Shares of Sureserve Group Plc (LON: SUR) today surged 14.29% higher after the compliance and energy support services group announced that it was considering reinstating a sustainable dividend payout policy.

The company, which was formerly known as Lakehouse, said that it had won 21 new contracts since releasing its annual report in May. The new deals have an annualised value of £16 million and they added £40 million to its order book.

The company anticipates new business in future and has beefed up its bidding teams to capitalise on the increased market opportunities that it has identified. Having paid off all its debts by July 2020 and with £25 million in reserve cash flows, the group’s board is considering a sustainable dividend policy.

The Group’s chairman Bob Holt said: “The strong trading performance of the group in the last 12 months has enabled the board to consider a sustainable dividend policy, which is more than adequately covered by significant earnings per share and regular recurring cash flows.”

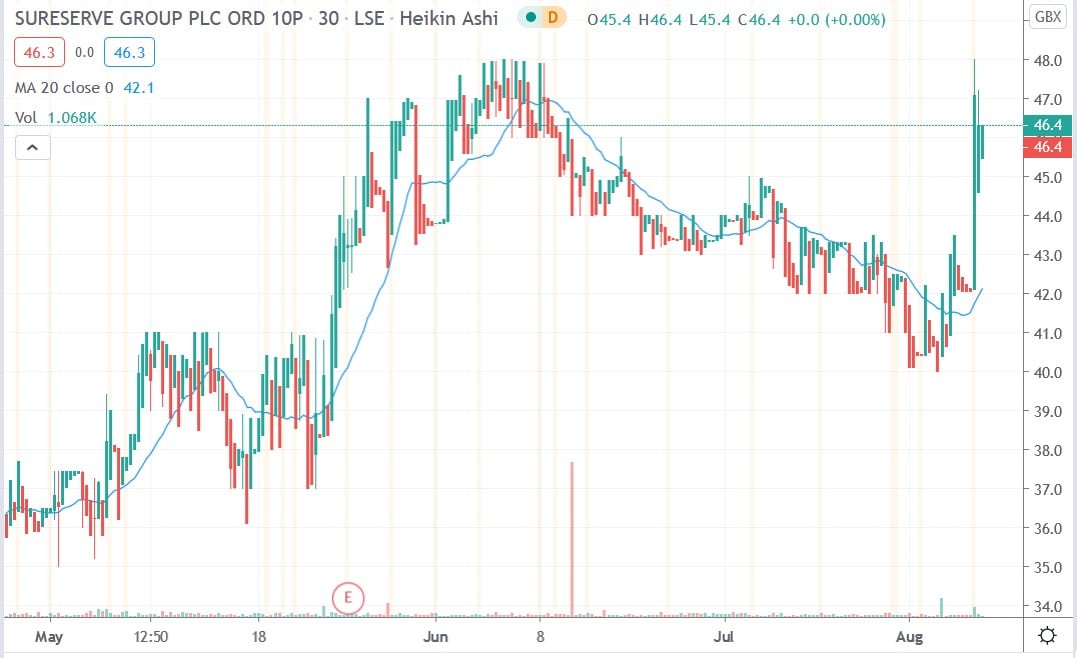

Sureserve Group share price

Sureserve stock today rallied 12% to trade at 48.0p having closed Tuesday’s session at 42.0p.

- Trade Sureserve Group shares with the best stock brokers

- Learn how to trade stocks on this free demo account