Key points:

- Sainsburys shareholders voted down the idea of paying the real living wage

- This would indicate that financial profits still matters, not just social

- This could be seen as a positive sign for the share price

The stock market has given a – muted to be fair – verdict on Sainsbury's (LON: SBRY) shares as shareholders rejected the idea of paying the real living wage to all workers. Sainsbury's shares are up a couple of percent since the results of the votes at the AGM came through and this special resolution on the real living wage (to distinguish it from the national living wage of Osborne's imagination) was the only vaguely contentious issue on the ballot.

The base contention behind the idea is that employers should pay enough to everyone to live at a nice standard. And it is a “nice” one too. It's calculated by asking people what someone should be able to do on their wages and not be poor. It's entirely different – and significantly higher – than the actual poverty level.

So, the idea was put forward for shareholders to vote upon. They rejected it, by a large margin.

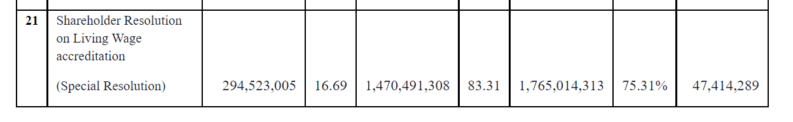

That's votes for, votes for by percentage, votes against, votes against by percentage reading from left to right.

Now, we could just regard this as the capitalists rejecting the righteous demands of the workers. Or it's possible that Sainsburys shareholders understand the basic problem here. As people have been pointing out ever since the living wage idea first surfaced 20 years back, this isn't really something to do with employers. Because that real living wage then gets taxed, both income tax and national insurance. When that is taken into account a tax free minimum wage would be about the same as the current post-tax real living wage. So, this is a problem to be solved by the Chancellor, by lowering taxes on low pay, rather than by employers.

Also read: How To Buy Tesco Shares.

So Sainsbury's seem to have headed off that threat to profits. But there's more to it than just that issue in and of itself. It's possible to argue that certain large companies have become a little too overcome with general wokeness – Unilever (LON: ULVR) is the usual post child for this argument – to the detriment of shareholder returns. It's said that doing what the customers want increases share prices, which it will do. But what the customers want and what loud activists say they want might not in fact be the same thing. So, here at Sainsburys we've loud activists saying that customers would like, therefore the company and share price would benefit from, paying higher wages.

That the shareholder base at Sainsburys as a whole soundly rejects this idea tells us that wokeness of the more extreme, profit limiting kind, isn't as yet an issue here. Which is good of course, for we're investing in order to make profit, not to make activists feel good about spending other peoples' money.

It is this which is the real meaning of the vote. That the other shareholders in Sainsburys still view the company as a method of enrichment for shareholders, not a part of some campaign or other for social or societal reasons. Which does indeed make Sainsburys a better investment for those of us looking for financial profit, not social.