Sonim Technologies Inc (NASDAQ: SONM) stock price rallied 115.5% premarket driven by surging interest from retail investors on popular social media platforms such as Reddit, Stocktwits and Twitter.

Interest in the phone manufacturer skyrocketed earlier today despite the company not making any massive announcements this week.

However, investors may have reacted to Sonim’s upcoming launch event scheduled for Thursday, October 28, 2021, where the technology firm will launch its latest rugged phone designed to withstand harsh operating conditions.

Sonim Technologies claims that its phones can withstand a fall from 6 feet onto a concrete surface, while its competitors’ phones can only withstand a fall from 4 feet onto a wooden surface.

The company has positioned itself as the leading manufacturer of rugged phones that can be used by people working in rugged environments such as remote oil fields, remote mines, and deep-sea fisheries, among other rugged areas.

Sonim intends to launch its newest device, the XP3Plus, as well as its XP5s, its XP8 and its XP3 devices. The company has invited all people interested in its rugged devices to the October 28th webinar.

The rugged phone manufacturer has created its own 12 benchmarks of rugged performance set to differentiate itself from competitors who add a case to their devices and call them rugged.

Sonim Technologies engineers its phones based on 12 criteria, including glove-friendly keypads, extra-loud audio, complete sealing to protect the phone from microparticles, and waterproofing to ensure the phone is fully submersible in the water, among other qualities.

Meanwhile, retail investors have pushed Sonim’s share price to unprecedented levels, and I wouldn’t be buying at current levels. Instead, I would wait for a pullback before jumping in.

*This is not investment advice.

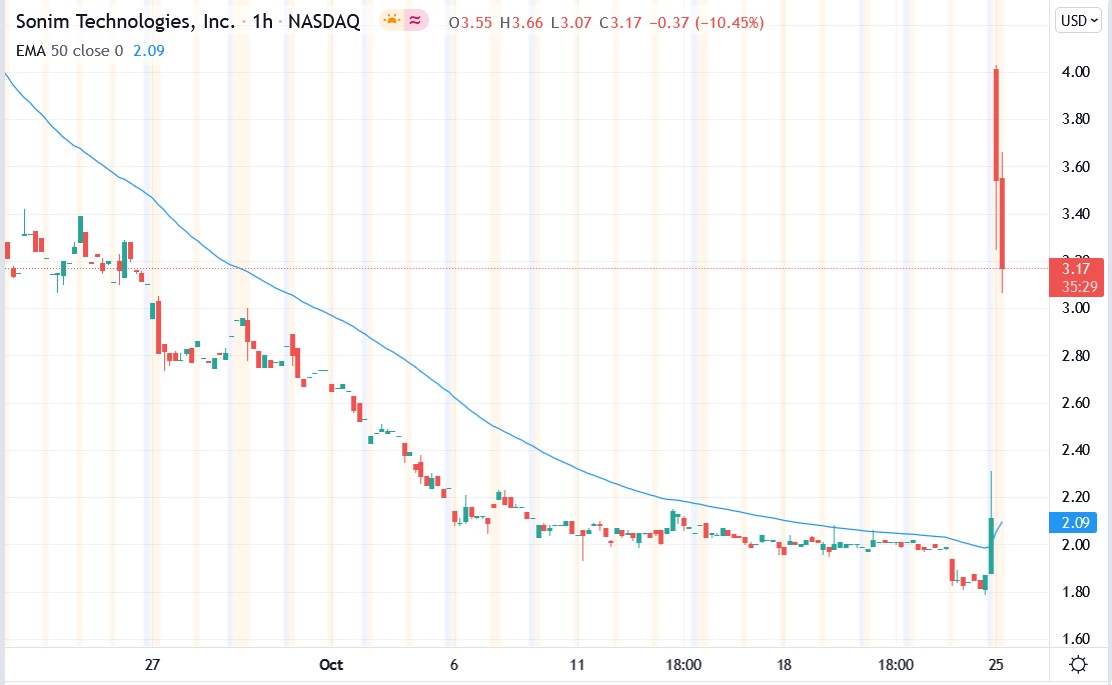

Sonim Technologies stock price.

Sonim Technologies stock price surged 115.51% to trade at $4.03, rising from Friday’s closing price of $1.87.

Should you invest in Sonim Technologies shares?

Tech stocks offer some of the best growth potential, but time and time again, traders and investors ask us “what are the best tech stocks to buy?” You've probably seen shares of companies such as Amazon and Netflix achieve monumental rises in the past few years, but there are still several tech stocks with room for significant gains. Here is our analysts view on the best tech stocks to buy right now