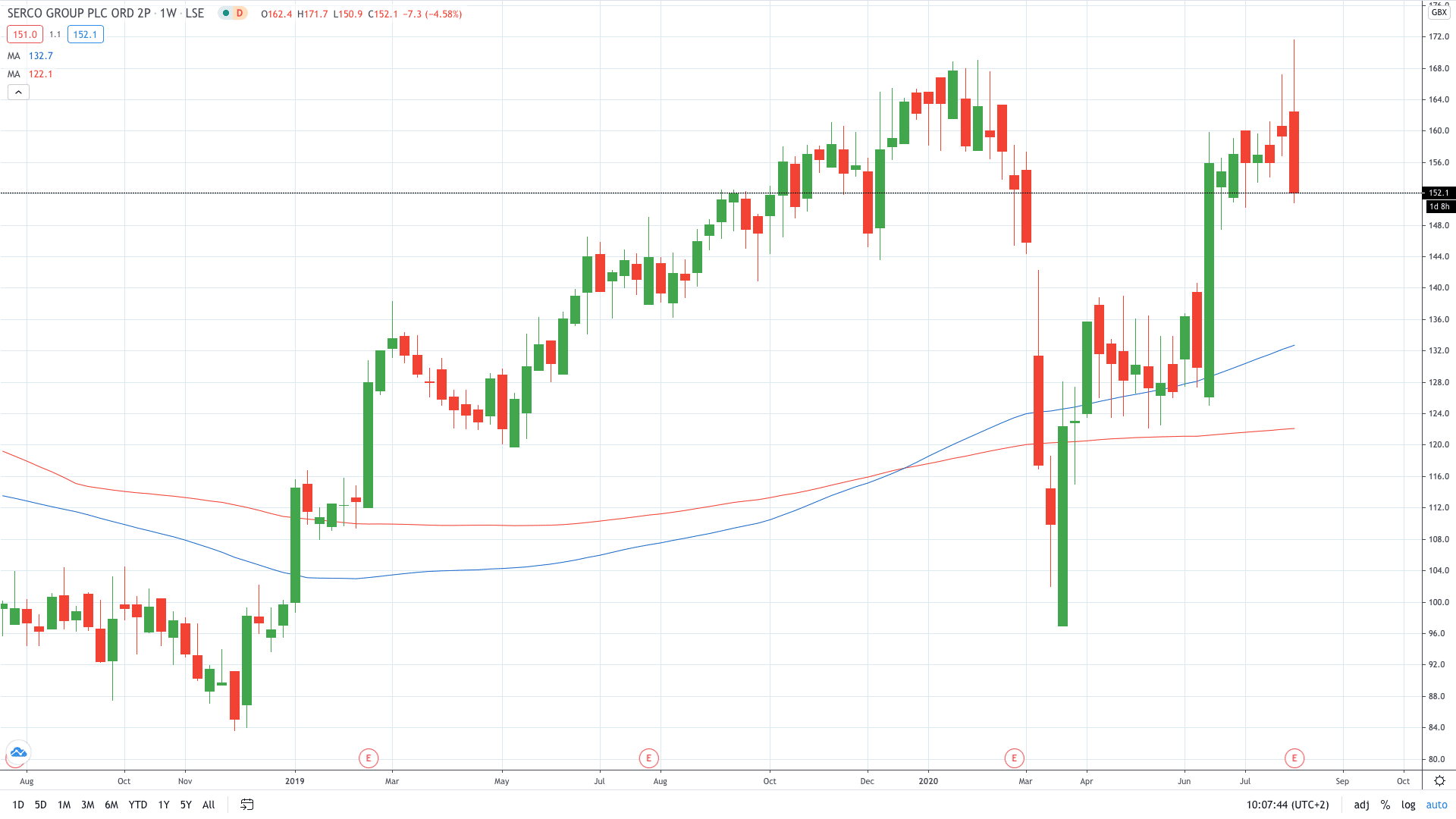

Serco share price initially moved higher to hit a 5-year high above 170p on the profit rise. However, profit-taking dragged the stock lower to now trade around 10% in the red at 152p.

- Read more about why Serco share price soared in June

- Learn stock trading strategies

- Learn from experts on risk management in trading