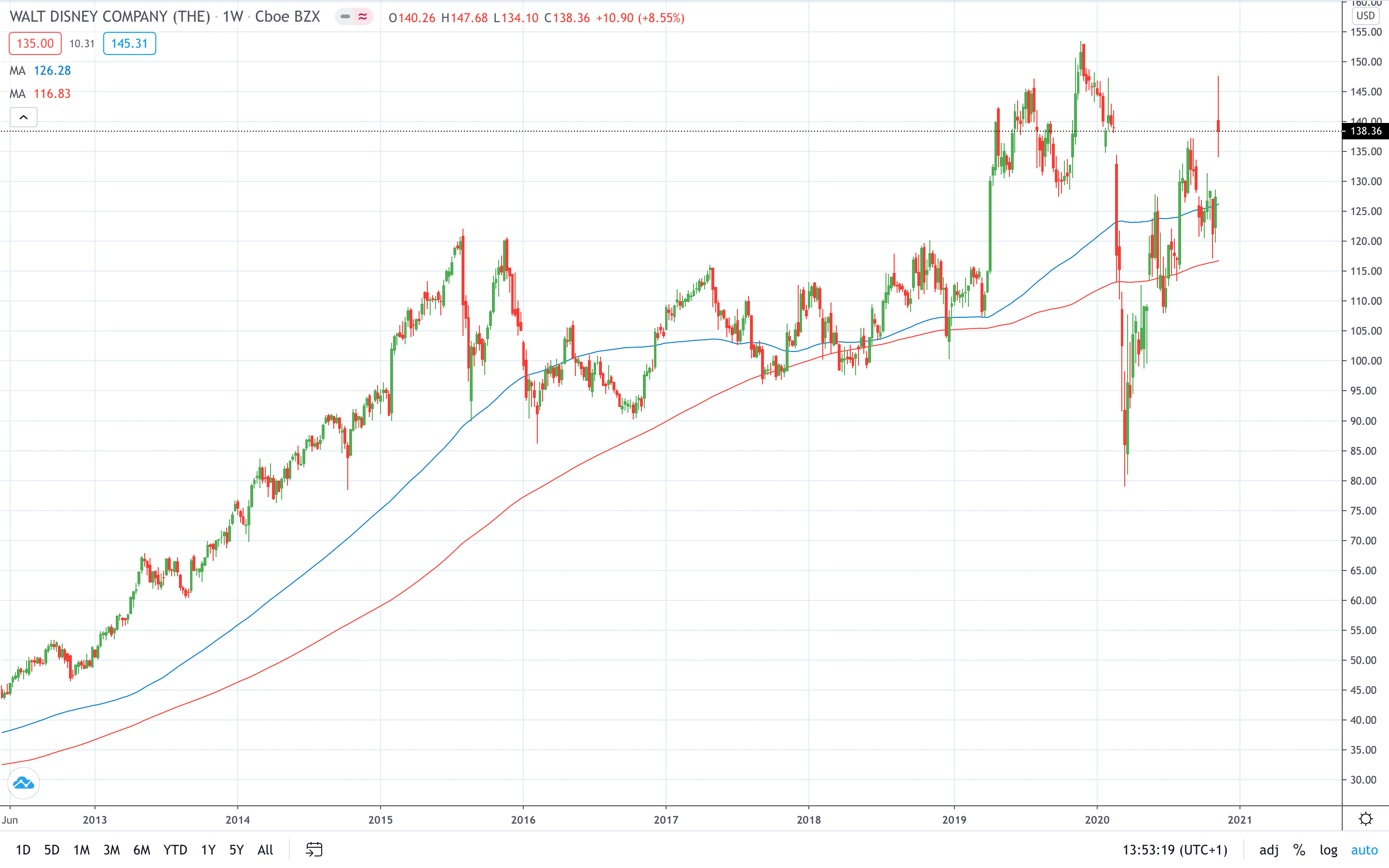

Shares of the Walt Disney Company (NYSE: DIS) closed the week higher after the company reported a narrower-than-expected loss for its fiscal fourth quarter.

Disney reported it lost $0.20 per share, which is much better than $0.71 a share that market analysts expected. Revenue came in at $14.71 billion to beat the Street consensus of $14.20 billion.

Investors were impressed with the fact that Disney+ now offers its services to over 73 million paid subscribers.

“Even with the disruption caused by COVID-19, we’ve been able to effectively manage our businesses while also taking bold, deliberate steps to position our company for greater long-term growth,” said Bob Chapek, Chief Executive Officer, The Walt Disney Company.

Following Q3 results, analysts at numerous firms raised their price targets on Disney after witnessing a narrower loss and an increase in the number of paid subscribers.

Disney share price closed the week 8.55% higher to print a new 2020 high.

PEOPLE WHO READ THIS ALSO VIEWED:

- BRITISH AIRWAYS: HERE’S WHY IAG SHARE PRICE SOARED TODAY

- Learn more on how to open a demo account

- Learn what is a Pip in trading